GBP/USD Technical Analysis

GBP/USD showed little movement last week. The upcoming week has five events. Here is an outlook for the highlights and an updated technical analysis for GBP/USD.

It was a tale of two sectors for British PMIs. The Manufacturing PMI improved from 53.3 to 55.2, pointing to strong expansion. However, the Services PMI fell into contraction territory, from 52.3 to 45.8 points. There was grim news from the BoE, as the BoE Monetary Policy Report projected a contraction of 2% in the fourth quarter. This was followed by Finance Minister Sunak’s spending review, in which he said that the Office of Budget Responsibility had projected a GDP decline of 11.3%.

In the US, PMIs for October indicated stronger growth in the manufacturing and services sectors. Services PMI improved to 57.7, as the index accelerated for a seventh straight month. Manufacturing PMI climbed to 56.7, up significantly from 53.3 beforehand. Both PMIs were well into expansionary territory, which indicates that the economic recovery continues to gain traction. Unemployment claims climbed for a second straight week, with a reading of 778 thousand. This was much higher than the estimate of 732 thousand. Durable goods orders reports were mixed. The headline figure slowed to 1.3%, down from 1.9%. However, the core release climbed from 0.8% to 1.3%.

The week wrapped up with the FOMC minutes of the November policy meeting. The minutes showed that officials did not believe any changes were needed to the current bond-purchase scheme of $120 billion/month, they were of the opinion that “circumstances could shift to warrant such adjustments.”

.

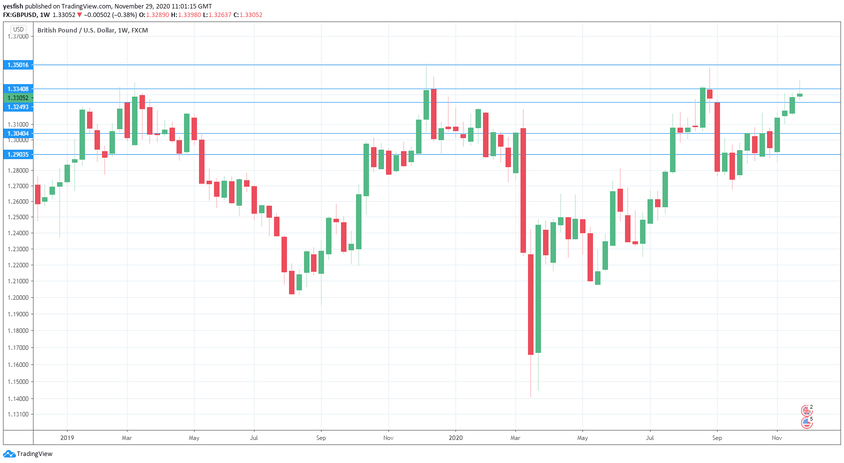

GBP/USD daily graph with resistance and support lines on it. Click to enlarge:

- Net Lending to Individuals: Monday, 9:30. New credit issued to the private sector rose to GBP4.2 billion in October and the upswing is projected to continue, with an estimate of 4.7 billion in November.

- Manufacturing PMI: Tuesday, 9:30. Manufacturing slowed to 53.7 in October, but is expected to accelerate to 55.2 in November, which would indicate strong expansion. This would confirm the initial PMI reading.

- BRC Shop Price Index: Wednesday, 00:01. Inflation in BRC shops has posted declines since mid-2018, indicative of weak inflation. The consensus for November stands at -1.3%.

- Services PMI: Thursday, 9:30. Business activity has been weakening, as the PMI slowed to 51.4 in October, down from 56.1 beforehand. The downturn is expected to continue, with a forecast of 45.8, which would indicate contraction. This figure would confirm the initial PMI reading.

- Construction PMI: Friday, 9:30. The construction sector remains continues to show expansion, but slowed to 53.1 in October, down from 56.8 points. The PMI is expected to fall to 52.3 in November, which is downwardly revised from the initial reading of 53.1 points.

Technical lines from top to bottom:

We start with resistance at 1.3615.

1.3502 (mentioned last week), an important monthly line.

1.3340 is next.

1.3249 is the first line of support.

1.3145 is next.

1.3040 has held in support since early November.

1.2903 is protecting the round number of 1.2900. It is the final support level for now.

I am neutral on GBP/USD

The pound has taken advantage of prolonged dollar weakness, and has gained 2.7% in the month of November. Brexit could be the market mover this week – if an agreement is announced, the pound would likely rise. However, with time running out, investors will be nervous if a deal has still not been reached, and the pound could face pressure.

Further reading:

- EUR/USD forecast – for everything related to the euro.

- USD/JPY forecast – projections for dollar/yen

- AUD/USD forecast – predictions for the Aussie dollar.

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!