GBP/USD had a turbulent week with the government and the BOE both impacting the currency and eventually finished higher. The upcoming week sees the Bank Stress Tests and the first PMI for November as we enter the last month of the year. Here are the key events and an updated technical analysis for GBP/USD.

Brexit negotiations provided some good news for a change: the May government is warming up to pay the EU its demands according to reports. This helped GBP/USD advance, as did the weakness of the greenback due to the Fed expressing worries about inflation. Yet in the UK, the government lowered its GDP forecasts and the GDP report was not that great. While the headline remained at 0.4% q/q, the construction sector is now officially in a recession.

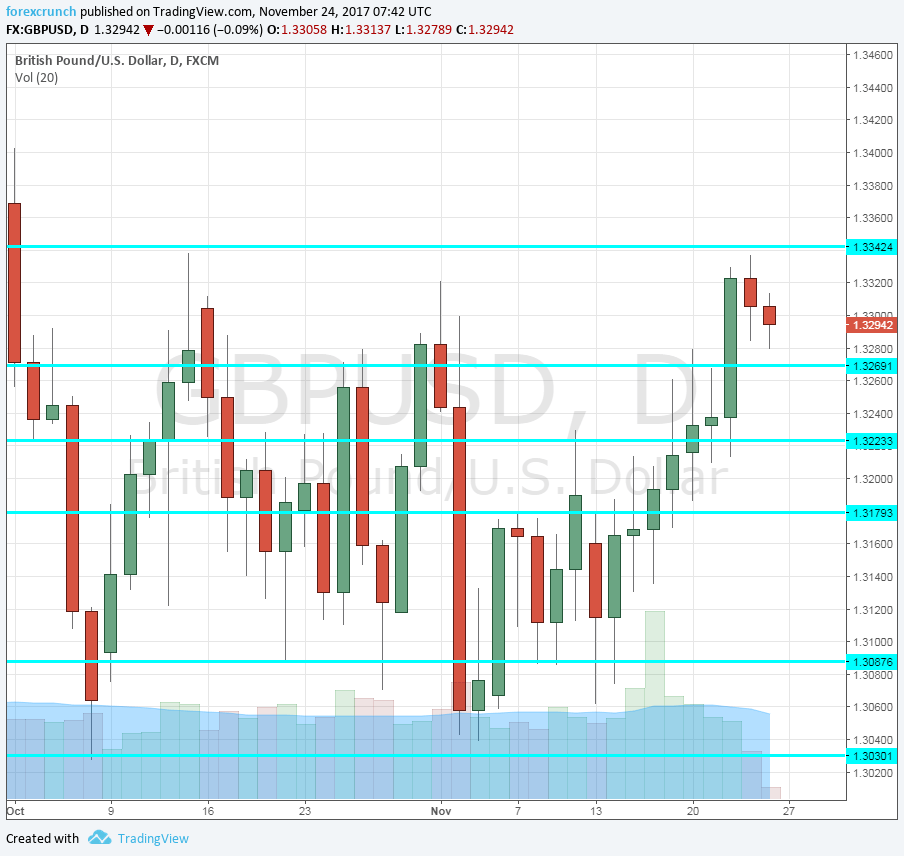

[do action=”autoupdate” tag=”GBPUSDUpdate”/]GBP/USD daily graph with resistance and support lines on it. Click to enlarge:

- Bank Stress Test Results: Tuesday, 7:00. This annual publication about the stability of Britain’s biggest banks was all-important after the financial crisis: weaker banks needed more government assistance. Now, the data will be watched in order to see any ramifications of Brexit on the banks, and therefore on the wider economy.

- BOE Financial Stability Report: Tuesday, 7:00. This publication of the financial stability report (published twice a year) is somewhat overshadowed by the annual and related bank stress test. Nevertheless, also this report is important for assessing the impact of Brexit on financial stability. In this case, lower lending costs up to November triggered higher risk-taking.

- BRC Shop Price Index: Wednesday, 00:01. The British Retail Consortium’s measure of retail sales in its stores has been worrying for quite a long time, suffering big falls. A drop of 0.1% was seen last time and yet another fall cannot be ruled out.

- Net Lending to Individuals: Wednesday, 9:30. The monthly level of borrowing to has been quite steady, ticking down from 5.7 to 5.5 billion in September, in line with averages. Higher lending represents a potential for economic expansion, thus indirectly raising the chances for higher interest rates. A more moderate expansion of 4.3 billion is predicted.

- Mortgage Approvals: Wednesday, 9:30. The official report for the whole economy lags the High Street Lending publication for around two-thirds of banks. Nevertheless, it provides an insight into the housing sector. Mortgages were stable at 66K in September. A level of 65K is on the cards.

- M4 Money Supply: Wednesday, 9:30. The amount of money in circulation dropped by 0.2%, disappointing early expectations in September. The figure for October could show a bounce. A rise of 0.3% is forecast.

- GfK Consumer Confidence: Thursday, 00:01. This survey of around 2000 consumers showed a significant deterioration in June and hasn’t recovered since then. A score of -10 was recorded for October and a similar number is likely for November.

- Manufacturing PMI: Friday, 9:30. As we turn the page into December, the first of three purchasing managers’ indicators is likely to be upbeat. The manufacturing sector enjoyed a windfall created by the weakness of the pound. A score of 56.3 was recorded in October, well above the 50-point threshold that separates expansion from contraction. A small rise to 56.6 is estimated.

GBP/USD Technical Analysis

Pound/dollar traded around the line of 1.3225 (mentioned last week).

Technical lines from top to bottom:

The recent cycle high of 1.3620 serves as strong resistance. 1.35 was the post-Brexit high and remains the top level.

The top of the range is 1.3340, capping the pair in both early October and late November. The previous 2017 high of 1.3270 is the next barrier.

1.3225 was the high point of September. It is followed by 1.3180, which capped the pair in July.

1.3080 worked as support in mid-October and also was weak support during November. 1.3030 is the bottom of the range, cushioning cable in October and also in early November.

1.2975 awaits on the lower side of 1.30. Further below, 1.2890 separated ranges on the way down. It is followed by 1.2820 and 1.2775.

I remain bearish on GBP/USD

Our latest podcast is titled German gyrations + nature and natural gas

Further reading:

- EUR/USD forecast – for everything related to the euro.

- USD/JPY forecast – projections for dollar/yen

- AUD/USD forecast – predictions for the Aussie dollar.

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!