GBP/USD enjoyed an outstanding week, climbing close to seven percent. There are eight events in the upcoming week. Here is an outlook for the highlights and an updated technical analysis for GBP/USD.

The Bank of England maintained rates at 0.10% at its scheduled meeting, as expected. A week earlier, the bank cut rates from 0.25% to 0.10%, in a coordinated emergency move with the Federal Reserve and other major central banks.

British Manufacturing PMI slowed to 48.0 in February, down from 51.8 a month earlier. The Services PMI plunged to 35.7, pointing to deep contraction. This reading was down sharply from 53.3 points a month earlier. Consumer inflation dipped from 1.8% to 1.7% in March, matching the estimate. Retail sales declined by 0.3% in March, down from 0.9% a month earlier. The indicator has been sputtering, with only one gain since July.

The U.S. dollar was broadly lower last week, following a staggering figure for unemployment claims, which hit 3.2 million. This was due to the shutdown of many factories and businesses across the country. The ISM Manufacturing PMI dipped to 49.2 in March, down from 50.8 a month earlier. It marked the first contraction since August. Elsewhere, durable goods orders in February were a mix. The headline figure jumped 1.2%, up from -0.2% a month earlier. However, the core reading declined by 0.6%, compared to a gain of 0.9% in February. GDP for Q4 showed a 2.1% in the third estimate, confirming the previous estimate.

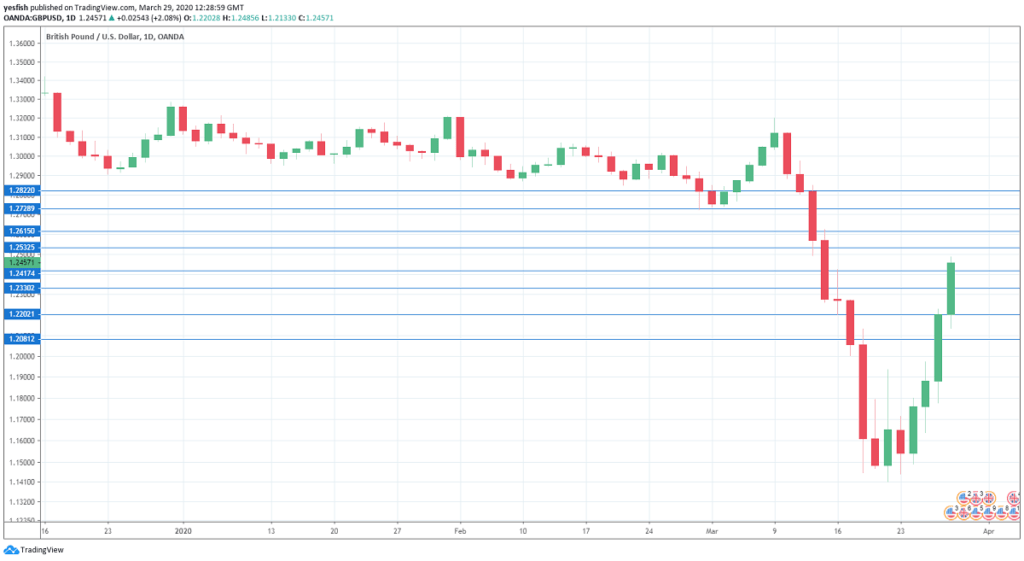

GBP/USD daily graph with resistance and support lines on it. Click to enlarge:

- Net Lending to Individuals: Monday, 8:30. Credit levels slipped to 5.2 billion pounds in January, down from 5.8 billion a month earlier. This reading was much lower than the forecast of 5.9 billion. The estimate for February stands at 5.1 billion.

- GfK Consumer Confidence: Monday, 23:01. Consumer confidence remains in negative territory, but has been slowly improving. The indicator improved to -7 in February, up from -9 a month earlier. This was the highest level since August 2018. Analysts are expecting the indicator to fall to -14 points.

- Current Account: Tuesday, 8:30. The UK continues to post large current account deficits. In Q3, the deficit narrowed to GBP 15.9 billion, down sharply from GBP 25.2 billion in Q2. The deficit is expected to narrow to -7.0 billion in the fourth quarter.

- Final GDP: Tuesday, 8:30. Economic growth rebounded in Q3 with a gain of 0.4%, after a decline of 0.2% in Q2. However, the estimate for Q4 stands at 0.0%, which points to a lack of growth.

- BRC Shop Price Index: Tuesday, 23:01. This indicator, which gauges inflation in BRC stores, has reeled off nine straight declines. In February, there was a decline of 0.6%, marking a 5-month low. Will we see another decline in the March release?

- Final Manufacturing PMI: Wednesday, 8:30. There was positive news, as the PMI climbed into expansion territory in February, with a reading of 51.7. This was its highest level since April. Will we see another reading in expansion territory in March?

- Construction PMI: Thursday, 8:30. The PMI was unexpectedly strong in February, with a reading of 52.6, which points to expansion. This beat the forecast of 49.0 and was the highest level since April. We now await the March release.

- Final Services PMI: Friday, 8:30. The index has registered above the 50-level for two straight months, which points to expansion. In February, the index slowed to 53.2, down from 53.9. Analysts are expecting the PMI to slide to 34.7 in March, which points to deep contraction.

GBP/USD Technical analysis

Technical lines from top to bottom:

With GBP/USD posting sharp gains last week, we start at higher levels:

1.2820 has held in resistance since early March. 1.2728 is next.

1.2616 switched to resistance in early March, after providing support since October.

1.2535 is next.

GBP/USD broke above 1.2420 (mentioned last week). It is currently an immediate support line. This is followed by 1.2330.

The round number of 1.22 remains relevant.

1.2080 is protecting the symbolic 1.20 level. It is the final support level for now.

I remain bearish on GBP/USD

The pound took full advantage of dismal U.S. jobless claims, but investors will likely stick with the safe-haven dollar during this crisis. This could mean trouble for the pound in the coming week.

Further reading:

- EUR/USD forecast – for everything related to the euro.

- USD/JPY forecast – projections for dollar/yen

- AUD/USD forecast – predictions for the Aussie dollar.

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!