- GBP/USD has been rising amid optimism coming from China.

- Growing chances of negative rates in the UK, Brexit, and US coronavirus may weigh on markets.

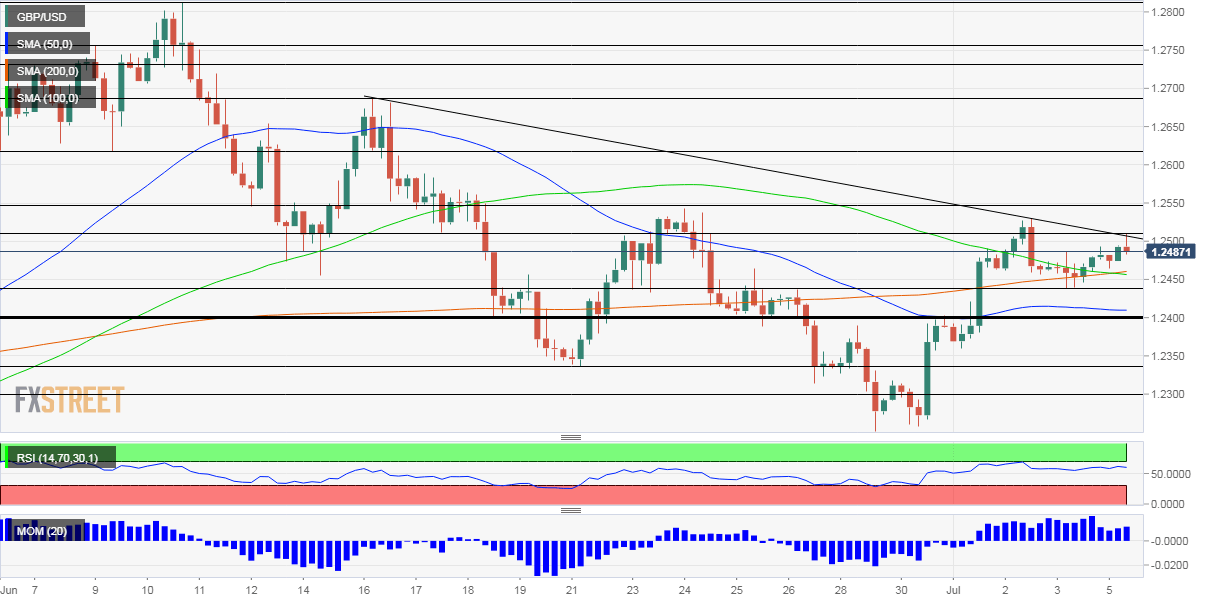

- Monday’s four-hour chart is showing bulls have an advantage.

Brits have returned to the pubs – and the pound is cheering due to developments on the other side of the world.

The Chinese media has been talking about a bull market following the recovery from coronavirus – and traders reacted. Stocks in the world’s second-largest economy kicked off the week with gains, weighing on the safe-haven US dollar. Trading volume in Shanghai is at its highest since 2015 and interest in bullish markets is up some ten times according to Chinese search engine Baidu.

COVID-19 also seems to be under control in the UK, where the exception of a localized lockdown in Leicester did not stop Brits in other places from going to the pub. However, that may currently be the only factor supporting sterling.

Andrew Bailey, Governor oft he Bank of England, reportedly sent a letter to commercial banks, preparing them for negative interest rates. They may need time to just their systems to such a move – but pressure on the pound is already seen now. GBP/USD is unable to take full advantage of the dollar’s weakness and lags behind the euro.

Another adverse factor is Brexit, with talks resuming after they were postponed late last week. The gap between the EU and the UK on regulatory alignment remains wide – and no breakthrough is likely anytime soon.

Across the pond, US investors return from the long Independence Day weekend, pushing S&P futures higher. While optimism about the global recovery is encouraging, America’s economy may already be feeling the impact of the surge in coronavirus cases. Goldman Sachs has lowered its outlook for the world’s largest economy.

COVID-19 statistics continue rising at a rapid pace, with cases nearing three million and the death toll hitting 130,000. Concerns are focused on Texas, Florida, and California – three large states that are under stress.

President Donald Trump continued dismissing the disease and preferred focusing on Thursday’s upbeat jobs report – showing the restoration of some 4.8 million jobs in June. The ISM Non-Manufacturing Purchasing Managers’ Index due out later on Monday will likely confirm the recovery seen in early June.

However, high-frequency data from later in the month – restaurant reservations, gasoline consumption, and jobless claims – show the recovery has leveled out. Further such reports may push the safe-haven dollar higher.

Updated coronavirus figures will likely continue showing a rapid increase – albeit perhaps at a milder rate due to the “weekend effect.” The numbers tend to be lower on Monday and catch up later on.

Overall, the current recovery in GBP/USD seems vulnerable to worrying developments on both sides of the Atlantic.

GBP/USD Technical Analysis

GBP/USD is trading above the 50, 100, and 200 Simple Moving Averages on the four-hour chart and momentum is to the upside. However, it has been setting lower highs in recent days, taking some of the sting out of the bullish case.

Resistance awaits at the daily high of 1.2510, followed by 1.2550, a peak in late June. The next levels to watch are 1.2620 or 1.2680.

Support is at 1.2440, a low point on Friday, followed b 1.24, a round number that also capped cable last week. Next, 1.2340 and 1.23 are eyed.

More: If the US presidential election were today? But it’s not.