GBP/USD showed limited movement last week. The week starts with a bank holiday and there is just one event on the schedule. Here is an outlook for the highlights and an updated technical analysis for GBP/USD.

In the UK, the labor market staggered last week as unemployment claims rocketed to 856.5 thousand in April. This was much higher than the forecast of 675.0 thousand. Wage growth slipped to 2.4% in March, down from 2.7% a month earlier. The unemployment rate dipped to 3.9%, well below the estimate of 4.4 percent. Retail sales plunged 18.1% in April, worse than the estimate of -15.8 percent. Inflation sank to 0.8% in April, its lowest level since August 2016. In March, CPI came in at 1.5 percent. Manufacturing PMI came in at 40.6 in May, above the estimate of 35.1. This was stronger than the April reading of 32.6 points. Services PMI improved to 27.8 in May, up from 13.4 in April. Still, this points to sharp contraction.

In the U.S., construction numbers softened in April. Building Permits fell to 1.07 million, down from 1.35 million. Housing starts slowed to 0.89 million, down from 0.95 million. In March, the final read for Manufacturing PMI came in at 41.5 points, and the initial estimate for April came in at 39.8 points. A reading below the 50-level points to contraction.

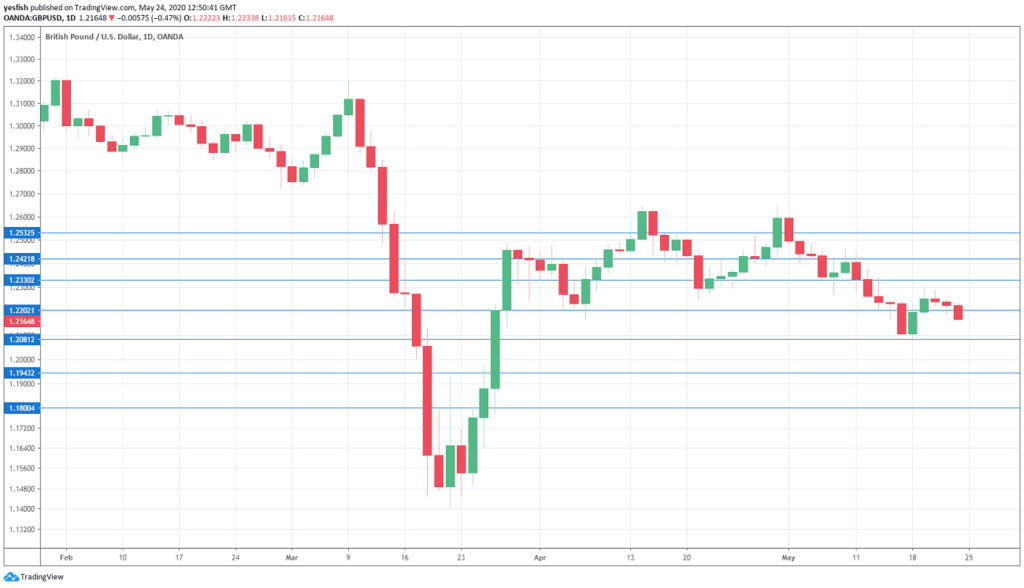

GBP/USD daily graph with resistance and support lines on it. Click to enlarge:

- CBI Realized Sales: Tuesday, 10:00. The Confederation of British Industry’s gauge of sales was in free-fall in April, dropping all the way to -55 points. The previous reading was -3 points. We will now receive the April release.

Technical lines from top to bottom:

We start with resistance at 1.2532.

1.2420 (mentioned last week) is next.

1.2330 has some breathing room in resistance.

The round number of 1.22 is a weak resistance line.

1.2080 is providing support.

1.1944 has held in support since mid-March.

The round number of 1.18 is the final support level for now.

I remain bearish on GBP/USD

The British economy continues to struggle, as the country has been hit hard by the Covid-19 pandemic. The Brexit deadlock has complicated matters, with little progress to report between London and Brussels on the post-Brexit relationship between the UK and the EU.

Further reading:

- EUR/USD forecast – for everything related to the euro.

- USD/JPY forecast – projections for dollar/yen

- AUD/USD forecast – predictions for the Aussie dollar.

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!