GBP/USD had another downbeat week, falling to the lowest in two months. Will it find a bottom soon? PMI data stands out in a busy week. Here are the key events and an updated technical analysis for GBP/USD.

UK GDP came out at 0.1% q/q and 1.2% y/y, far worse than expected. Blaming the weather did not work and the pair fell sharply. IT was not only a pound plunge story: US bond yields shot higher, with the 10-year Treasuries crossing the 3% level and the USD followed higher. Everything went against cable.

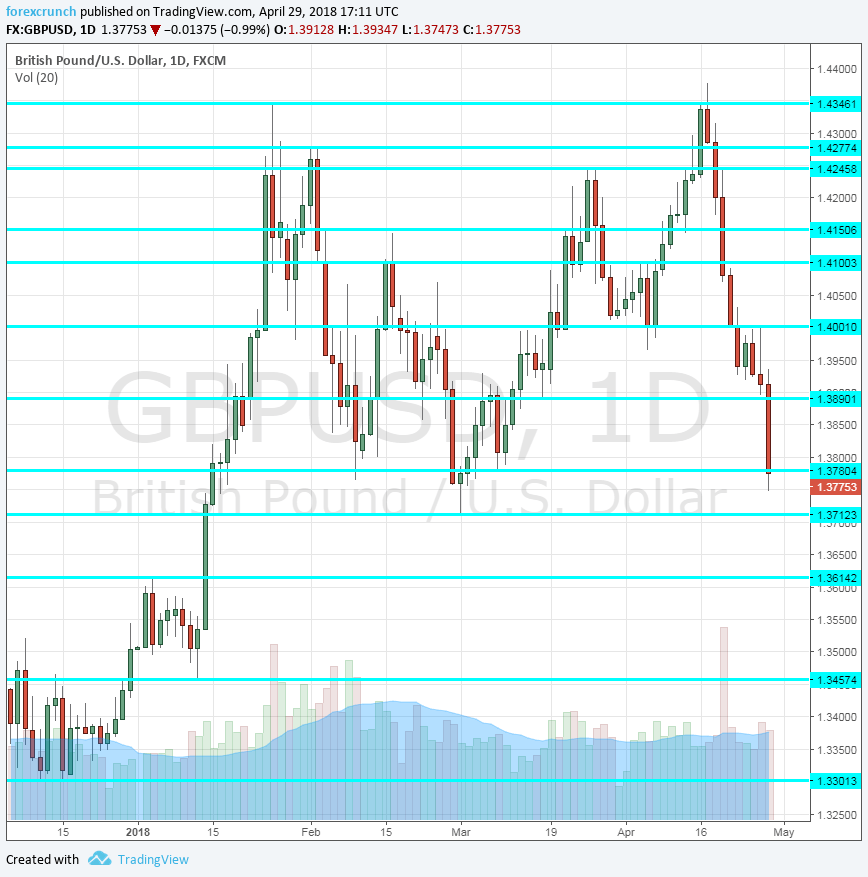

[do action=”autoupdate” tag=”GBPUSDUpdate”/]GBP/USD daily graph with resistance and support lines on it. Click to enlarge:

- Manufacturing PMI: Tuesday, 8:30. The first of Markit’s forward-looking indices is the best one, at least in March. It then stood at 55.1 points and is now expected to tick down to 54.9. The manufacturing sector is small but important.

- Net Lending to Individuals: Tuesday, 8:30. Extended lending to individuals implies elevated economic activity down the line. A relatively high level of 5.4 billion was seen in February. The forecast for March is a drop to 4.9 billion.

- M4 Money Supply: Tuesday, 8:30. The amount of money in circulation has surprisingly dropped by 0.3% in February after expanding beforehand. It is now expected to rise by 0.2% in the read for March.

- Mortgage Approvals: Tuesday, 8:30. The official level of mortgage approvals dropped to 64K in February, yet it is still within the averages. Another slide to 63K is on the cards.

- BRC Shop Price Index: Tuesday, 23:01. The British Retail Consortium’s Shop Price Index provides an insight into inflation early in the month. A drop of 1% y/y was seen in March and the figure for April will likely be similar.

- Construction PMI: Wednesday, 8:30. The second PMI in the series has shown the worst result. The 47 score in March reflects an outright contraction in the construction sector. A bounce back above 50 is on the cards now: 50.9 points is projected.

- UK Services PMI: Thursday, 8:30. The services sector is the largest in the UK as in other developed economies. Markit’s forward-looking index has a significant impact on the pound. The figure fell to 51.7 points in March, indicating a major slowdown. A bounce back to 53.3 points is on the cards for April.

GBP/USD Technical Analysis

Pound/dollar was initially trying to recapture the 1.40 level (mentioned last week). The failure led to a total collapse and the pair ended the week at 1.3775.

Technical lines from top to bottom:

1.4376 is the new post-Brexit high and looms above. 1.4345 is the January 2018 swing high that is worth watching.

1.4300 capped the pair in mid-April. 1/4260 was the high point in March and provides another line of defense.

1.4150 capped the pair in mid-February. 1.41 capped the pair in early April and also in mid-March.

It is followed by the round level of 1.40, which is eyed by many. 1.3960 was a swing low in early April.

1.3890 served as support in mid-March and maintains its role. 1.3790 was a swing low in mid-March.

Further below,1.3780 was a line of support in March and 1.3710 was the lowest point since early in the year.

Even lower, 1.3615 capped the pair in late 2018 and the next level to watch is 1.3460.

I remain bearish on GBP/USD

The pound has all the reasons to fall, a weak economy and Brexit uncertainty. Moreover, the US Dollar may extend its moves as the Fed prepares use for another hike.

Our latest podcast is titled Is inflation rearing its ugly head? Oil is on fire

Further reading:

- EUR/USD forecast – for everything related to the euro.

- USD/JPY forecast – projections for dollar/yen

- AUD/USD forecast – predictions for the Aussie dollar.

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!