GBP/USD suffered its worst week since October, falling over 1 percent. The Brexit saga remains on the minds of nervous investors. There are key numbers on both sides of the pond in the upcoming week. The U.K releases CPI and retail sales this week, and the U.S will publish Final GDP for the third quarter. As well, the Federal Reserve is expected to raise rates at its policy meeting.

The Brexit saga continues, with new developments almost every day. Prime Minister May survived a leadership vote, but opposition to the Brexit withdrawal group remains strong. It’s difficult to see how she will push the withdrawal agreement through parliament, with the Irish backstop a key issue which has not yet been resolved. Unless May can pull a rabbit out of a hat, the U.K could be headed out of the EU with no deal in place, which would be bad news for the pound.

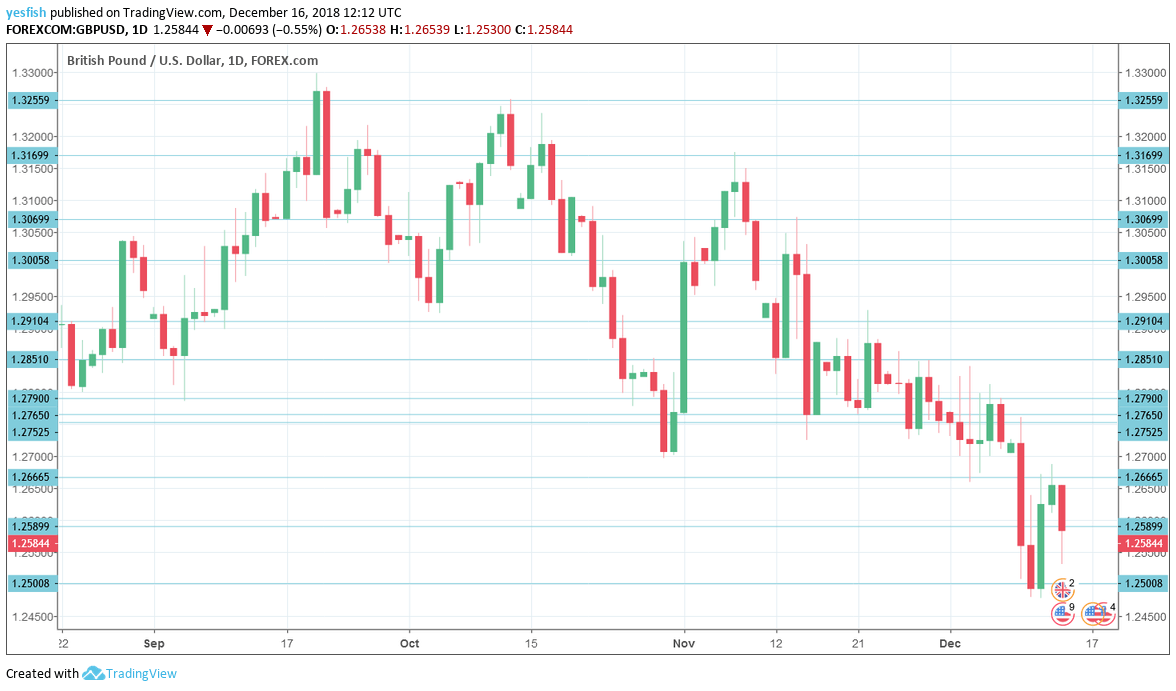

GBP/USD daily graph with resistance and support lines on it. Click to enlarge:

- CBI Industrial Order Expectations: Monday, 11:00. Manufacturing orders jumped to 10 in November, surprising the markets, which had forecast a decline. Another increase in orders is expected, with an estimate of 6 points.

- CPI: Wednesday, 9:30. This key indicator should be treated as a market-mover. Inflation has held steady at 2.4% for the past two months, but is expected to tick lower to 2.3% in November.

- CBI Realized Sales: Wednesday, 11:00. Sales volume jumped to 19 in November, crushing the estimate of 10 points. Will the upward trend continue in December?

- Retail Sales: Thursday, 9:30. Consumer spending is down, with retail sales posting two consecutive declines. The markets are expecting better news, with a forecast of 0.3%.

- Official Bank Rate: Thursday, 12:00. The Brexit clock is ticking and with no withdrawal agreement in place, the BoE is very unlikely to raise rates at its policy meeting. The MPC is expected to vote unanimously to maintain rates at 0.75%

- GfK Consumer Confidence: Friday, 12:01. Consumer confidence continues to weaken, dropping to -13 in November. Another soft reading is expected this week.

- Current Account: Friday, 9:30. The current account deficit has been growing, and this trend is expected to continue in the third quarter. The negative trend is attributable to the global trade war and uncertainty over Brexit, which has hurt British exports.

- Final GDP: Friday, 9:30. The economy is expected to expand 0.6% in Q3, which would be unrevised from the initial GDP release back in November.

* All times are GMT

GBP/USD Technical analysis

Pound/dollar had a dismal week, breaking below several support levels and testing the 1.25 level (mentioned last week), for the first time since April 2017.

Technical lines from top to bottom:

1.3255 was the high point in mid-October, ahead of the EU Summit on Brexit. 1.3170 was a swing high in early November.

1.3070 was a high point in mid-November. The symbolic number of 1.3000 is important after providing support to the pair in late September. 1.2910 was a high point in late November. 1.2850 capped recovery attempts in late November.

Further down, 1.2790 served as support late August and also beforehand. 1.2765 was a swing low in mid-November. It is followed by the trough of 1.2725 seen earlier that month.

The current 2018 trough at 1.2660 is the next level. 1.2590 was a swing low in September 2017.

Even lower, 1.25 is a round number and also worked as support in early 2017. It could break this week.

Further down, 1.2420 and 1.2330 are notable.

I am bearish on GBP/USD

Prime Minister May remains embattled at home and is unlikely to secure any concessions from European leaders. A hard Brexit is a serious possibility, which would have serious repercussions on the British economy. In this uncertain environment, the pound will likely face further headwinds.

Our latest podcast is titled What to expect from the Fed, trade, and the Brexit saga

Further reading:

- EUR/USD forecast – for everything related to the euro.

- USD/JPY forecast – projections for dollar/yen

- AUD/USD forecast – predictions for the Aussie dollar.

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!