GBP/USD rebounded last week and pushed above the 1.23 line. This week’s key events include monthly GDP and manufacturing production. Here is an outlook for the highlights of the upcoming week and an updated technical analysis for GBP/USD.

The pound managed to post gains despite gloomy British indicators. British GDP declined by 0.2% in the second quarter, marking the first time the economy has contracted since 2013. Manufacturing PMI improved to 48.3, but this marked a fifth straight month below the 50-level, which indicates contraction. Construction PMI slowed to 43.3, down from 45.0 a month earlier.

U.S. numbers continue to point to a slowdown in the economy. The ISM Manufacturing PMI for September pointed to contraction for a second straight month. The Services PMI pointed to expansion, but slipped to 52.6, its lowest reading since August 2016. Employment data also disappointed. Nonfarm payrolls came in at 136 thousand, shy of the forecast of 145 thousand. Wage growth fell to 0.0%, down from 0.4% a month earlier. The unemployment rate fell to 3.5%, its lowest rate since 1969.

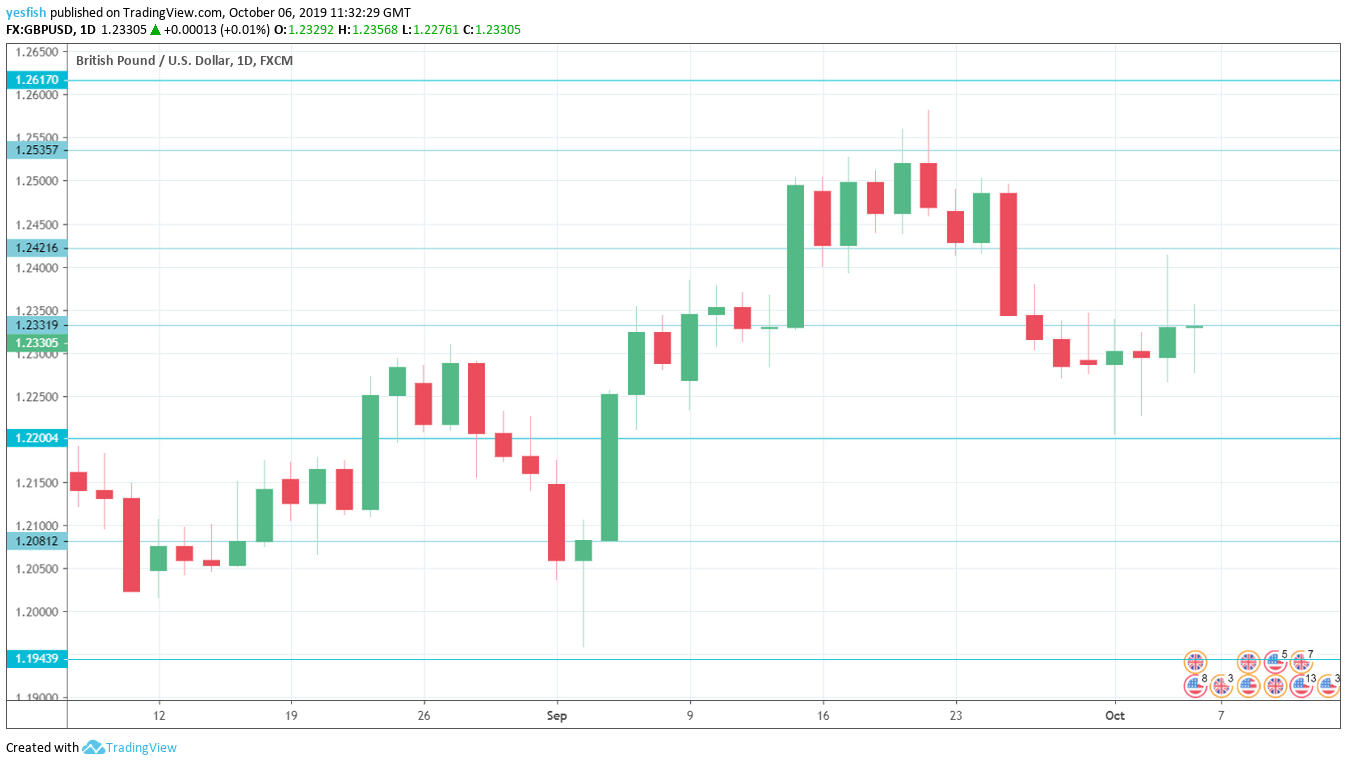

GBP/USD daily graph with resistance and support lines on it. Click to enlarge:

- Halifax HPI: Monday, 7:30. The housing inflation indicator posted a gain of 0.3% in August after back-to-back declines. Another gain is projected for September, with an estimate of 0.4%.

- BRC Retail Sales Monitor: Tuesday, 23:01. This release is a useful gauge of consumer spending. The indicator has posted three declines in the past four months, and a decline of 0.8% is forecast for September.

- GDP: Thursday, 8:30. GDP is one of the most important indicators and should be considered a market-mover. The monthly indicator showed that the economy grew 0.3% in July, above the estimate of 0.1%. However, the markets are braced for a flat reading of 0.0% in August.

- Manufacturing Production: Thursday, 8:30. This key manufacturing indicator rebounded in July with a gain of 0.3%, above expectations. The markets are expecting a weak gain of 0.1% in August.

GBP/USD Technical analysis

Technical lines from top to bottom:

We begin with resistance at 1.2616. This line has provided resistance since early July. 1.2535 is next.

1.2420 (mentioned last week) was under pressure late last week.

1.2330 was relevant during the week and the pair is currently trading at this line.

The round number of 1.22 is the first support level. It was an important support level in December 2016.

1.2080 is protecting the symbolic 1.20 level.

1.1944 is the final support line for now.

I remain bearish on GBP/USD

The U.K. is scheduled to leave the EU later this month and London and Brussels still far apart on a withdrawal agreement. This means that the U.K could leave without a deal in place, which would be detrimental to the economy and could send the pound sharply lower.

Further reading:

- EUR/USD forecast – for everything related to the euro.

- USD/JPY forecast – projections for dollar/yen

- AUD/USD forecast – predictions for the Aussie dollar.

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!