- GBP/USD has been experiencing the calm before the storm ahead of the BOE.

- Additional QE from the central bank, Brexit, and US coronavirus are on the agenda.

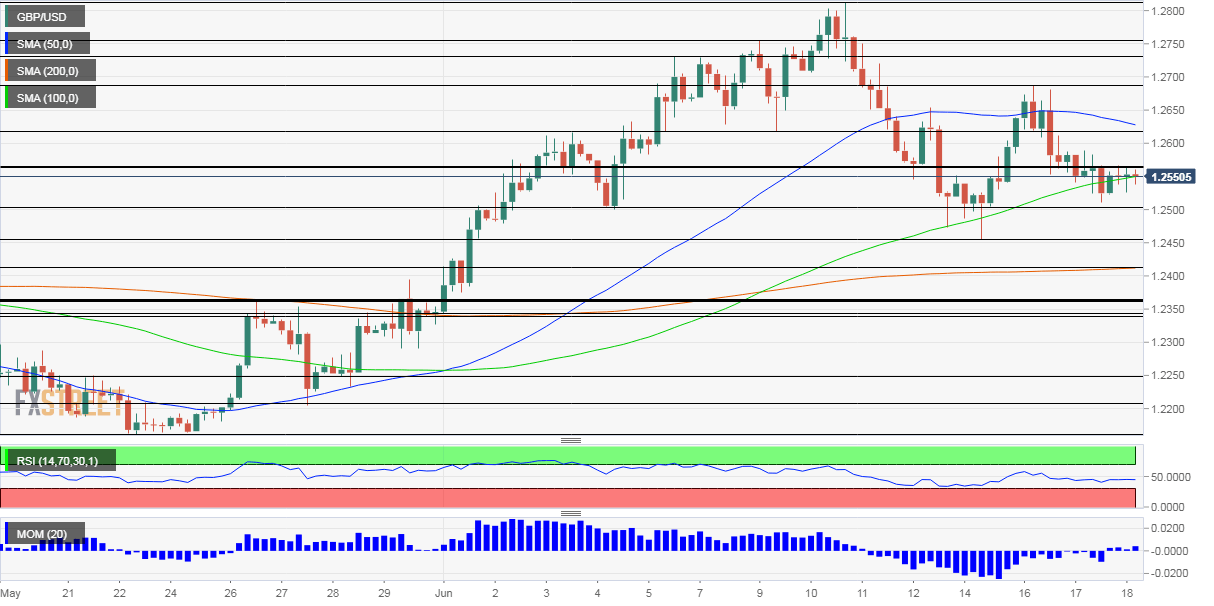

- Thursday’s four-hour chart is showing an advantage for the bulls.

Another bailout from Andrew Bailey? The Governor of the Bank of England holds the keys to the next moves in sterling – limited ranges are set to make way for high volatility. To what direction?

The BOE is set to expand its bond-buying scheme by around £100 billion or as much as £150 billion according to some estimates. Pound-printing used to mean devaluing the currency in the pre-pandemic era – but that is no longer the case.

Bailey’s previous expansion of the program to its current £645 billion enabled the government to support workers and provide another stimulus in times of trouble and thus supporting the economy. In Thursday’s decision, a higher sum would send sterling higher while a sub £100 billion would weigh on the pound.

The meeting minutes may also reveal how the bank sees the economy as it emerges from lockdown and more importantly for the market reaction, the bank’s opinion on negative interest rates. Bailey said that sub-zero borrowing costs are “under active consideration” but later hinted such a move is not imminent.

The BOE is likely to leave rates unchanged at 0.10%, but laying the ground for going further down would hurt sterling. That may come via a vote of one or more of the Monetary Policy Committee’s members in such a direction. The probability is low but the impact could be significant.

See Bank of England Preview: Bailey may boost pound by going big on bond-buying, beware negative rates

Beyond the BOE

Sterling has been struggling with Brexit uncertainty, and recent developments have been somewhat worrying. While European Commission President Ursula von der Leyen may be ready to offer concessions on fisheries, Germany has reportedly lowered expectations for any progress during the summer.

French President Emmanuel Macron will visit Prime Minister Boris Johnson in London – a rare face-to-face encounter in coronavirus times. The two leaders are always friendly to each other but significant differences remain, with France often seen as the tougher player.

The UK is preparing a “shock and awe” campaign to prepare for Brexit, a headline that has raised eyebrows. It also triggered concerns for a no-trade-deal outcome to the current transition period which expires at year-end.

The US dollar has somewhat advanced amid rising coronavirus hospitalizations and cases in several US southern states such as Texas and Florida. The outbreak in Beijing – which resulted in substantial limits to transport – also worries investors.

President Donald Trump has responded angrily to revelations by former National Security Adviser John Bolton in his upcoming book. Bolton says that Trump sought the help of his Chinese counterpart Xi Jinping in his reelection campaign. The US elections are held only in November but are gaining more traction with Trump’s rival Joe Biden benefiting from a growing lead in the polls.

Jerome Powell, Chairman of the Federal Reserve, called on Congress to do more at a critical juncture for the recovery, evidenced in robust retail sales. Weekly unemployment claims are eyed on Thursday.

See Jobless Claims Preview: Better is still a long way to go

Overall, the focus is on the BOE, but pound/dollar traders have many topics to ponder on.

GBP/USD Technical Analysis

Momentum on the four-hour chart has turned positive and the currency pair has recaptured the 100 Simple Moving Average, another positive development. On the other hand, it remains capped by the 50 SMA.

Some resistance awaits at 1.2565, the daily high, followed by 1.2615, a swing low from early June. It is followed by 1.2680, the weekly high, and then by 1.2730.

Support awaits at 1.25, a psychologically significant level, followed by 1.2450, the weekly low, and then by 1.2410, where the 200 SMA hits the price.

More Why EUR/USD may rally, where to find the key to gold move, lots more – Interview with Richard Perry