GBP/USD reversed directions last week and recorded considerable gains. There are five events on the schedule in the upcoming week. Here is an outlook for the highlights and an updated technical analysis for GBP/USD.

There were no British events last week, but the pound managed to take advantage of a broadly-lower U.S. dollar. The pound has gained 1.1% in December, in what has been a roller-coaster month.

In the U.S. durable goods orders plunged 2.0% in November, compared to a gain of 0.6% a month earlier. This was shy of the estimate of +0.2%. The core release, which excludes volatile items such as aircraft orders, slowed to 0.0%, down from 0.6% in October. This figure was well off the estimate of a 1.5% gain. The weak durables reports indicate that the manufacturing sector is showing signs of weakness. On the employment front, unemployment claims dropped sharply for a second straight week, to 222 thousand. This matched the estimate.

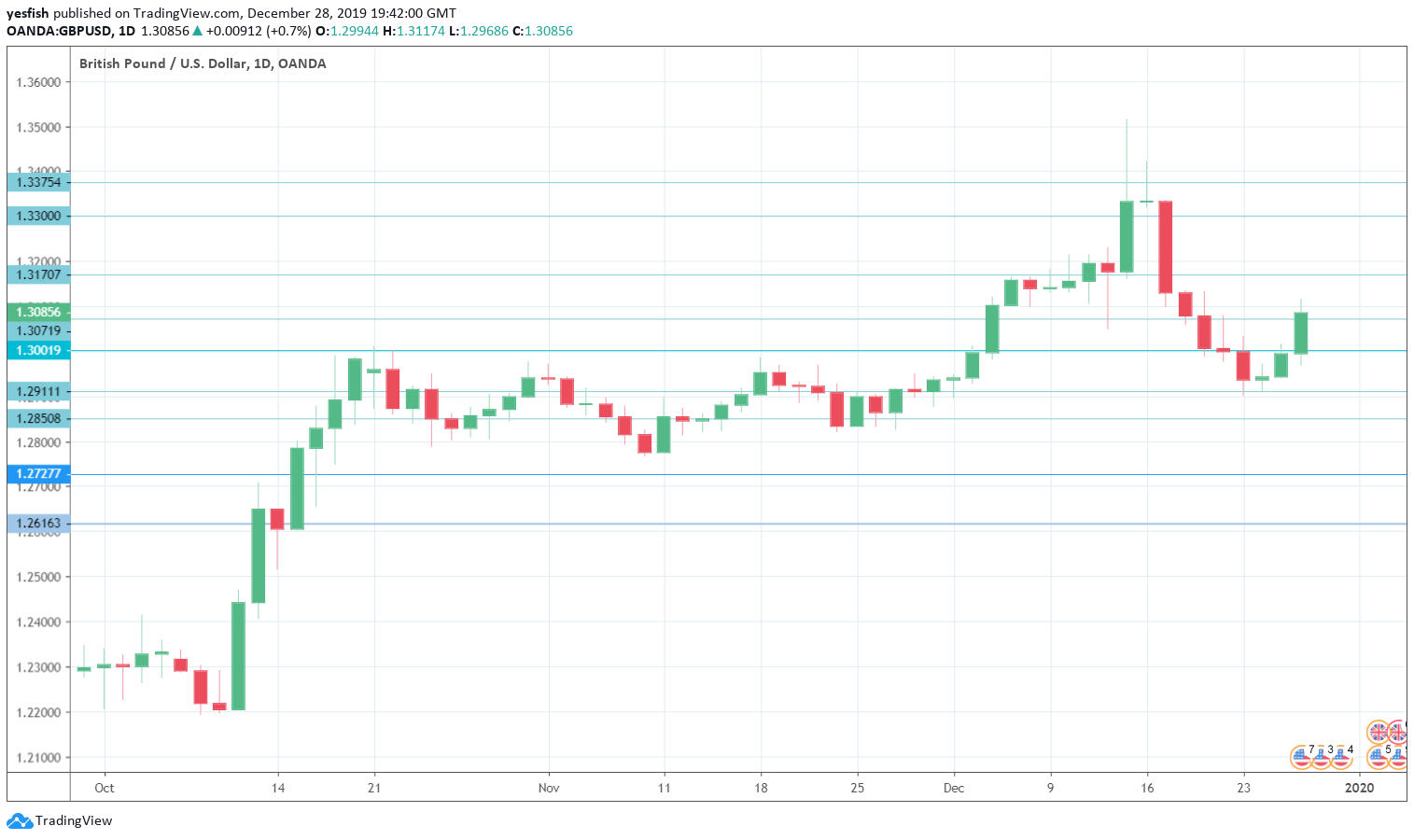

GBP/USD daily graph with resistance and support lines on it. Click to enlarge:

- High Street Lending: Monday, 9:30. The number of new mortgages approved by major British banks dipped to 41.2 thousand in October, shy of the estimate of 43.1 thousand. The estimate for November stands at 41.3 thousand.

- Final Manufacturing PMI: Thursday, 9:30. The second-estimate for Manufacturing PMI is expected to confirm the initial reading of 47.4, which points to contraction. The manufacturing sector has been struggling, as the PMI has not been in expansion territory since April.

- BRC Shop Price Index: Friday, 0:01. This consumer spending gauge continues to contract and declined by 0.5% in November. Another decline is likely in the December release.

- Construction PMI: Friday, 9:30. The construction sector continues to contract, as the PMI has fallen below the 50-level since April. In November, the index rose to 45.3, above the estimate of 44.5 pts. The upward trend is expected to continue in December, with an estimate of 45.8 pts.

GBP/USD Technical analysis

Technical lines from top to bottom:

We start with resistance at the round number of 1.3500. 1.3375 is next.

1.3300 has held in resistance since mid-December. 1.3170 follows.

1.3070 has switched to a support role after gains by GBP/USD. It is a weak line.

1.3000 (mentioned last week) saw action throughout the week.

1.2910 has held in support since early December. 1.2850 is next.

1.2728 has provided support since mid-October.

1.2616 is the final support level for now.

I am bearish on GBP/USD

The post-election euphoria which sent the pound soaring has quickly evaporated, as the pound struggles to stay above the 1.30 line. Manufacturing and construction PMIs are expected to indicate contraction, and the post-Brexit era is full of uncertainty, as the UK and the EU will commence talks on a free-trade deal.

Further reading:

- EUR/USD forecast – for everything related to the euro.

- USD/JPY forecast – projections for dollar/yen

- AUD/USD forecast – predictions for the Aussie dollar.

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!