- GBP/USD rallies from fresh 8-month high on a dovish comment from Fed’s chairman, Powell.

- Bulls will now be nervous holding GBP heading into the UK elections.

The markets getting out of US dollars on recent dovish comments made by Fed’s Chairman Powell in a post-Federal Reserve interest rate decision and presser. The DXY has dropped to a low of 97.08 from a high of 97.60 and GBP/USD has subsequently rallied to a fresh 1.3212 eight-month high.

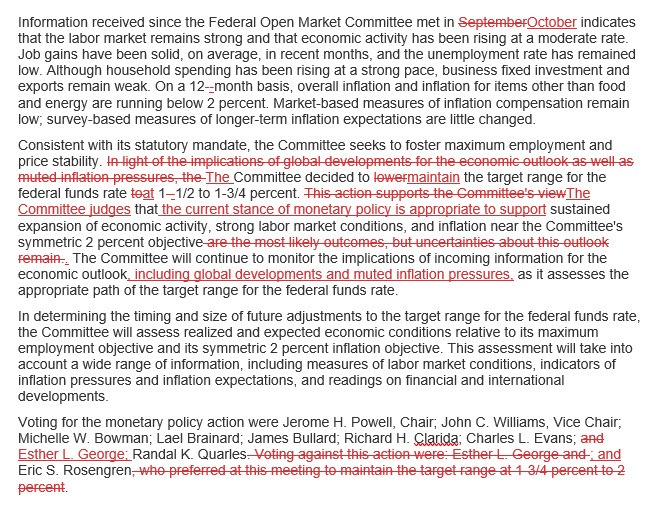

GBP/USD was steady following what, at first, appeared to be a hawkish outcome from the Fed statement. Markets were then awaiting Powell’s presser and despite a bullish economic outlook in his opening statement, Powell followed-up in a Q&A by stating that he would prefer to see a ‘significant and persistent’ move up in inflation before raising rates. This should not be a surprise yet the markets sent the US dollar over a cliff and the DXY to test a critical support area around 97 the figure.

We can now expect bulls to be nervous running so far with a currency that is about to come under immense scrutiny with the UK elections on the horizon. GBP/USD is currently steady on the 1.32 handle at the time of writing and showing little signs of further upside at this juncture.

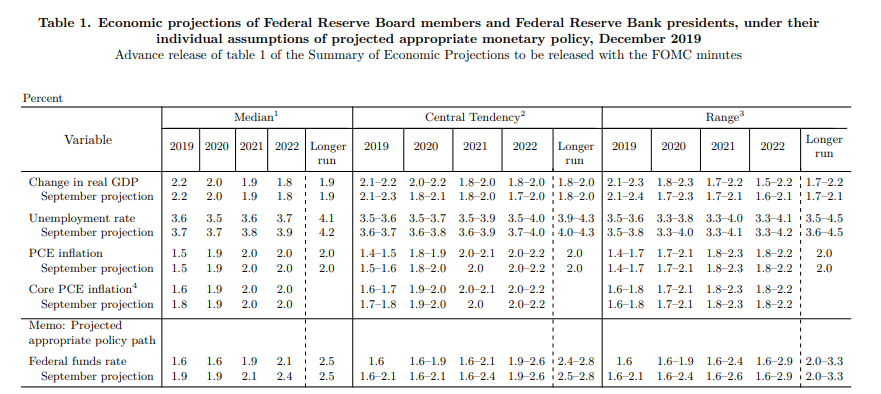

Key takeaways from FOMC statement and projections

- The market has priced in virtually no chance of rate move through February.

- IOER 1.55% vs 1.55% prior.

- Fed drops language about ‘uncertainties about this outlook remain’.

- Vote was unanimous.

- “The Committee will continue to monitor the implications of incoming information for the economic outlook, including global developments and muted inflation pressures, as it assesses the appropriate path of the target range for the federal funds rate”.

- No changes in the economic outlook paragraph.

- Says “the current stance of monetary policy is appropriate”.

- Leaves forecasts for GDP and inflation unchanged, lowers unemployment.

- Median forecast is for one rate hike in 2021 and one in 2022.

Fed projections

Fed statement changes

UK elections are the major focus

We are now counting down to the UK election vote for Thursday where results are expected to come in from around 0200 GMT onwards. Sterling has been better offered as of yesterday’s YouGov outcome that proved the Conservative’s lead was narrowing. There are mounting risks of a hung parliament – an outcome discussed in more detail here.

- UK Election Preview: GBP bulls to hold their horses

GBP/USD levels

- Bullish targets: 1.3160/87 was the pre-Fed high target, 1.3211 was the post-Powell high. 1.3380 is a key upside target ahead of 1.3850.

- Bearish targets: 1.3107, 1.3013, 1.2930, 1.2768.

Bulls have taken out the 50% mean reversion of the mid-April-3rd September range in the 1.3160s and a five-year downtrend with a confluence of the 200-week moving average. 1.3187 May highs have given way to the highest levels since March 2019, printing a fresh high of 1.3212.

- Chart of the week: GBP/USD bulls target closes above critical 1.3160/90 on UK election week