GBP/USD dropped as the government’s soft Brexit plan ran into opposition and as the US Dollar gained ground. What’s next? UK inflation, employment, and retail sales figures stand out. Here are the key events and an updated technical analysis for GBP/USD.

The UK government agreed on a common rulebook with the European Union, akin to a customs union. The good news was clouded by the resingations of Brexit minister David Davis and Foreign Secretary Boris Johnson. Nevertheless, the government remains stable. In the US, data has been upbeat and so has the Fed. The trade wars, with the recent details on a $200 billion worth of goods prepared by the US against China, benefits the greenback.

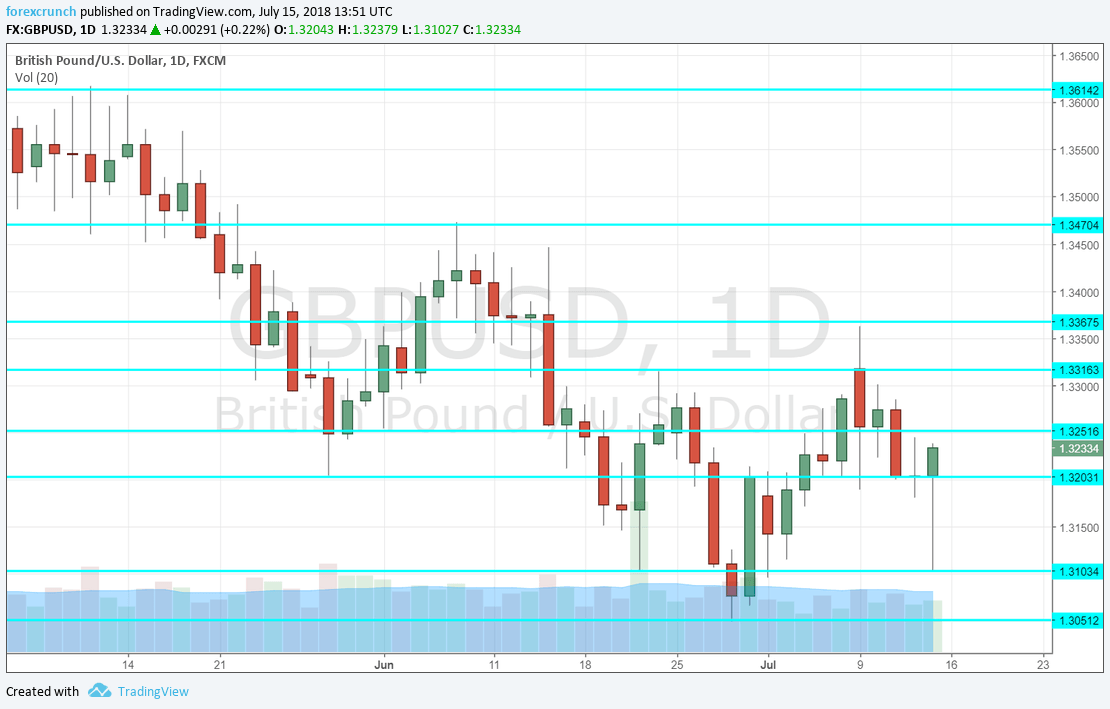

[do action=”autoupdate” tag=”GBPUSDUpdate”/]GBP/USD daily graph with resistance and support lines on it. Click to enlarge:

- Rightmove HPI: Sunday, 23:01. The earliest report on UK house prices showed a rise of 0.4% in June, slower than in May. We may see another month of modest growth now.

- Mark Carney talks: Tuesday, 8:00. The governor of the Bank of England testifies in Parliament and may face tough questions about postponing the rate hike and the impact of Brexit on the economy. There are growing chances of a rate hike in August, but nothing is fully priced in. Any hints will likely rock the pound.

- UK jobs report Tuesday, 8:30. Jobs are aplenty, but wages are not rising at a satisfactory pace. The Claimant Count Change is expected to increase by 2.3K in June after a drop of 7.7K in May. Fluctuations in jobless claims are quite frequent. The unemployment rate for May is estimated to have remained steady at 4.2%. Average Hourly Earnings, arguably the most essential data points, carry expectations for another month at 2.5% in May, which is below the inflation rate. Any change in wages will rock the pound.

- UK inflation report: Wednesday, 8:30. Britain’s Consumer Price Index has been falling of late, contributing to the decision not to raise rates in May. Annual headline CPI fell to 2.4% in May and is now projected to rise to 2.6%. Core CPI is expected to remain stable at 2.1%. The Retail Price Index (RPI) which is also eyed, carries expectations for an increase from 3.3% to 3.5% y/y. Contrary to the US, headline CPI tends to have the most significant impact.

- CB Leading Index: Wednesday, 13:30. The Conference Board’s composite indicator showed a monthly drop of 0.2% last time, causing some worries. We could see a recovery now.

- Retail Sales: Thursday, 8:30. Consumers were out and about spending in May, as headline sales leaped by 1.3%. A more modest increase of 0.2% is on the cards now. The publication tends to have a strong, yet a short-lived impact on GBP/USD.

- Public Sector Net Borrowing: Friday, 8:30. Borrowing by the government has been OK last time, with 3.4 billion pounds. It is expected to broaden to 3.7 billion this time. Higher government lending is negative for the pound.

* All times are GMT

GBP/USD Technical analysis

Pound/dollar started the week with an upswing, reaching a peak of 1.3365. It then dropped and bounced only at the round number of 1.3100 mentioned last week.

Technical lines from top to bottom:

1.3615 capped the pair in late 2017. 1.3470 was a swing high in early June.

The round number of 1.34 could provide further support. 1.3365 was a swing high in mid-July. Further down, 1.3315 was a swing high in late June.

1.3250 was a swing low in early June. Even lower, 1.3205 was the low point in late May. 1.3100 was a swing low in mid-June and 1.3050 is the latest 2018 low. The round number of 1.3000 awaits below. Even lower, 1.2950 is notable.

I am neutral on GBP/USD

While the British government suffered top-tier resignations from Johnson and Davis, the soft-Brexit plan is moving forward and this is good news for the pound.

Our latest podcast is titled Festive Fed, Dovish Draghi, and a global trade war

Further reading:

- EUR/USD forecast – for everything related to the euro.

- USD/JPY forecast – projections for dollar/yen

- AUD/USD forecast – predictions for the Aussie dollar.

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!