- GBP/USD is holding onto gains amid hopes for fiscal stimulus.

- Investors are shrugging off heightened Brexit rhetoric.

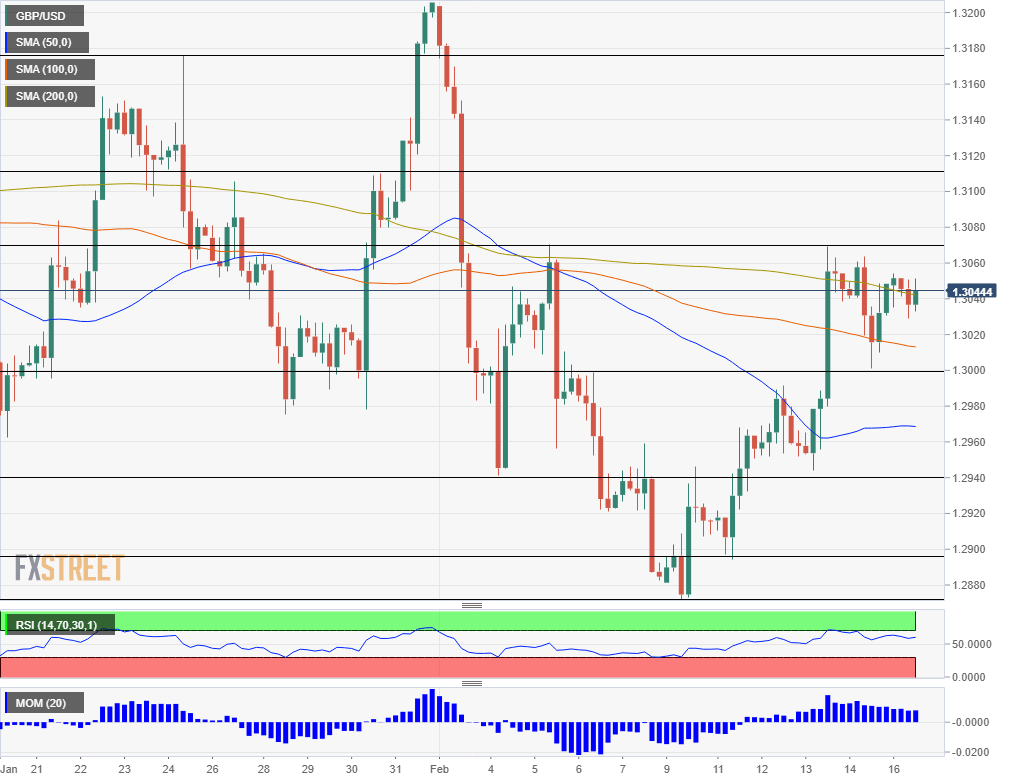

- Monday’s four-hour chart is pointing to potential gains.

When a Tory government abandons fiscal conservatism – why should pound traders remain cautious? The perceived willingness of Prime Minister Boris Johnson to open the UK’s purse strings continues having a positive impact on the pound.

The PM’s forcing out of the fiscally prudent Sajid Javid out of his role as Chancellor of the Exchequer – rushing in the lesser-known Rishi Sunak in his place – continues supporting the pound. Investors assume that if Johnson moves forward with infrastructure spending, the government’s stimulus will relieve the Bank of England of its need to cut interest rates.

Sterling has been holding onto its gains as markets shrug off growing concerns about EU-UK talks about future trade relations. Jean Yves le Drian, France’s foreign minister, said that both sides will “rip off each other” in talks. David Frost, Britain’s top negotiators, is set to present more details about the UK’s stance and according to excerpts released to the press, it will contain new demands on labor rights in the post-Brexit world.

Investors seem to see the recent statements and leaks as posturing ahead of official negotiations which kick off in two weeks. Both sides may compromise once the doors are closed behind them.

Digesting US data, coronavirus headlines

European traders have time to digest recent mixed US figures while markets on the other side of the Atlantic are closed. Retail sales figures for January fell short of forecasts, especially as the Control Group showed stagnation. On the other hand, consumers remain confident according to the University of Michigan’s preliminary gauge for February. The indicator topped 100 points, better than estimates.

Coronavirus news continues dominating the headlines, with China reporting over 70,000 infections and more than 1,700 deaths. While economic activity has mostly returned to normal, Hubei province remains under lockdown. Outside the world’s second-largest economy, over 400 cases have been identified on the Princess Diamond cruise ship docked at Yokohama, Japan. The repatriation of Americans and others causes fears of wider spreading.

So far, pound/dollar seems relatively unaffected by developments related to the respiratory disease but the news is coming out thick and fast.

GBP/USD Technical Analysis

Momentum on the four-hour chart remains positive for cable that is battling the 200 Simple Moving Average after surpassing the 50 and 100 SMAs. Bulls remain in control.

Resistance awaits at 1.3070, which has capped the pair twice in February – a double-top. The next level to watch is 1.3110, capping GBP/USD in late January, followed by 1.3175, a swing high from earlier last month. 1.3210 is next.

Support awaits at 1.30, a round number that also held sterling on Friday. Next, 1.2940 was a stepping stone on the way up and 1.2875 is the 2020 low.