GBP/USD continued struggling as trade wars, Brexit, Carney influenced it. What’s next? The EU Summit on Brexit and final GDP are the center of attention. Here are the key events and an updated technical analysis for GBP/USD.

The UK government managed to overcome yet another vote in parliament on the Brexit bill, but this is not necessarily a good thing, as chances for a hard Brexit are still real. US President Trump rattled markets with yet another contemplation of slapping further tariffs on China. The pound was carried along to lower ground.

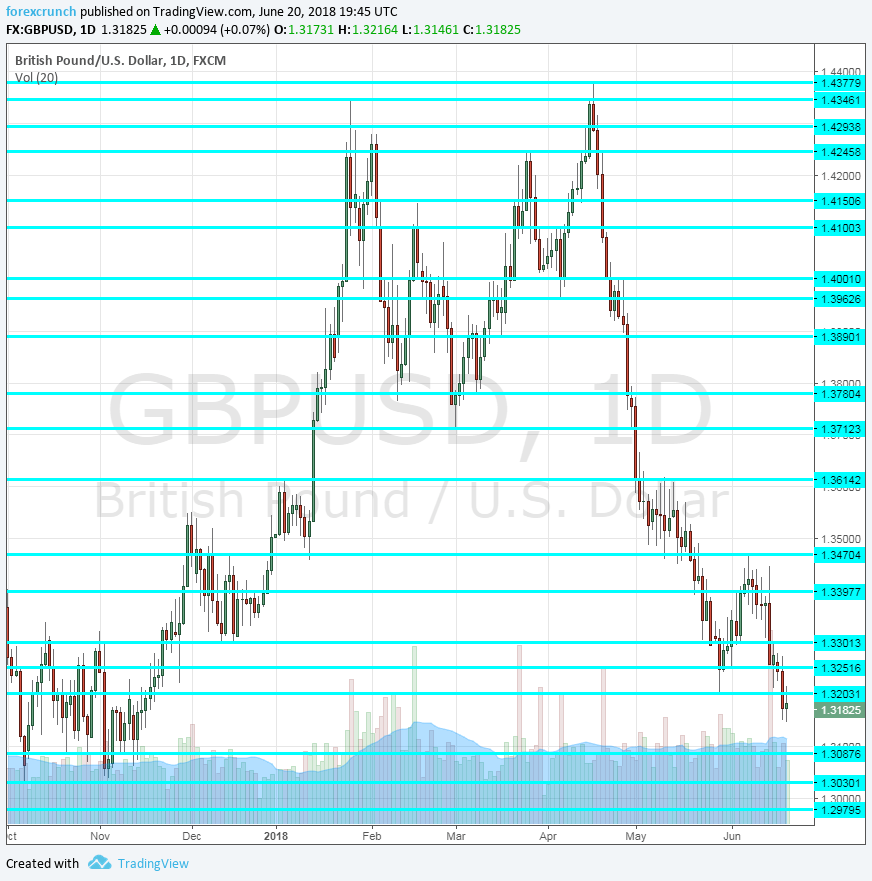

[do action=”autoupdate” tag=”GBPUSDUpdate”/]GBP/USD daily graph with resistance and support lines on it. Click to enlarge:

- High Street Lending: Tuesday, 8:30. This measure of lending reflects around two-thirds of mortgages and leads over the official mortgage figures. In April, they reported a level of 38K, up from the previous month.

- CBI Realized Sales: Tuesday, 10:00. The Confederation of British Industry provided a positive surprise in May with an upbeat score of 11. Another small increase could be seen for June.

- EU Summit: Thursday and Friday. Leaders of the European Union meet to discuss various topics and Brexit tops the agenda. The EU and the UK were expected to reach agreements on the main topics of the Irish border and the Customs Union by this meeting and it seems nothing will be achieved. There is a high likelihood that the can will be kicked down the road to the next EU Summit in October, where everything will need to be discussed ahead of March 29th, 2019, Brexit day. The British Pound will likely remain pressured but a failure to agree on anything may weigh on broader markets as well. In additions, the EU Summit will likely include a discussion on the trade spat with the US.

- GfK Consumer Confidence: Thursday, 23:01. The 2000 strong survey showed a slight improvement in consumer sentiment back in May, up to -7 points. The negative figure still reflects pessimism among consumers. No significant changes are likely now.

- Final GDP: Friday, 8:30. The British economy suffered a significant slowdown in the first quarter of the year. It grew by only 0.1% q/q and 1.2% y/y according to the first and second reads. The final release will likely repeat the same figures. Also in the UK, the second quarter already looks more promising.

- Current Account: Friday, 8:30. Britain had a current account deficit of 18.4 billion pounds in the last quarter of 2017. A deficit is likely also for Q1 2018 and it may have widened.

- Net Lending to Individuals: Friday, 8:30. More lending means more economic activity. Net lending stood at 5.7 billion pounds in April, better than had been expected. Another positive month is likely.

- M4 Money Supply: Friday, 8:30. The amount of money in circulation grew by 0.2% in April, above expectations and after two months of drops. Another modest rise could be seen for May.

- Mortgage Approvals: Friday, 8:30. Contrary to the High Street figure, the overall number of mortgages decreased to 62K in April. A minor rise could be seen now.

* All times are GMT

GBP/USD Technical analysis

Pound/dollar fell below 1.3205 (mentioned last week), reaching new lows.

Technical lines from top to bottom:

1.3780 was a line of support in March and 1.3710 was the lowest point since early in the year.

Below, 1.3615 capped the pair in late 2017. 1.3470 was a swing high in early June.

The round number of 1.34 could provide further support. Further down, 1.33, which supported the pair in December, is still relevant.

1.3250 was a swing low in early June. Even lower, 1.3205 was the low point in late May. 1.3080 served as support back in November 2017. The ultimate line is 1.3000.

I remain bearish on GBP/USD

The EU Summit is expected to confirm the dire situation of Brexit negotiations which are going nowhere fast. The GDP figure will do the same. With ongoing trade wars, the pair could continue its downtrend.

Our latest podcast is titled Festive Fed, Dovish Draghi, and a global trade war

Further reading:

- EUR/USD forecast – for everything related to the euro.

- USD/JPY forecast – projections for dollar/yen

- AUD/USD forecast – predictions for the Aussie dollar.

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!