- GBP/USD bulls stepping up the pace into critical resistance territory.

- Brexit negotiations have resumed in London, markets looking for a breakthrough and compromise.

GBP/USD is making firm tracks to the upside, but there is still too much resistance to convince the bears that this isn’t another opportunity at a discount to be short. More on that below.

Meanwhile, it is hard to be upbeat on the pound all the while it carries so much Brexit baggage with it.

Brexit negotiations have resumed

Brexit negotiations have resumed in London today, this time, they are face-to-face.

The stakes are high after the last round of talks last week ended a day early in Brussels because of deep divides between the UK and EU.

EU chief negotiator Michel Barnier was signalling that “serious divergences remain”. However, it’s too early to conclude that the chances of a trade agreement are falling.

Even if there is a breakthrough, the risks of the economic impact could be significant for which will be priced into the pound while the transition period ends later this year.

For the time being, markets will be looking for signs of compromise which would no doubt relieve some of the uncertainty from out of steering markets and be supportive of GBP.

There is some speculation that the UK could be signing up to the EU’s compromise requests initially, with a caveat, that it could move away from them in the future, in the knowledge that the EU would respond with tariffs.

US coronavirus situation is concerning

Meanwhile, the USD is under pressure, losing some of its risk-off allure as markets continue to shrug off the latest COVI19 headlines pertaining to the difficulties in containing the virus, specifically in the US.

More on that here: US COVID-19 storm clouds, transmission rate on the rise, concerns over airborne spread

GBP/USD levels

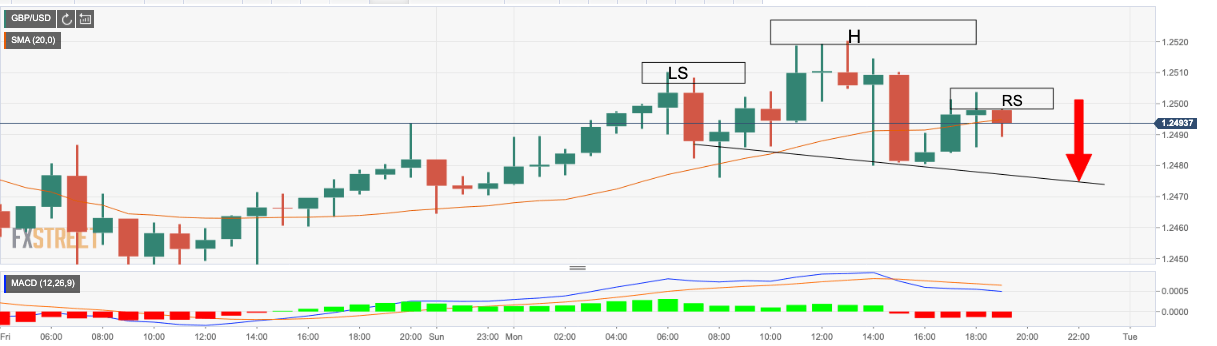

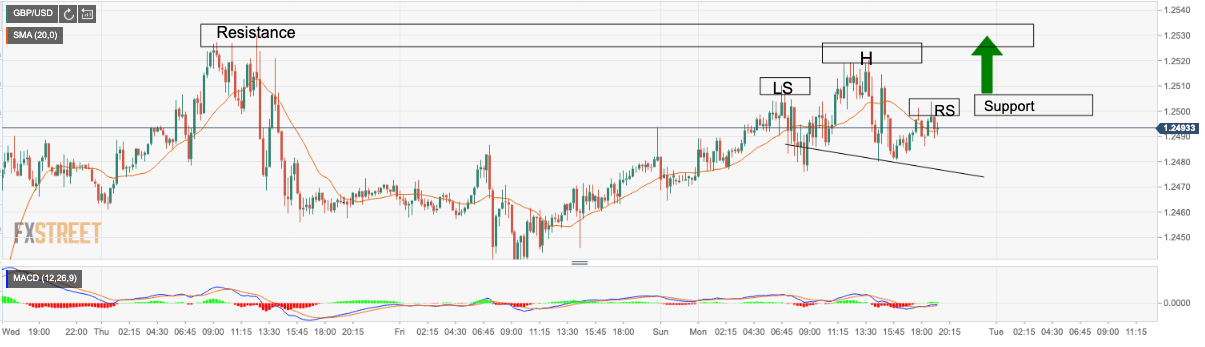

As mentioned above, cable is testing the 1.25 handle, but meeting tough resistance so far.

On the hourly time frame, the price has started to form a non-symetrical -looking H&S with the highs on the right-hand shoulder below those of the left.

Failures to break equal high puts the emphasis on the path of least resistance towards a test of recent 1.2480 lows and beyond.

With a price that is now below the 20-hour moving average and MACD turning south towards zero, bears will be moving down to the lower time frames for short entry signals.

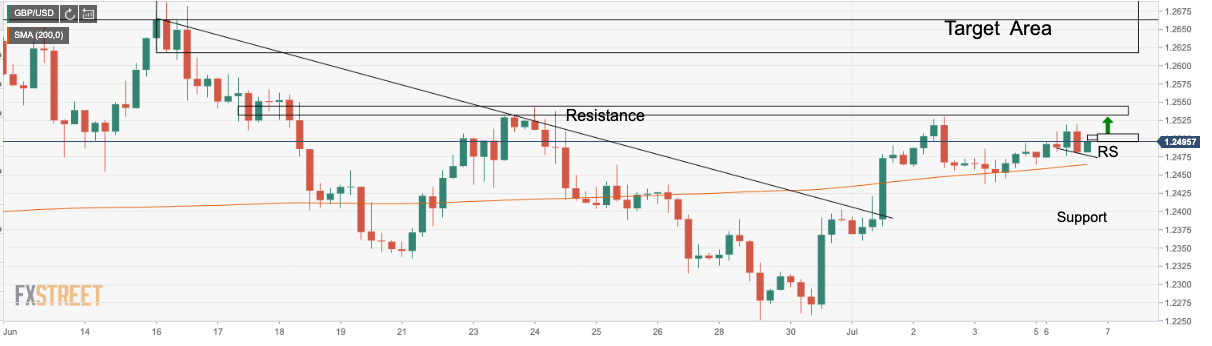

Bulls to target 1.2650s

On the flip side, should the price action break the LS, then there is renewed scope for a continuation of the recent breakout.