GBP/USD managed to break higher but could not surpass the 1.40 level. What’s next? A very busy week consists of inflation, employment, retail sales, the rate decision and the EU Summit which focuses on Brext. Here are the key events and an updated technical analysis for GBP/USD.

The Chancellor of the Exchequer Phillip Hammond presented an upgrade to growth forecasts for 2018 and helped the pound recover. The question of the Irish border remains an open issue in the Brexit negotiations. In the US, the ousting of Rex Tillerson as Secretary of State sent the dollar lower while figures were mixed: inflation came out as expected, retail sales missed expectations but consumers are confident.

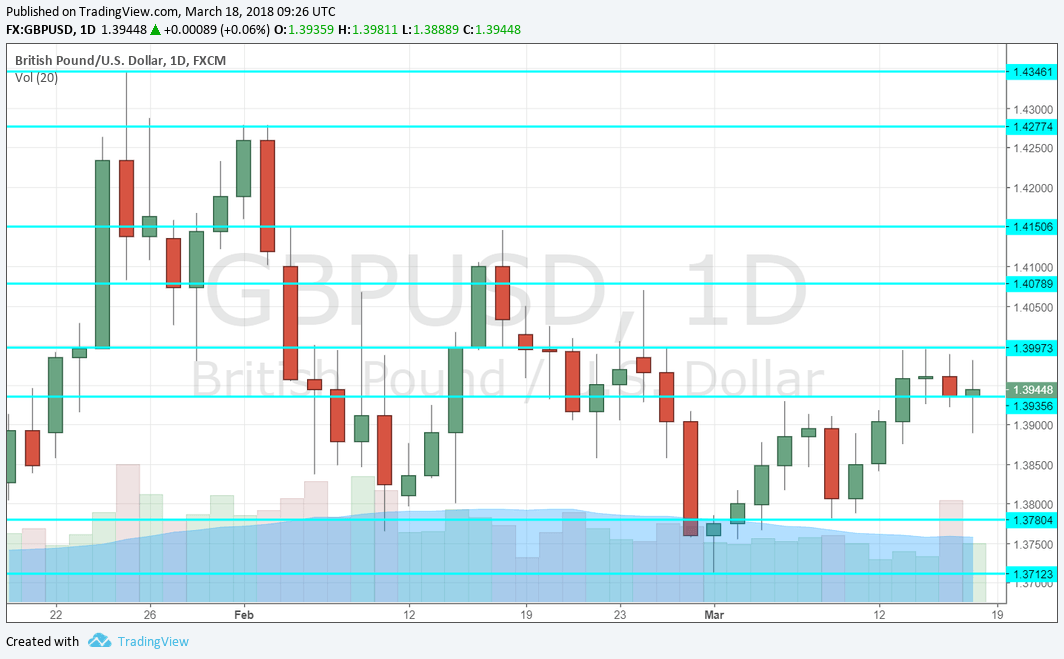

[do action=”autoupdate” tag=”GBPUSDUpdate”/]GBP/USD daily graph with resistance and support lines on it. Click to enlarge:

- Rightmove HPI: Monday, 00:01.This early report of house price development has shown a significant monthly increase of 0.8% in February after rising in January as well. We may see a slide now.

- Inflation data: Tuesday, 9:30. Inflation in the UK is stuck at 3%, the top end of the 1-3% target range and the BOE is still considering raising rates in May. The publication will certainly impact the decision later this week. Core inflation was also high at 2.7%. Contrary to other developed countries, Britain does not suffer from deflation. The weaker exchange rate since the EU Referendum is the main culprit for higher prices. A drop to 2.8% is on the cards now. Core CPI is projected to slide from 2.7% to 2.5% and the Retail Price Index (RPI) carries expectations for a drop from 4% to 3.7%.

- Jobs report: Wednesday, 9:30. Wages remain the main dish in the comprehensive jobs report. Back in December, they rose by 2.5% y/y, as expected, higher than the lows, but still below inflation that is eroding standards of living. An acceleration to 2.6% is forecast now. The big surprise of the previous report was a rise in the unemployment rate to 4.4%. No change is likely now. The jobless claims, known as Claimant Count Change, dropped by 7.2K back in January. Another fall of 3.1K is on the cards now.

- CBI Industrial Order Expectations: Wednesday, 11:00. The Confederation of British Industry’s measure of order expectations has dropped in the past two months, reaching a score of 10 points in February. Yet another deterioration in March to 8 points.

- Retail Sales: Thursday, 9:30. Hours before the rate decision, the retail sales report provides a snapshot of the consumer. The numbers badly disappointed in the past two months, falling in December and hardly rising in January. A bounce with a rise of 0.4% is on the cards now.

- EU Summit: Thursday, during the day and potentially into the night. The leaders of the European Union convene to discuss various matters and Brexit leads the agenda. Will they make progress on trade, the rights of citizens, and the Irish border? Finalizing the transition deal is the key event and Ireland is high on the agenda. The UK wants to be out of the Customs Union but with no customs checks between the Republic of Ireland and Northern Ireland. This circle will be hard to square. A breakup of talks could weigh on the pound.

- Rate decision: Thursday, 12:00. The Bank of England made a hawkish shift in its “Super Thursday” in February by saying that rates will rise faster and earlier than expected. This sent the pound higher. No rate hike is expected in this March decision but markets will try to assess if the BOE is indeed keen on hiking in May, lifting the interest rates to the highest levels since the financial crisis. The voting pattern of the MPC will initially move the markets before the statement and the accompanying meeting minutes will be digested. It will be interesting to see if Governor Mark Carney and his colleagues will react to the latest figures.

- David Ramsden talks: Thursday, 17:00. The BOE Deputy Governor will speak in London and may help clarify any messages that the BOE tried to convey earlier in the day. The event is around Fintech, but he may refer to monetary policy.

- BOE Quarterly Bulletin: Friday, 12:00. The BOE continues moving the markets on Friday with its quarterly bulletin. The document consists of many assessments and analyses that discuss economic developments.

- Gertjan Vlieghe talks: Friday, 12:30. The External MPC member will speak in Birmingham and may also help explain the decisions of the previous day. His words may have a lesser effect if the EU Summit results in a significant market moving outcome.

GBP/USD Technical Analysis

Pound/dollar made a move to the upside but was capped by 1.40 (mentioned last week).

Technical lines from top to bottom:

1.4345 is the January 2018 swing high that is worth watching. 1.4280 was a top line in early February and it comes next.

1.4160 capped the pair in mid-February. 1.4070 is next, after serving as a swing high in late February.

It is followed by the round level of 1.40, which is eyed by many. 1.3935 capped the pair early in March and remains a battle line. 1.3790 was a swing low in mid-March.

1.3765 was the low point in early February. 1.3710 was a low point in early March.

1.3620 capped the pair on its way up and then turned into support. 1.3550 was the November peak.

I am bearish on GBP/USD

While the Fed may not be extremely hawkish, the pound may suffer from not-that-great data, a not-so-hawkish BOE and also from the high chance that the question of the Irish border may lead to an unsuccessful summit.

Our latest podcast is titled The Powell Power Play.

Further reading:

- EUR/USD forecast – for everything related to the euro.

- USD/JPY forecast – projections for dollar/yen

- AUD/USD forecast – predictions for the Aussie dollar.

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!