GBP/USD showed slight gains last week. There are five events on the schedule in the upcoming week. Here is an outlook for the highlights and an updated technical analysis for GBP/USD.

There was positive news from the U.K. labor market, as unemployment claims fell to 14.9 thousand in December, down from 28.8 thousand a month earlier. This was much lower than the estimate of 33.4 thousand and the lowest level since January. Wage growth remained steady at 3.2%, above the estimate of 3.1%. The initial Manufacturing PMI reading for January improved to 49.8, above the estimate of 48.8 pts. This was also above the final December reading of 47.5 pts, but still points to contraction. The initial Services PMI release for January came in at 52.9, above the estimate of 51.1 pts. This is stronger than the final December release of 50.0 pts.

In the U.S., unemployment claims came in at 211 thousand, lower than the estimate of 214 thousand. The indicator has now beaten the forecast for a third straight week. The manufacturing PMI slowed in January, coming in at 51.7 pts. This marked a 3-month low and missed the forecast of 52.4 pts. There was better news in the services sector, as services PMI improved from 52.2 to 53.2, which was above the estimate of 52.9 pts. This marked a 10-month high.

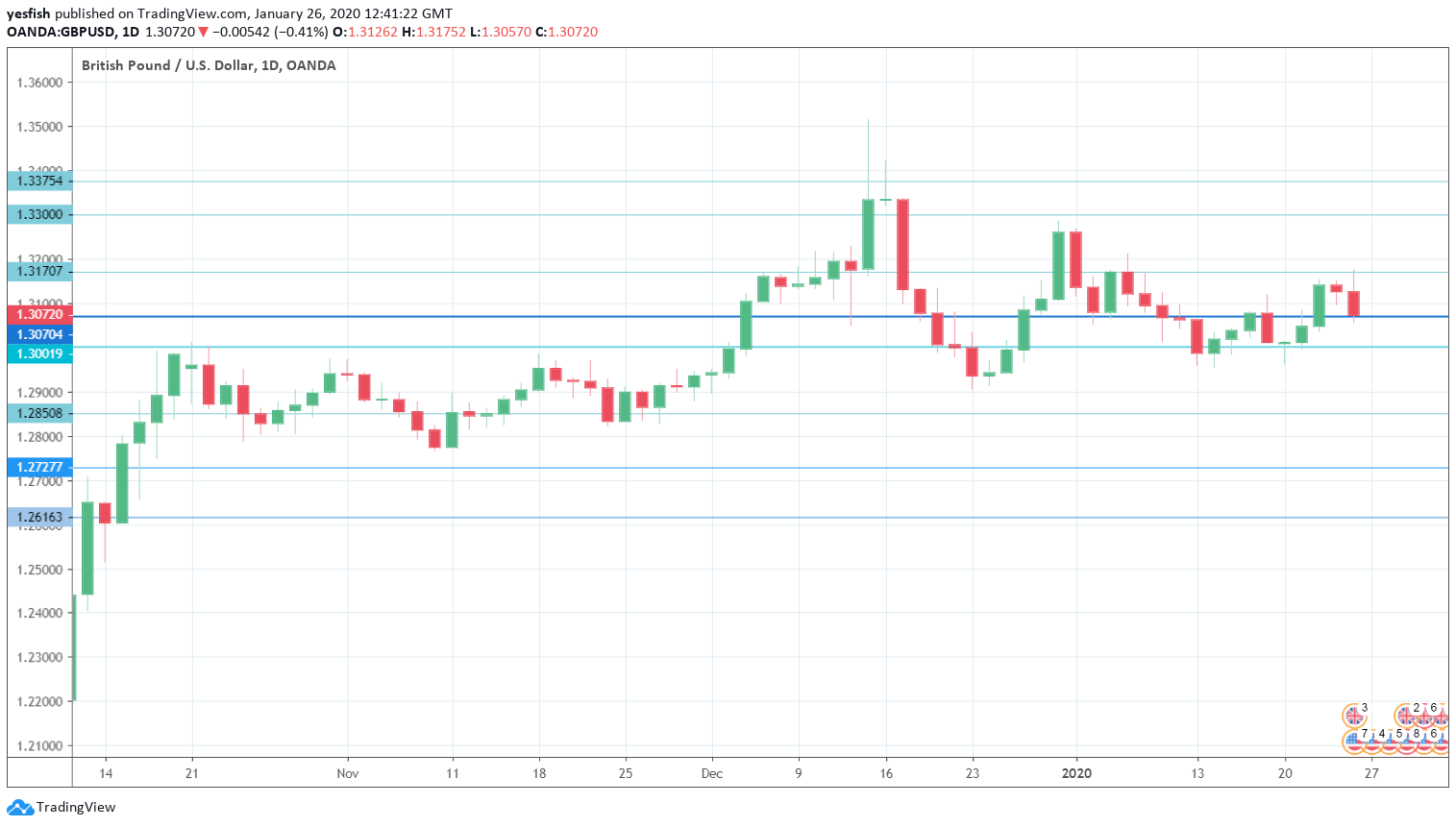

GBP/USD daily graph with resistance and support lines on it. Click to enlarge:

- High Street Lending: Monday, 9:30. The U.K’s major banks reported an increase in the number of mortgages approved in November, at 43.7 thousand. This was above the estimate of 41.3 thousand. The upswing is expected to continue in December, with an estimate of 44.0 thousand.

- CBI Realized Sales: Tuesday, 11:00. The Confederation of British Industry index improved to zero in December, and manufacturers expect higher sales volume in January, with an estimate of 5 pts. The indicator has been mired in negative territory since April.

- BRC Shop Price Index: Wednesday, 0:01. This consumer inflation indicator continues to post declines and came in at -0.4% in December. Will we see an improvement in the January release?

- BoE Rate Decision: Thursday, 12:00. The BoE is expected to maintain the benchmark rate at 0.75%. At the December rate meeting, two MPC members voted to immediately lower rates, while seven members voted to leave the benchmark rate at 0.75%. As for the QE program, members are expected to vote unanimously to maintain the program at 435 billion pounds.

- GfK Consumer Confidence: Friday, 0:01. Consumers remain pessimistic about the economy, as the indicator remains mired in negative territory. The December release improved to -11, up from -14 pts a month earlier. Another improvement is projected in January, with an estimate of -9 pts.

- Net Lending to Individuals: Friday, 9:30. Consumer borrowing levels are connected to consumer spending, a key driver of economic growth. The indicator slowed to GBP 4.5 billion in November, shy of the estimate of 5.1 billion. Analysts expect an improvement in December, with an estimate of 5.0 billion.

GBP/USD Technical analysis

Technical lines from top to bottom:

We start with resistance at 1.3375. This line has held since mid-December, when the pound went on an extended slide. 1.3300 is next.

1.3170 has been in a resistance role since the first week in January.

1.3070 remains relevant and GBP/USD ended the week just above this line.

1.3000 (mentioned last week) is the next support level.

1.2910 has held in support since early December. 1.2850 is next.

1.2728 has provided support since mid-October. It is the final support level for now.

I am neutral on GBP/USD

The pound was up 2.5% in December, but January has been a different story, as the currency has declined 1.4 percent. The U.K will finally depart the EU on January 31, but tough negotiations are expected with the EU over a new trade relationship, which could weigh on the pound.

Further reading:

- EUR/USD forecast – for everything related to the euro.

- USD/JPY forecast – projections for dollar/yen

- AUD/USD forecast – predictions for the Aussie dollar.

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!