GBP/USD remained under immense pressure following Brexit and the flash crash. There could be much more in store:

Here is their view, courtesy of eFXnews:

There are six main reasons why we remain bearish GBP:

1. The UK economy may be about to experience a ‘once in a generation’ structural transition. A weaker GBP may be needed to ‘oil the wheels’ as it undergoes this shift.

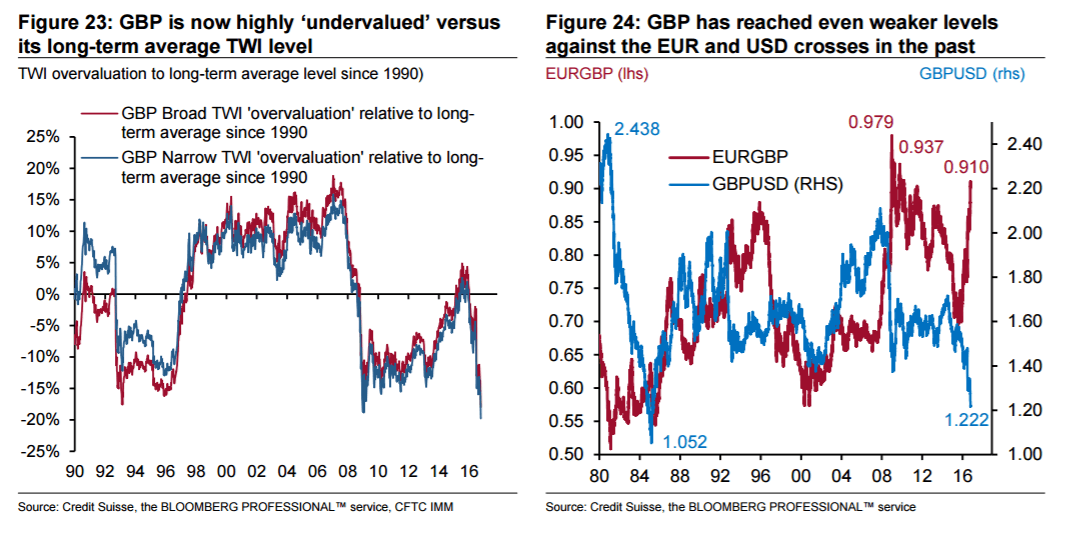

2. While GBP TWI recently reached ‘all time lows’, such valuation methods become less meaningful when economies are facing significant structural changes like the UK is.

3. Policymakers still give a green light to a weaker pound. Sterling’s fall did not stop the BoE from cutting rates in August, or from suggesting it may do so again. Until there are genuine concerns about loss of purchasing power abroad or imported inflation, policymakers may still tolerate GBP weakness. The market has recently started to price BoE hikes, but we suspect a rapid drop in GBPUSD below 1.10 would be needed to warrant a bold emergency measure from a still dovish-tilted BoE.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.

4. Over time, global reserve managers may increasingly reconsider holding GBP allocations that may still be high to historical precedents. GBP no longer provides ‘yield appeal’ is it may have done in the last few years. Repeat ‘flash crashes’ or potential credit rating downgrade risks make GBP a less preferred ‘reserve’ currency.

5. The UK’s balance sheet is large (relative to GDP) and leveraged (liabilities are large and liquid vs assets), which always leaves room for large FX moves.

6. We are not convinced that a hard-Brexit is fully factored into market expectations yet. The GBPUSD implied volatility curve is no longer inverted as it would be during a true crisis, and the fact that the GBP options market remains well functioning is itself an indicator that a genuine hard-Brexit scenario may not entirely be factored into market thinking. Similarly, UK 5-year CDS suggests markets are relatively sanguine about the hard-Brexit risks. The swap is now below where it was through most of July 2016, and considerably below 2008/09 levels.

On a 3-month horizon, we remain bearish sterling and forecast GBPUSD at 1.16 and EURGBP at 0.95.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.