GBP/USD Technical Analysis

GBP/USD rose close to 1.0 percent and broke above the 1.35 level. The upcoming week has six events, including GDP. Here is an outlook for the highlights and an updated technical analysis for GBP/USD.

In the UK, the focus was on the November PMI reports. Manufacturing PMI climbed to a 35-month high of 55.5 in November, up from 53.7 in October. The Services PMI slipped into contraction territory, falling from 51.4 to 47.6. Construction PMI rose to 54.7, up from 53.1 points. Inflation in BRC shops fell by 1.8%, its sharpest drop in six months.

The US manufacturing sector continued to grow, as the ISM Manufacturing PMI came in at 57.9, although this was weaker than the previous release of 59.3 points. The ISM Services PMI fell to 55.9, down from 56.6 points. Still, this was a sixth straight month of expansion. In testimony on Capitol Hill, Federal Reserve Chair Powell reiterated his message for further fiscal stimulus support from the federal government. Nonfarm payrolls dropped to 245 thousand, down sharply from 638 thousand. This missed the estimate of 480 thousand. Wage growth surprised with a gain of 0.3%, above the estimate of 0.1%. .

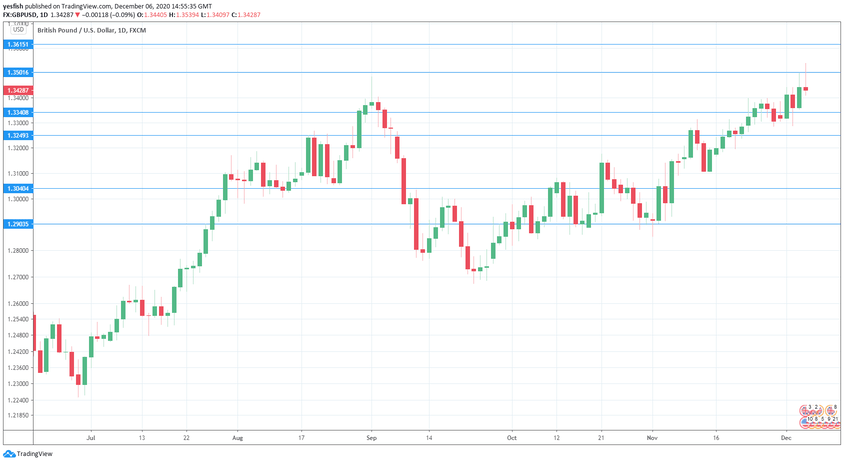

GBP/USD daily graph with resistance and support lines on it. Click to enlarge:

- BRC Retail Sales Monitor: Tuesday, 00:01. Retail sales in BRC shops slowed in October, with a reading of 5.2%. We now await the November reading.

- RICS House Price Balance: Thursday, 00:01. The housing sector has improved in recent months. In October, 68% of surveyors reported a rise in house prices. Another strong reading is expected in November, with a forecast of 60%.

- GDP: Thursday, 7:00. The monthly GDP has been pointing to slower growth and the indicator fell to 1.1% in September. The downtrend is expected to continue in October, with an estimate of 0.4%.

- Manufacturing Production: Thursday, 7:00. The pace of growth in manufacturing has been slowing, and the September reading came in at a negligible 0.2%. The forecast for October stands at 0.3%.

- BOE Financial Stability Report: Friday, 7:00. The Bank of England publishes its thorough report on financial stability twice a year. Apart from the details on banks, the BOE also makes available some economic assessments which are relevant to monetary policy.

- CBI Leading Index: Friday, 14:30. The index came in at -1.5% in September, pointing to contraction in economic activity. Will we see an improvement in October?

Technical lines from top to bottom:

1.3735 is an important monthly resistance line.

1.3615 is next.

1.3502 (mentioned last week) was tested last week as GBP/USD moved sharply higher.

1.3340 is the first line of support.

1.3249 follows.

1.3145 is the final support level for now.

I am neutral on GBP/USD

The pound had a great week, but this was more a result of weakness in the US dollar rather than strength in the pound. Both the US and UK are grappling with a renewed wave of Covid, which is weighing on economic growth.

Further reading:

- EUR/USD forecast – for everything related to the euro.

- USD/JPY forecast – projections for dollar/yen

- AUD/USD forecast – predictions for the Aussie dollar.

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!