- GBP/USD has been on the back foot amid concerns about US stimulus.

- Vaccine developments and additional stimulus headlines from Washington are eyed.

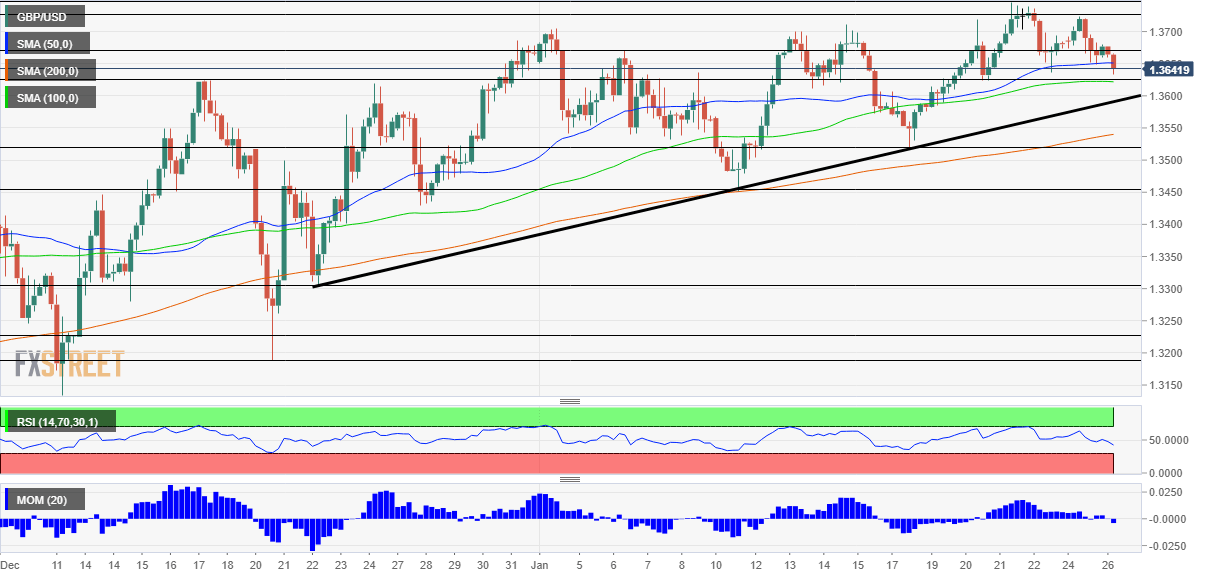

- Tuesday’s four-hour chart is showing bears are gaining ground.

Coronavirus crisis? Not in Britain’s labor market, which has shown resilience once again and may help sterling recover – at least while US stimulus talks continue.

The UK’s Unemployment Rate has edged up to 5% in November, below 5.1% expected and a low level also in absolute terms. The bigger surprise came from Average Earnings, which accelerated to an annual increase of 3.6% both when including and excluding bonuses. The more recent Claimant Count Change rose by 7,000, also exceeding estimates.

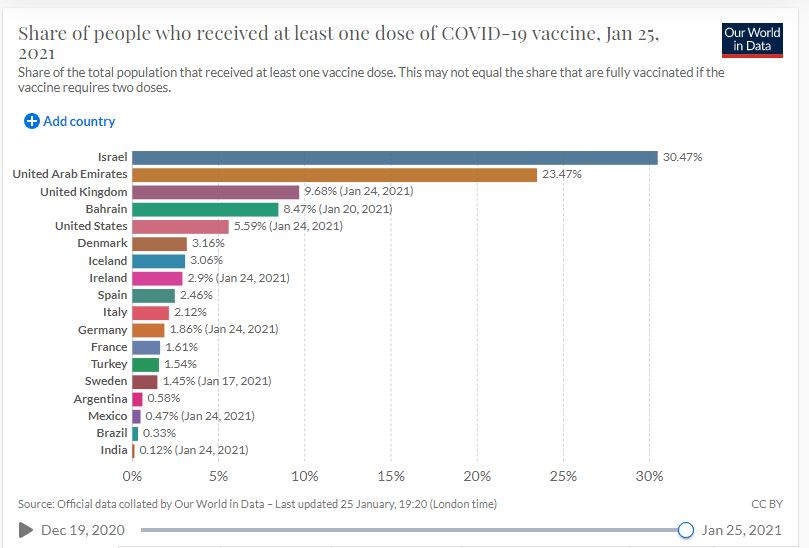

Britain’s successful furlough scheme is the main reason employment remains robust, and it will likely be extended as much as necessary. Can government efforts in the vaccination rollout also boost sterling? Nearly 10% of the population has already received at least one shot, and the pace is nearing the 500,000/day target.

Source: OurWorldInData

Recent data from Israel has shown that among those who received two jabs, nobody has been hospitalized. The UK’s policy to delay the second inoculation has come under scrutiny, but by reaching more people, it may offer at least some protection.

On the other side of the pond, the safe-haven dollar is gaining ground amid concerns that President Joe Biden’s stimulus plan is delayed or watered down. The administration is ready to negotiate with Republicans and markets are worried that momentum is lost.

Will Democrats call time after several days of attempts and go it alone? Markets probably expect the White House to climb down from the $1.9 trillion stimulus plan but not to levels above $1 trillion. Headlines from Washington are set to rock the greenback later in the day.

The Conference Board’s Consumer Confidence figure for January is also of interest.

See Conference Board Consumer Confidence January Preview: Mirror to the labor market

All in all, while GBP/USD is on the back foot, there is room for recovery.

GBP/USD Technical Analysis

Pound/dollar is has dropped below the 50 Simple Moving Average on the four-hour chart but has bounced off the 100 SMA. Momentum has flipped to the downside, but only just – and the currency pair is still holding about the uptrend support line that has been accompanying it since mid-December.

All in all, bulls are not giving up.

Some resistance awaits at 1.3670, which capped GBP/USD early in the year. The recent high of 1.3725 and the 2021 peak of 1.3740 are next.

Support awaits at the daily low of 1.3630, followed only by 1.3520, which was a stepping stone on the way up. The next level to watch is 1.3450.

GBP/USD Price Forecast 2021: Cable braces for calendar comeback amid three exits