GBP/USD was in free-fall last week, as the pair plunged close to 6 percent. This week features employment reports. Here is an outlook for the highlights and an updated technical analysis for GBP/USD.

The BoE followed the lead of the Federal Reserve and cut the benchmark rate by 50 basis points, to 0.25%. This decision was unanimously taken (9-0). In December. the British economy was stagnant, with a reading of 0.0%. This missed the estimate of 0.2% and was down from the 0.3% reading in November. On the manufacturing front, Manufacturing Production edged lower to 0.2% in December, down from 0.3% a month earlier.

In the U.S., President Trump banned flights from Europe, which sapped risk appetite and sent investors scurrying to the U.S. dollar. Inflation levels remained low in February, with CPI coming in at 0.1% and Core CPI at 0.2%. Consumer confidence dropped sharply in February, falling from 100.9 to 95.9 points.

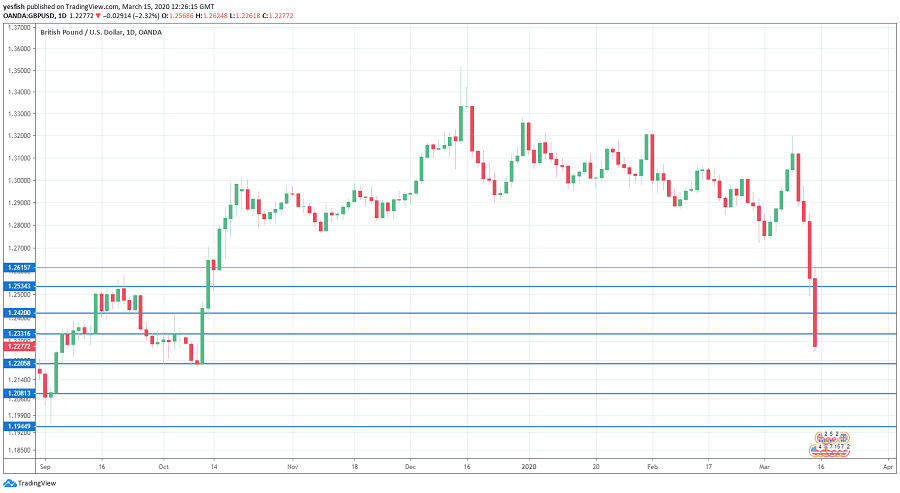

GBP/USD daily graph with resistance and support lines on it. Click to enlarge:

- Employment Data: Tuesday, 9:30. Wage growth slowed to 2.9% in December, the first time it has fallen below the 3.0% threshold since August 2018. The January forecast stands at 3.0%. Unemployment rolls slipped to 5.5 thousand in January, much lower than the estimate of 20.2 thousand. Another strong reading is expected, with a forecast of 6.2 thousand. The unemployment rate is expected to remain unchanged at 3.8%.

- Consumer Inflation Expectations: Friday, 9:30. Consumer inflation expectations are carefully monitored, as inflation expectations can manifest into actual inflation figures. In Q3, the indicator slowed to 3.1%, down from 3.3% in the previous quarter. We now await the reading for the first quarter.

GBP/USD Technical analysis

Technical lines from top to bottom:

We begin with resistance at 1.2616 (mentioned last week). This line has provided resistance since July 2019. 1.2535 is next.

1.2420 has switched to a support role after sharp losses by GBP/USD last week. This is followed by 1.2330.

The round number of 1.22 is under pressure in support. It could be tested early in the week.

1.2080 is protecting the symbolic 1.20 level.

1.1944 is the final support line for now.

I am bearish on GBP/USD

The growing coronavirus crisis in the U.S., which has led to a travel ban on flights from Europe, has unnerved investors and triggered broad gains for the U.S. dollar. If the outbreak worsens, the pound could continue to lose ground next week.

Further reading:

- EUR/USD forecast – for everything related to the euro.

- USD/JPY forecast – projections for dollar/yen

- AUD/USD forecast – predictions for the Aussie dollar.

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!