GBP/USD enjoyed some Brexit optimism but the global gloom kept the pair’s gains limited. What’s next? PMI data and a testimony by Carney stand out Here are the key events and an updated technical analysis for GBP/USD.

Michel Barnier, the EU’s Chief Negotiator, surprised by saying the EU is ready to offer the UK a deal “like no other country.” The pound jumped on the surprising burst of optimism. Later, things calmed down as there is still a lot of work to do. Moreover, Trump drive to fight trade wars with everybody weighs on markets and sent the US Dollar higher. The optimism from the deal with Mexico faded as he intends to go all in on China, reopened the spat with the EU and is tough on Canada.

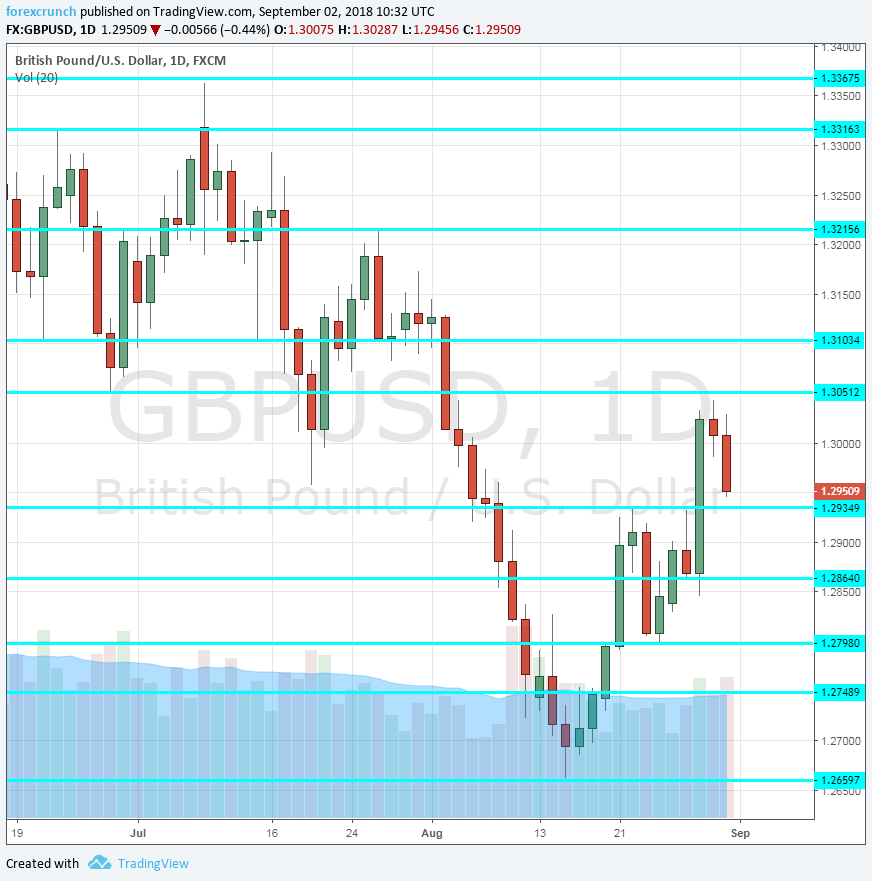

[do action=”autoupdate” tag=”GBPUSDUpdate”/]GBP/USD daily graph with resistance and support lines on it. Click to enlarge:

- Manufacturing PMI: Monday, 8:30. The manufacturing sector has been doing OK, enjoying the weaker pound. A score of 53.9 is projected for August, a minor drop from 54 reported back in July.

- BRC Retail Sales Monitor: Monday, 23:01. The British Retail Consortium’s measure of like for like sales increased by 0.5% in July. A similar figure is likely for August.

- Construction PMI: Tuesday, 8:30. The mood in the construction sector is more volatile than in other areas of the economy. After a rise to 55.8 points in July, a drop to 54.9 is on the cards for August.

- Inflation Report Hearings: Tuesday, 12:15. Bank of England Governor Mark Carney and his colleagues testify before the Treasury Committee

- UK Services PMI: Wednesday, 8:30. The third and last of the series of Markit’s PMI’s is for the largest sector, the services one. A disappointing score of 53.5 points was recorded in July, with Brexit concerns playing a role in the downturn in sentiment. Another not-so-great growth number may lower Q3 growth expectations.

- Halifax HPI: Friday, 7:30. The Halifax Bank of Scotland showed three consecutive months of price rises in the UK. Another increase of 0.5% is projected for August.

- Consumer Inflation Expectations: Friday, 8:30. This official gauge by the Bank of England was stable in recent months around 2.8-2.9%. A repeat of last month’s 2.9% increase is on the cards.

* All times are GMT

GBP/USD Technical analysis

Pound/dollar was on the move, topping 1.300 at one point but stopped short of the 1.3000 level mentioned last week.

Technical lines from top to bottom:

1.3215 was the high point for the pair in mid-July and a lower high on the chart.

1.3100 was a swing low in mid-June and 1.3050 was a previous 2018 low.

Below 1.3000 we find 1.2935, a high point in late August. 1.2865 separated ranges in late August. Further down, 1.2790 served as support late August and also beforehand.

1.2750 held the pair down when the pair was on the back foot. The current 2018 trough at 1.2660 is the next level.

1.2590 was a swing low in September 2017. Even lower, 1.25 is a round number and also worked as support in early 2017.

I remain bearish on GBP/USD

Brexit is biting and the optimism is not based on any details. Alongside Trump’s trade wars, there is more room to the downside than to the downside.

Our latest podcast is titled Brexit summer blues, trade troubles

Further reading:

- EUR/USD forecast – for everything related to the euro.

- USD/JPY forecast – projections for dollar/yen

- AUD/USD forecast – predictions for the Aussie dollar.

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!