- GBP/USD has tumbled toward 1.32 in response to a growing divide in Brexit talks.

- EU and UK negotiations continue talking, keeping some hope alive.

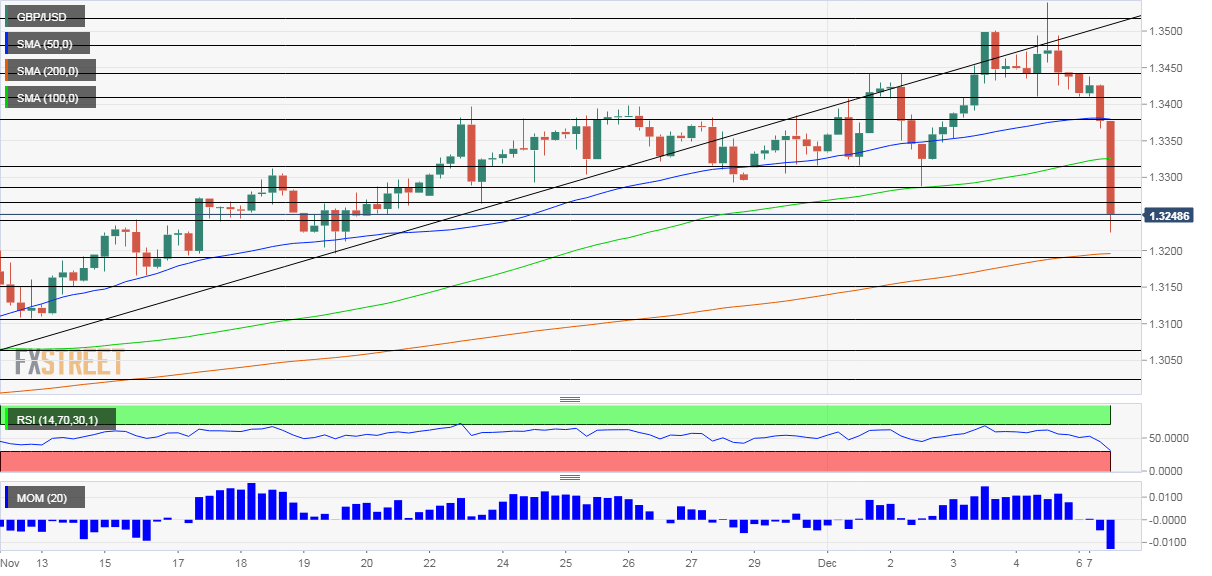

- Monday’s four-hour chart is pointing to oversold conditions.

Taking the stairs up and the lift down – this typical pattern in stock markets is now visible in GBP/USD, which has lost its hard-earned gains amid fears that Brexit talks collapse.

UK Prime Minister Boris Johnson is reportedly ready to abandon talks “within hours” if the EU does not retract its latest demands. This headline from The Sun turned a modest decline in the cable into a spiraling free-fall. Is it just posturing – meant for the local audience – before a final handshake? If that is the case, there is a major buying opportunity.

Where do Brexit talks stand?

The three thorny topics are still unresolved. On fisheries, a minuscule yet politically sensitive industry, there has been progressing but it is unclear how disputes related to quotas would be resolved. France reportedly made demands on the topic, as it shares waters with Britain. Another update suggests that London made new demands on fish, not France. It is hard to know which such “behind the scenes” report is correct.

The second sensitive issue is a level-playing field or competition rules. Over the weekend, The Times reported that French President Emmanuel Macron and German Chancellor Angela Merkel agreed to soften EU demands on the topic.

Perhaps the third issue is the hardest to resolve – governance. Brussels’ level of distrust in Johnson rose after the PM introduced the Internal Markets Bill a few months ago. The legislation knowingly violates the Withdrawal Agreement that he signed last year. Amid suspicions, member states demand more assurances that a deal would be enforced.

Both sides prefer a deal over no deal, especially as the pandemic continues weighing on the economies on both sides of the English Channel. Is it enough for compromises at the last moment? The answer depends on the definition of “the last moment.” Perhaps an accord is unachievable on Monday but could be reached on Thursday and on Friday when EU leaders convene virtually.

At the time of writing, talks continue in Brussels and have yet to break up, keeping hope alive. An official conclusion of the current round of talks could send GBP/USD down, while any reports of progress could boost it.

One thing is clear – sterling’s sensitivity to Brexit headlines has reached extreme levels.

Outside this topic, markets are mixed. Britain will begin injecting the Pfizer/BioNTech vaccine on Tuesday and the US FDA will likely approve it on Thursday.

COVID-19 cases, hospitalizations, and deaths continue rising at an alarming rate in the US and it has also contributed to lower hiring levels in November. Nonfarm Payrolls rose by only 245,000, around half the early expectations. On the other hand, investors hope that the deterioration will push lawmakers on Capitol Hill to approve a stimulus bill, yet that is still in the air, like Brexit talks.

GBP/USD Technical Analysis

Pound/dollar has tumbled down, sending momentum on the four-hour chart to negative territory. On the other hand, the fall was so sharp that it also pushed the Relative Strength Index to 30 – on the verge of oversold conditions.

GBP/USD pierced the 50 and 100 Simple Moving Averages on its way down but remains above the 200 SMA. Will cable bounce from here? At the time of writing, it is some 30 pips off the lows but over 150 down on the day.

The daily low of 1.3225 provides some support and it is followed by 1.3195, which cushioned the currency pair in mid-November. Further down, the next support lines are 1.3150 and 1.3105.

Resistance is at 1.3265, which was a swing low in late November, followed by 1.3320, a cushion from early December. The next cap is at 1.3370, which held cable down at the end of last month, and then at 1.3410.

See Three reasons to expect a sustained Santa rally for sterling