- GBP/USD has moved higher in synch with the weakness in the US dollar.

- Bulls have broken a key resistance zone which leaves the focus on the upside.

At the time of writing, GBP/USD is trading at 1.3807 and has printed a fresh cycle high of 1.3816, trading some 0.5% higher on the day having travelled from a low of 1.3731.

The US dollar fell on Tuesday amidst huge US fiscal stimulus which is likely on the cards and ahead of the US Consumer Price Index on Wednesday.

The market’s consensus expectation is reinforcing the sentiment for the Federal Reserve’s commitment to accommodative monetary settings which is weighing in the greenback.

Headline inflation is presumed to have risen 0.3% MoM with core rising 0.2% MoM. Both are expected to come in at 1.5% YoY, below the Fed’s 2.0% target.

Meanwhile, the Bank of England has recently lowered expectations for negative interest rates which have boosted investment into the pound this month.

The rapid vaccine rollout and the corresponding likelihood of a spring recovery have taken the pressure off the central bank to offer further stimulus and lower rates.

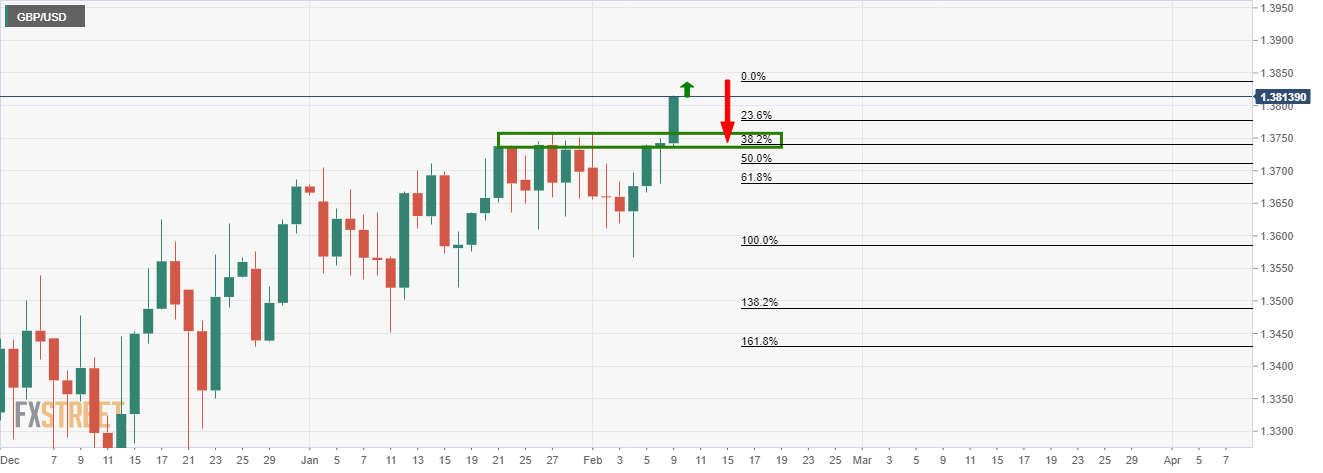

GBP/USD technical analysis

Further to the prior price analysis, Weekly support holds the bears off, where the price was stuck between the support and resistance on the longer-term time frames, bulls may well want to step back in at this juncture.

A push higher would be preferable for a swing trader’s point of view in anticipation of a meaningful correction, at least to a 38.2% Fibonacci of the daily impulse.

In doing so, this would make for a convincing confluence of old resistance as an optimal entry point to ride the next bullish impulse to new highs.