- GBP/USD has been licking its wounds from Carney’s dovish words.

- US Non-Farm Payrolls and Brexit speculation are in focus.

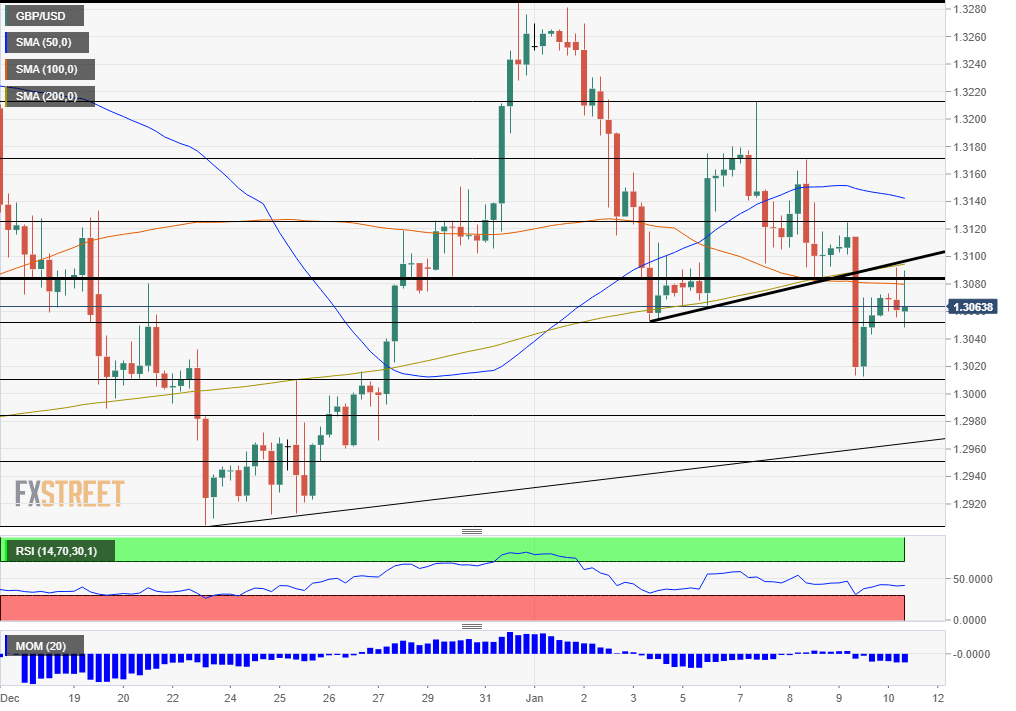

- Friday’s four-hour chart is pointing to further falls.

Is the Bank of England on course to cut rates in the near future? The pound has been struggling to recover from the dovish hints from the bank.

Mark Carney, Governor of the Bank of England, said on Thursday that he may react “promptly” to economic weakness and that the bank has the equivalent of 250 basis points of ammunition to use in case of a downturn. Bond markets reflect higher odds of a rate reduction in the spring.

The BOE rarely had any impact on sterling in recent months, as UK politics were left, right, and center. However, after the Conservatives’ landslide win, there is no more drama in parliament and economics have their say. Carney’s speech came while the House of Commons cleared the Brexit Withdrawal Bill. It will now be debated in the House of Lords. which is unlikely to cause any significant delays.

The UK is on course to leave the EU at the end of the month and speculation about future EU-UK relations is rife. Prime Minister Boris Johnson remains optimistic about reaching an accord by year-end, while Brussels has its doubts.

With calm in Mid-East tensions, broader markets also focus on economics rather than politics. The all-important US Non-Farm Payrolls is set to show an increase of 164,000 jobs and an annual rise of 3.1% in wages. Real estimates may be higher after robust US figures earlier this week.

See:

- Non-Farm Payrolls Preview: All signs are go

- Nonfarm Payrolls Preview: New year, old data

Expectations may be too high – leaving ample room for a disappointment. The event triggers high volatility.

Overall, the US NFP and Brexit speculation are set to move pound/dollar.

GBP/USD Technical Analysis

Cable remains under pressure after losing the critical 1.3080 level – the confluence of the 100 Simple Moving Average on the four-hour chart and a support line from earlier this week. Momentum remains to the downside and the 50 and 100 SMAs also cap the pair.

Support awaits at 1.3050, the early January high. Next, we find the fresh 2020 low of 1.3010. It is followed by 1.2985 and 1.2950.

This week’s highs of 1.3125, 1.3150, and 1.3215 all serve as resistance lines.