GBP/USD stabilized and traded in a narrow range just before Christmas. The holiday week features only one event, but low liquidity could trigger outsized moves. Here are the key events and an updated technical analysis for GBP/USD.

Britain’s GDP growth was upgraded, at least on a y/y basis, to 1.7%. The good news was countered by falling consumer confidence and a wider current account deficit. In the US, GDP was revised down to an annualized level of 3.2% but other figures were mostly positive. The signing of the tax bill into law was already priced in and did not help the US dollar.

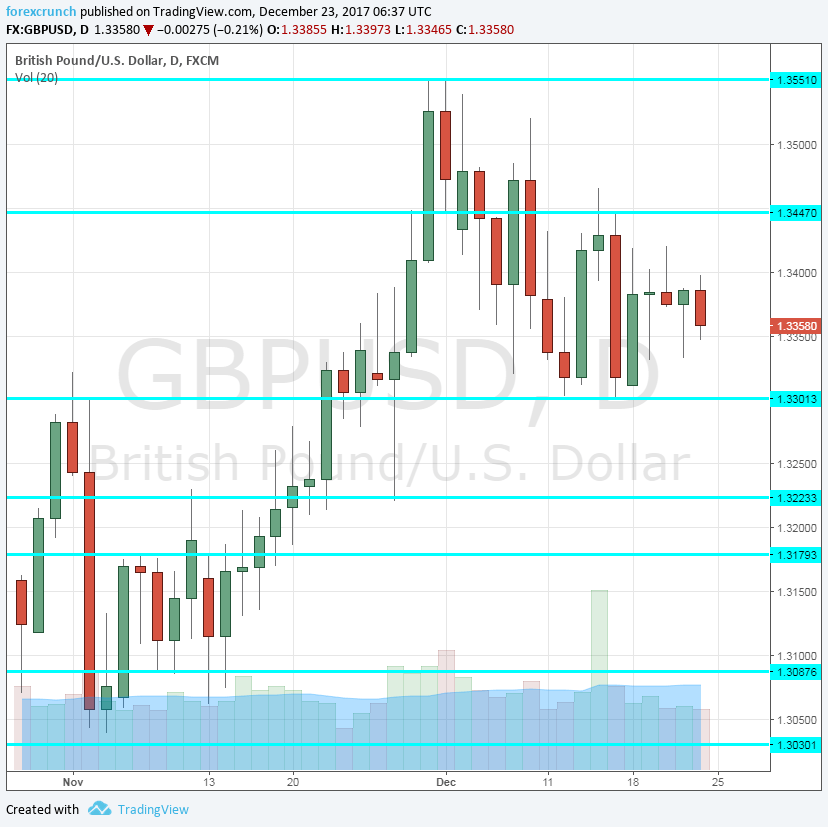

[do action=”autoupdate” tag=”GBPUSDUpdate”/]GBP/USD daily graph with resistance and support lines on it. Click to enlarge:

- High Street Lending: Wednesday, 9:30. This measure of the number of mortgages by the top banks stood at 40.5K in October, ticking down from previous levels. A small rise to 40.6 is on the cards. Britain’s housing sector is cooling.

BP/USD Technical Analysis

Pound/dollar was confined to a narrow range, deep within the 1.33 and 1.3450 levels mentioned last week.

Technical lines from top to bottom:

The recent cycle high of 1.3620 serves as strong resistance. 1.3550 was the November peak.

1.3450 capped the pair in mid-December and serves as resistance. The round level of 1.33 is a key level of support, working as such around the same period of time.

1.3225 was the high point of September. It is followed by 1.3180, which capped the pair in July.

1.3080 worked as support in mid-October and also was weak support during November. 1.3030 is the bottom of the range, cushioning cable in October and also in early November.

I am neutral on GBP/USD

The holiday week could allow more time for consolidation for cable. 2018 may be different, with Brexit bringing the economy and the pound lower.

Our latest podcast is titled What does 2018 have in store for financial markets?

Further reading:

- EUR/USD forecast – for everything related to the euro.

- USD/JPY forecast – projections for dollar/yen

- AUD/USD forecast – predictions for the Aussie dollar.

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!