GBP/USD traded sideways last week, after recording sharp gains in the two previous weeks. There are four events in the upcoming week. Here is an outlook for the highlights of the upcoming week and an updated technical analysis for GBP/USD.

In the U.K. key consumer data disappointed. CPI fell to 1.7% in August, its lowest level since December 2016. Retail sales declined by 0.2%, marking a 3-month low. The Bank of England held the course, with a unanimous decision to maintain rates at 0.75%.

In the U.S., the Federal Reserve lowered rates by 25 basis points, a move that was widely expected. The pound was unable to take advantage, as the cut was accompanied by a hawkish message from Jerome Powell. The Fed chair stated that the U.S. economy was in strong shape and that the rate cut was an insurance policy in case economic conditions worsened.

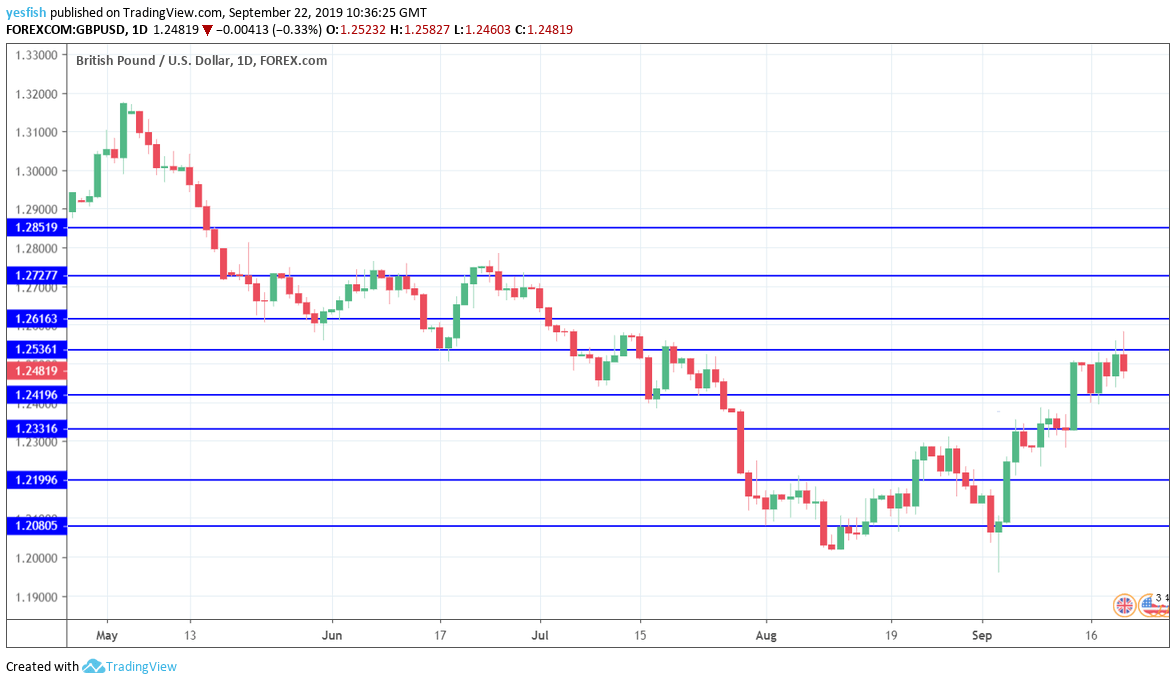

GBP/USD daily graph with resistance and support lines on it. Click to enlarge:

- CBI Industrial Order Expectations: Monday, 10:00. Manufacturers continue to project decreasing order volumes, indicative of ongoing weakness in the manufacturing sector. The August release improved to -13, compared to -34 in the previous month. The September forecast stands at -14.

- Public Sector Net Borrowing: Tuesday, 8:30. The U.K. posted a surplus of GBP 2.0 billion in July. This marked the first surplus in five months. Will we see another surplus in the August release?

- High Street Lending: Wednesday, 8:30. The major British banks approved 43.3 thousand mortgages In July, above the estimate of 42.8 thousand. This was the highest level since January 2017.

- CBI Realized Sales: Wednesday, 10:00. Retailers and wholesalers had little to smile about in August, as sales volume fell to -49, much lower than the forecast of -13. The estimate for September is -22.

GBP/USD Technical analysis

Technical lines from top to bottom:

We start with resistance at 1.2910. This line has held since mid-May.

1.2850 capped recovery attempts in late November. 1.2728 is next.

1.2616 has provided resistance since early July.

1.2535 remains relevant and was tested during the week.

1.2420 (mentioned last week) is providing support.

1.2330 is the next support level.

The round number of 1.22 was an important support level in December 2016.

1.2080 is protecting the symbolic 1.20 level. It is the final line for now.

I remain bearish on GBP/USD

The pound has been unexpectedly strong recently, as the currency continues the symbolic 1.25 line, but there could be serious headwinds ahead, with the U.K. scheduled to leave the EU next month, and London and Brussels still far apart on a withdrawal agreement.

Further reading:

- EUR/USD forecast – for everything related to the euro.

- USD/JPY forecast – projections for dollar/yen

- AUD/USD forecast – predictions for the Aussie dollar.

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!