GBP/USD had a very volatile week after the EU and the UK reached a draft Brexit deal but parliamentary support is unclear, to say the least. What’s next? Apart from Brexit, the Inflation Report Hearings will be of interest. Here are the key events and an updated technical analysis for GBP/USD.

The UK and the European Union reached a withdrawal deal, including on the sensitive issue of the backstop for the Irish border. The compromise leaves the UK in a customs union for the time being while the border remains open. The agreement left many hard-Brexiteers frustrated as the UK is not taking back control. It also left pro-Remain ones disappointed as the new arrangements are worse than the previous ones. The Pound rallied on the deal but plunged when Brexit Secretary Dominic Raab resigned. Leaders of the EU will convene on November 25th to celebrate the agreement and then the battle moves on to the British Parliament. At the moment, it seems UK PM May does not have support, but nobody wants to replace her. Apart from Brexit, salaries accelerated to 3%, inflation came out slightly below expectations at 2.4% and retail sales disappointed. In the US, data slightly missed expectations. More importantly, several Fed officials expressed concern about the global economy and seemed to be in no rush to raise rates.

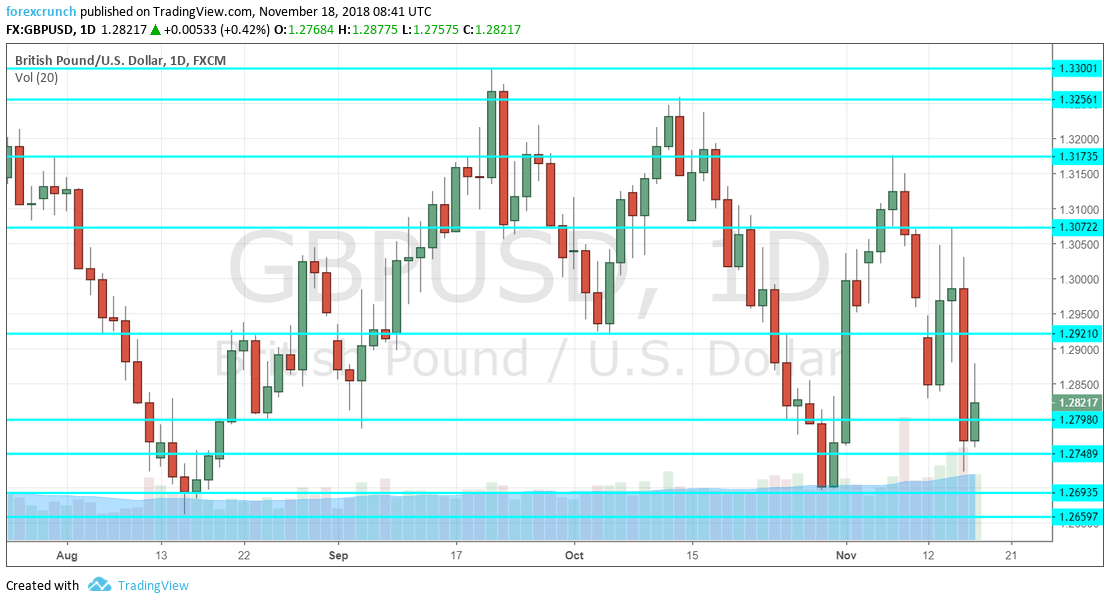

[do action=”autoupdate” tag=”GBPUSDUpdate”/]GBP/USD daily graph with resistance and support lines on it. Click to enlarge:

- Rightmove HPI: Monday, 00:01. The UK’s earliest report on house prices is not necessarily the most accurate one but is still of importance. Prices rose by 1% m/m in October. The data for November is due now.

- Inflation Report Hearings: Tuesday, 10:00. Bank of England Governor Mark Carney and several of his colleagues will appear before a committee in parliament to discuss the latest developments. They will have the opportunity to shape rate hike expectations, which have fallen after the recent political chaos. They may also respond to the latest economic figures. Perhaps there is no rush to raise rates also due to slightly lower inflation. On the other hand, rising wages imply higher inflation in the future. And of course, Brexit will be a crucial topic in the hearings. MPs will surely ask about the economic impact of the deal. The BOE may not have the full answers just yet.

- CBI Industrial Order Expectations: Tuesday, 11:00. The Confederation of British Industry’s latest figure was a disappointment: -6 points, indicating a decreasing volume of orders is expected. The same score is on the cards now, in the report for November.

- Public Sector Net Borrowing: Wednesday, 9:30. The government’s coffers did not suffer massive deficits of late, allowing the Chancellor of the Exchequer Phillip Hammond to declare that austerity was coming to an end. The recent figure was 3.3 billion pounds. A larger monthly deficit of 5.6 billion is projected now.

- Michael Saunders talks Friday, 20:55. External BOE member Saunders will speak in the Annual Southwest Economic Dinner and may shed more light on the BOE’s policies.

* All times are GMT

GBP/USD Technical analysis

Pound/dollar had another Sunday gap, this time to the downside, but it recovered quickly, only to fall sharply and break below 1.3000 (mentioned last week).

Technical lines from top to bottom:

1.3375 was a high point in July. It is followed by 1.3300 was the high point in September and also a psychologically important round number.

1.3255 was the high point in mid-October, ahead of the EU Summit on Brexit. 1.3170 was a swing high in early November.

1.3070 was a high point in mid-November. The round number of 1.3000 is important after providing support to the pair in late September. 1.2920 was a low point in early October.

Further down, 1.2790 served as support late August and also beforehand. 1.2750 was the low point in mid-November. 1.2700 was the low point in late October.

The current 2018 trough at 1.2660 is the next level. 1.2590 was a swing low in September 2017.

Even lower, 1.25 is a round number and also worked as support in early 2017.

I am bullish on GBP/USD

While UK politics seems to be in turmoil, there is no leader that is willing to step forward and challenge Theresa May. The lack of a full revolt will likely push the pair higher, especially as the Fed is not so hawkish.

Our latest podcast is titled Are stocks free falling or is it a buying opportunity?

Further reading:

- EUR/USD forecast – for everything related to the euro.

- USD/JPY forecast – projections for dollar/yen

- AUD/USD forecast – predictions for the Aussie dollar.

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!