Should I stay or should I go? This is the question facing Brits regarding the European Union membership. And what will happen to the pound? The team at CIBC weighs in:

Here is their view, courtesy of eFXnews:

Financial markets are starting to take it seriously, and with good reason. Polls show a tightening race ahead of the referendum on June 23rd, while internet searches for “Brexit” are running slightly higher than the peak seen for “Grexit”, when Greece’s status was in jeopardy. A British exit from the EU would stir up new uncertainties, both for the UK and the Eurozone, that a decision to remain would avoid. So we can understand why Sterling has headed weaker this year.

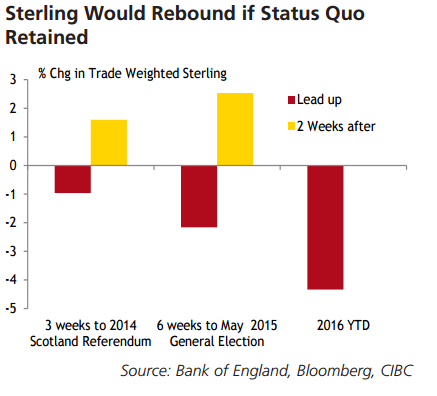

However, we would be buyers of Sterling and other affected assets just ahead of the vote. Should the “remain” side win, Sterling would likely see a quick rebound, just as it did after the Scottish independence referendum, or when a general election seen as a close call returned the certainty of a Tory majority. Although there hasn’t been any obvious underperformance so far in UK equities versus others in Europe, that could still develop, and would be reversed on a “stay” vote.

True, a vote for “leave” would initially be a further negative for Sterling, as investors worry about risks to British trade, or even London’s status as a European financial centre. But second thoughts on its long term implications could reverse that damage, since a “Brexit” need not be the slamming of economic doors to Europe that many assume. History, trade patterns and other factors suggest that the most likely mediumterm outcome of a “leave” victory would be fairly minimal in terms of actual disruptions to trade, markets or capital flows.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.