For a second straight week, GBP/USD showed significant movement but ended the week unchanged. There are seven events on the schedule in the upcoming week. Here is an outlook for the highlights and an updated technical analysis for GBP/USD.

In the U.K, Services PMI was unchanged, with a reading of 50.0. This level separates expansion from contraction. There was good news from the housing sector, as Halifax HPI climbed 1.7%, its strongest gain in 10 months.

In the U.S., Services PMI improved to 55.0, up from 53.9 points. This points to stronger expansion in the services sector. However, employment numbers for December were a major disappointment. Nonfarm payrolls fell to 145 thousand, compared to 266 thousand a month earlier. This missed the estimate of 162 thousand. Wage growth slipped from 0.3% to 0.1%, and fell shy of the forecast of 0.1%. The unemployment rate was unchanged at 3.5%.

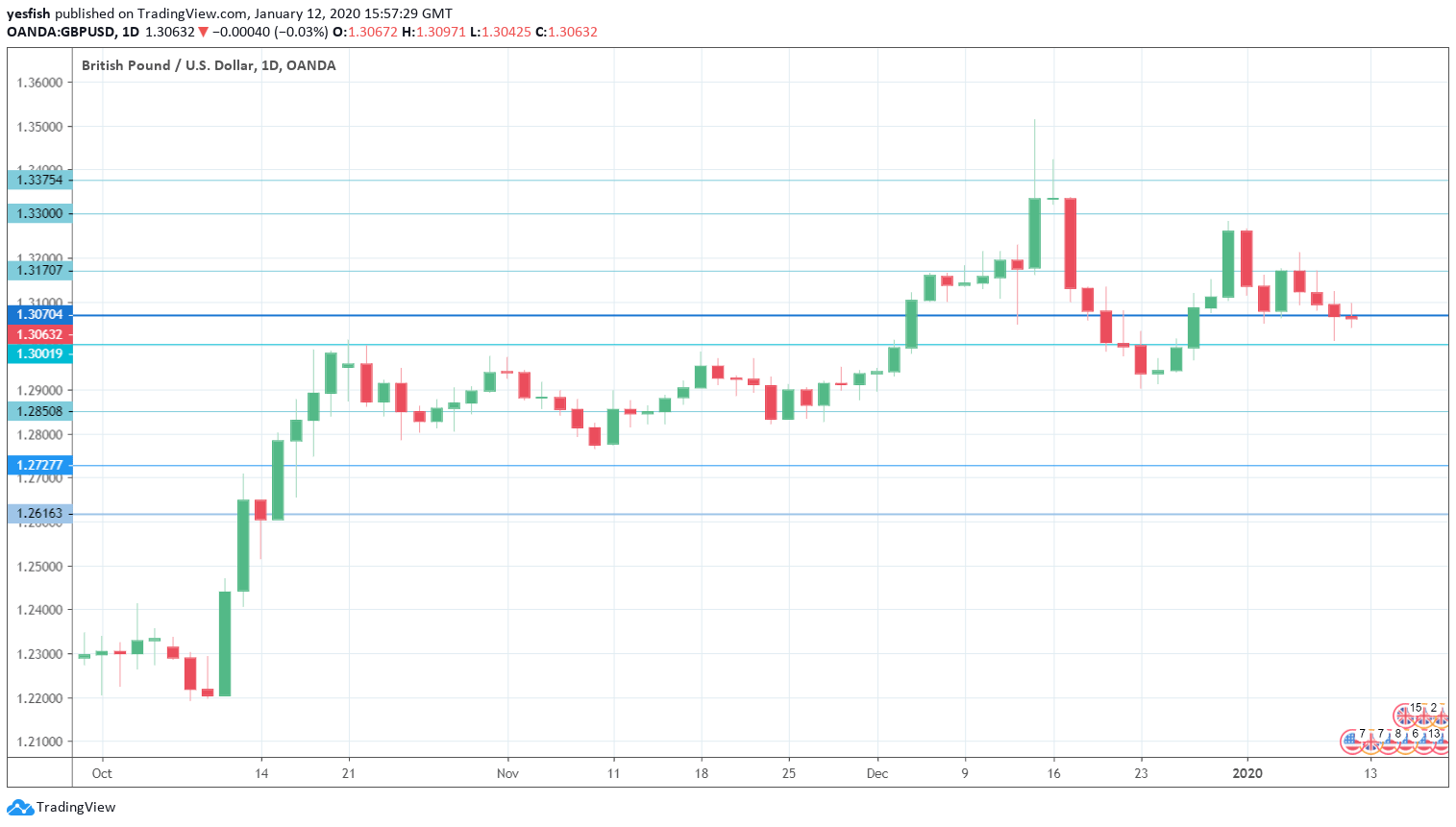

GBP/USD daily graph with resistance and support lines on it. Click to enlarge:

- GDP: Monday, 9:30. The British economy has failed to record a gain in three months, as the economic picture remains gloomy. GDP was flat in October and another zero reading is projected for November.

- Manufacturing Production: Monday, 9:30. This key indicator improved in October, posting a gain of 0.2% after back-to-back declines. The estimate for November stands at -0.3%.

- Inflation Data: Wednesday, 9:30. Consumer inflation came in at 1.5% in November, identical to the figure in October. This is well below the BoE’s target of 2 percent. The forecast for the December release stands is unchanged at 1.5%.

- CB Leading Index: Wednesday, 14:30. The Consumer Board index fell by 0.4% in October. We will now receive the November data.

- BoE Credit Conditions Survey: Thursday, 9:30. This quarterly report provides details of credit levels of consumers and businesses. Stronger borrowing by the private sector translates into increased spending, which is an important driver of economic activity.

- RICS House Price Balance: Thursday, 0:01. The housing market remains weak. In November, 12% more surveyors reported a price decrease than those that reported an increase in prices. The estimate for December is that 5% more surveyors will report a price decrease.

- Retail Sales: Friday, 9:30. This key indicator has posted two successive declines, which points to weakness in consumer spending. The November release came in at -0.6%. Analysts expect a strong rebound in December, with an estimate of 0.8%.

GBP/USD Technical analysis

Technical lines from top to bottom:

We start with resistance at the round number of 1.3500. 1.3375 is next.

1.3300 has held in resistance since mid-December, when the pound went on an extended slide. 1.3170 follows.

1.3070 remains relevant. It is an immediate resistance line.

1.3000 (mentioned last week) is providing support.

1.2910 has held in support since early December. 1.2850 is next.

1.2728 has provided support since mid-October.

1.2616 is the final support level for now.

I am bearish on GBP/USD

The British pound has started the New Year with losses, falling 1.5% so far in January. With economic indicators pointing to a weak economy and post-Brexit uncertainty around the corner, the pound may find itself back below the 1.30 level.

Further reading:

- EUR/USD forecast – for everything related to the euro.

- USD/JPY forecast – projections for dollar/yen

- AUD/USD forecast – predictions for the Aussie dollar.

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!