- Inflation Report: Wednesday, 7:00. Headline inflation improved from 0.3% to 0.6% in December and another solid gain is expected in January, with a forecast of 0.5%. Core CPI rose from 1.1% to 1.4% in December. The estimate for January stands at 1.2%.

- GfK Consumer Confidence: Friday, 00:01. The index remains mired in negative territory, as the British consumer is pessimistic about the economy. The indicator came in at -28 in January and is expected to improve marginally in February, to -26 points.

- Retail Sales: Friday, 7:00. Retail sales posted a weak gain of 0.3% in December and analysts are bracing for a dismal January, with a forecast of -2.6%. A significant decline could weigh on the British pound.

- Services PMI: Friday, 9:30. Services fell sharply in December, from 49.9 to 38.8. A reading below the 50-level indicates contraction. The January forecast stands at 42.3.

- Manufacturing PMI: Friday, 9:30. Manufacturing remains in expansion mode but did fall to 52.9 in December. The street consensus for January is 53.1.

- CBI Industrial Order Expectations: Friday, 11:00. Order volume sank to -38 in January, down from -25 beforehand. The estimate for February is at -38.

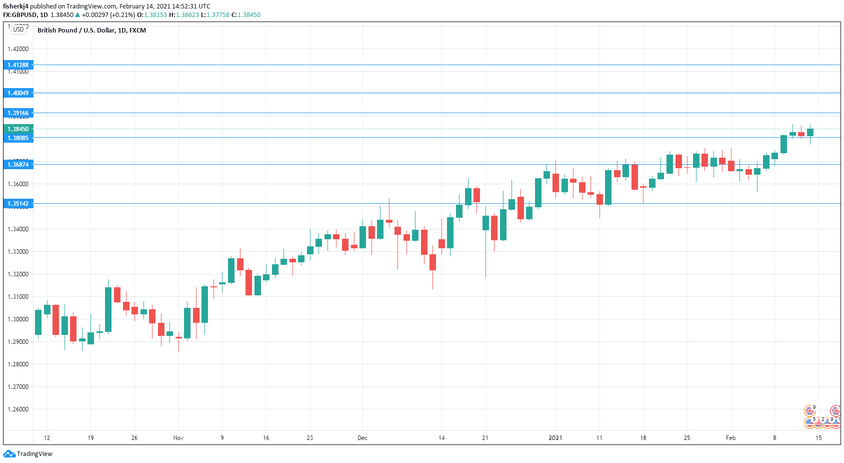

GBP/USD Technical analysis

Technical lines from top to bottom:

We start with resistance at 1.4128, an important monthly line.

The round number of 1.4000 follows.

1.3917 has held since April 2018.

1.3808 is an immediate support line.

1.3687 has held since early February.

1.3514 (mentioned last week) is the final support level for now.

.

I am neutral GBP/USD

The UK vaccine rollout is gathering steam, but Covid lockdowns are weighing on growth. In the US, the Biden stimulus package will likely weigh on the US dollar.

Further reading:

- EUR/USD forecast – for everything related to the euro

- USD/JPY forecast – projections for dollar/yen

- AUD/USD forecast – predictions for the Aussie dollar

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week

Safe trading!