- GBP/USD is holding in positive territory as the US dollar gives back ground.

- The daily chart offers a bearish bias from resistance and a confluence of the 61.8% Fibo.

GBP/USD is currently trading at 1.3890 at the time of writing, rising from a low of 1.3801 to a high of 1.3925, up some 0.54% on the day so far.

The pound is supported by positive developments in Britain’s vaccination programme, with the Bank of England’s governor cautiously optimistic about the nation’s economic recovery.

More than 22 million people have already had the first dose of a COVID-19 vaccine in the UK which has encouraged demand for UK assets.

In the prior week’s futures markets, net GBP long positions surged to their highest levels since April 2018.

”Optimism about the impact of the UK’s rapid vaccine roll-out programme on the country’s recovery has been feeding bullish bets on the pound. Net longs were previously lifted by the more hawkish than expected take-away from the February BoE policy meeting,” analysts at Rabobank explained.

Meanwhile, in a speech to the Resolution Foundation, a think tank, BoE Governor Andrew Bailey was cautiously optimistic when he said that he didn’t expect a jump in inflation, which his chief economist and some investors consider a risk.

Also supporting the pound was finance minister Rishi Sunak’s decision last week to extend his jobs support programme until the end of September in the budget.

As for the US dollar, net USD short positions shrunk for a second week to the lowest level since December.

In the spot market, the DXY traded at the highest level since November 24 near 92.50 at the start of the week. However, it has met a setback in trade on Tuesday, falling to a low of 91.90.

”Some consolidation is to be expected but we believe DXY is on track to test the November 23 high near 92.80 and then the November 11 high near 93.208,” analysts at Brown Brothers Harriman argued.

The analysts note that ”real yields and breakeven inflation rates seemed to have stabilized, albeit at elevated levels.”

”And importantly”, they added, ”the Fed can still take comfort from seeing longer-dated inflation expectations below shorter-dated measures, and still not far off from the targe.”

GBP/USD technical analysis

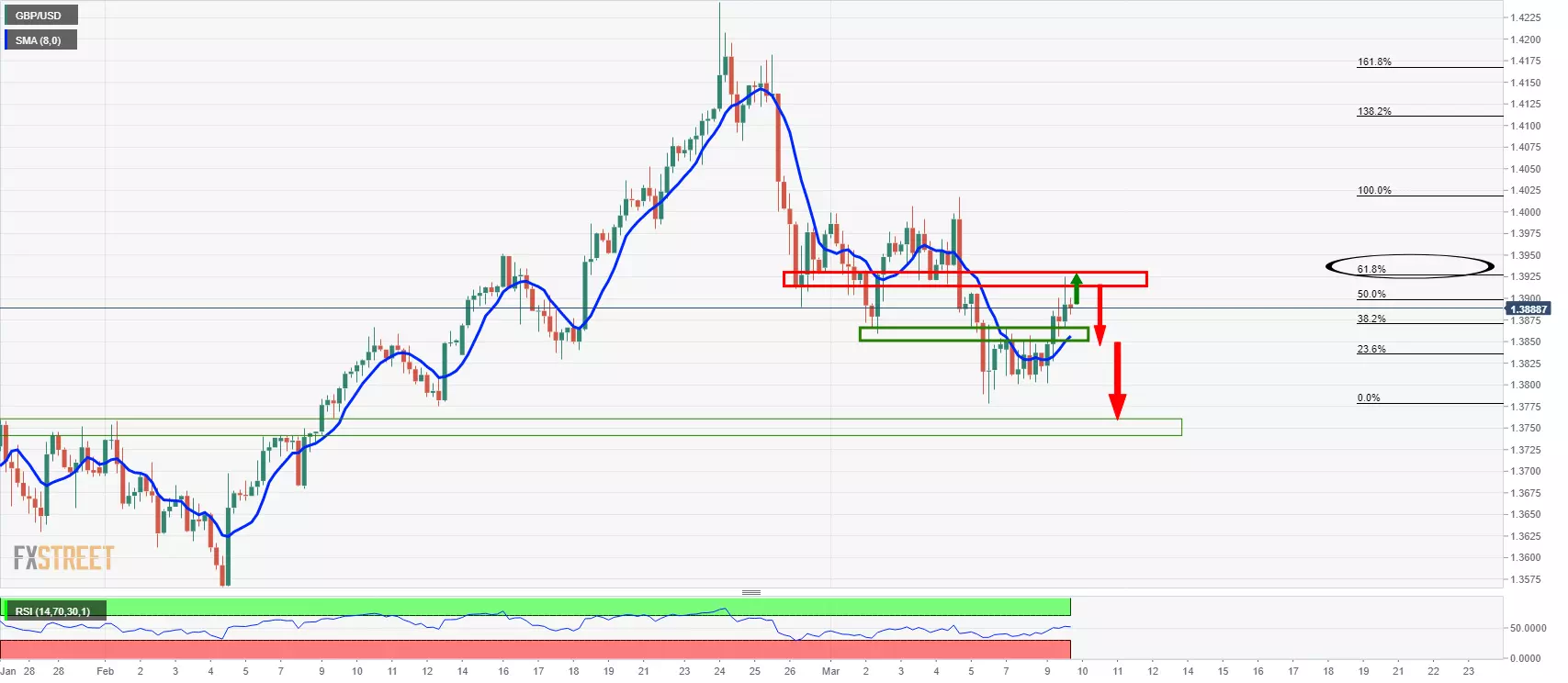

The daily chart offers a downside prospect given the resistance at the old support structure and a 61.8% Fibonacci retracement level.

From a 4-hour perspective, the price is in bullish territory and testing the near term resistance while above the 8 SMA and support.

A break of support and the 8 SMA opens risk to 1.3760.