- GBP/USD dropped sharply as PM May is getting closer to leaving.

- Apart from Brexit, US-Sino trade relations, and UK inflation stand out.

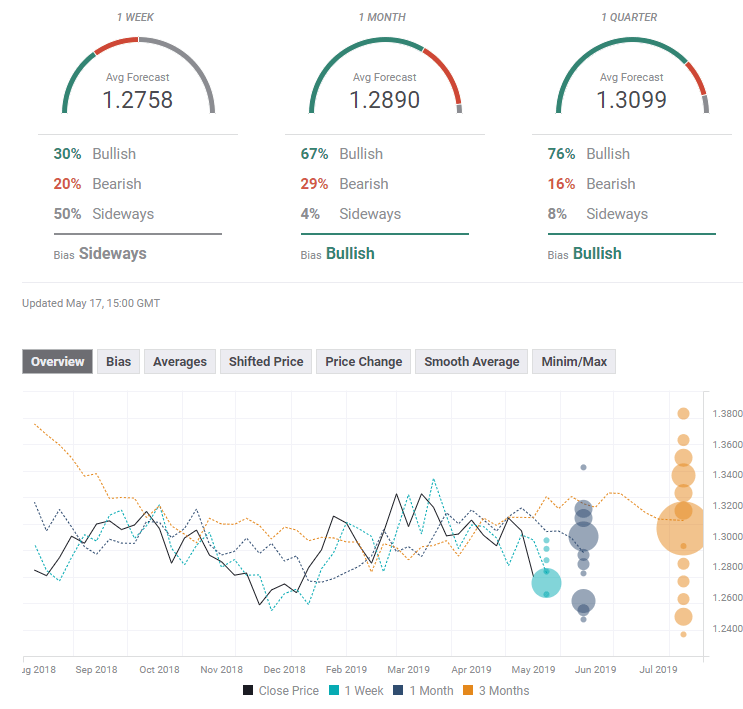

- The technical outlook is now fully bearish for the currency pair. Experts are mostly bullish after the fall.

What just happened: The beginning of June is the end of May

UK PM Theresa May has agreed to set a timetable for her departure in the first week of June, right after the fourth vote on Brexit in parliament. She decided to do so after facing insurmountable pressure from the 1922 Committee of backbenchers in her Conservative Party.

The leading candidate for the leadership of the party and the country is her former Foreign Secretary Boris Johnson who said he would run once there is a vacancy. The pound suffered on the political uncertainty and the potential ascent of a staunch supporter of Brexit to the top role.

Opposition Labour decided to end talks as the government is on the verge of collapse, adding to the pound’s pain.

Even before the gathering of the backbench Tories, cross-party talks with the Labour party did not go anywhere fast. The government and the opposition have remained divided on staying in a customs union with the EU. Both parties are projected to suffer significant losses in the upcoming European Parliament elections, and these polls are pushing Labour towards supporting a second Brexit referendum.

And while May may lose her job, fewer Brits are out of work: the unemployment rate dropped to 3.8%, better than expected, while pay rises moderated to 3.2% on an annual basis. Brexit remains the main driver of the pound.

Elsewhere, the trade war between the US and China continued escalating with the latter announcing counter-tariffs on the former. US President Donald Trump remained optimistic on reaching a deal but also took measures to limit Huawei, a Chinese telecommunications giant. The worsening mood pushed the dollar higher.

US data was mixed with disappointing retail sales but upbeat housing and other data points. Politics remain left, right, and center also for the greenback.

UK events: Politics and also inflation eyed

Politics remain in the spotlight, and the upcoming week could see new indicative votes in parliament. MPs may vote on what kind of Brexit they want. At the time of writing, such votes are not confirmed.

The pound will also likely respond to the leadership contest in the Conservative Party. While Boris Johnson is popular among Tory members, MPs and the public are less enthusiastic about him. Additional candidates may throw their hats into the ring. If a prominent pro-Remain candidate emerges, the pound has room to gain. These include foreign secretary Jeremy Hunt, and pensions and work minister Amber Rudd.

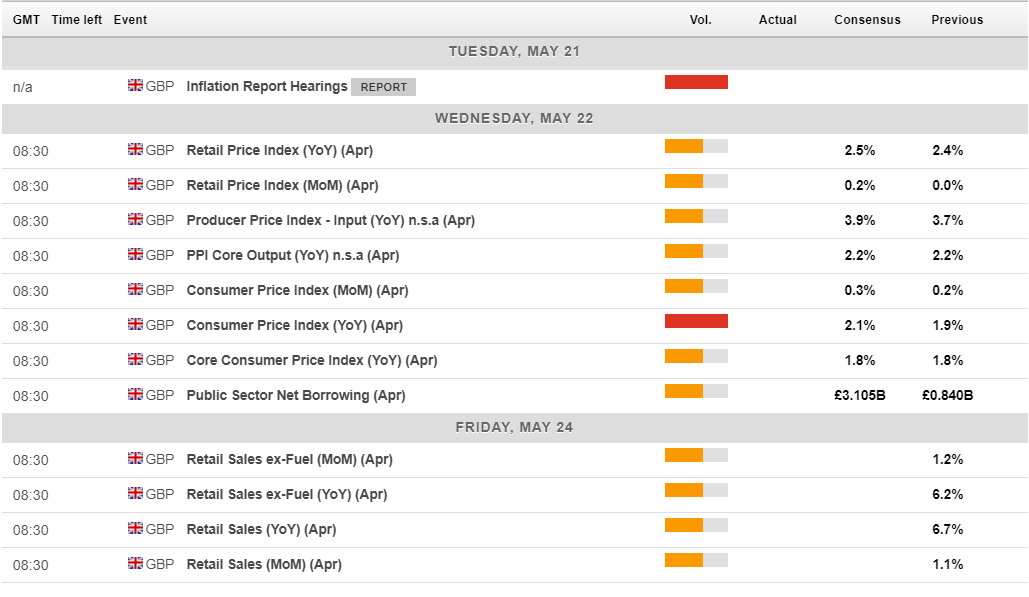

On Tuesday, Bank of England Governor Mark Carney and several of his colleagues will appear before parliament to discuss the recent inflation report. In a long session, they are likely to repeat their views about the economy and stress that all their outlooks depend on Brexit.

The most significant economic release is due on the following day. The inflation report for April is set to show an increase in consumer prices, with the headline projected to accelerate from 1.9% to 2.1%. Core CPI is forecast to remain unchanged. Inflation remains under control.

Last but not least, retail sales have likely fallen in April after surging in March. The impact of the data on the pound may be subdued as the figures are volatile and Brexit is the center of attention.

Here are the events lined up in the UK on the forex calendar:

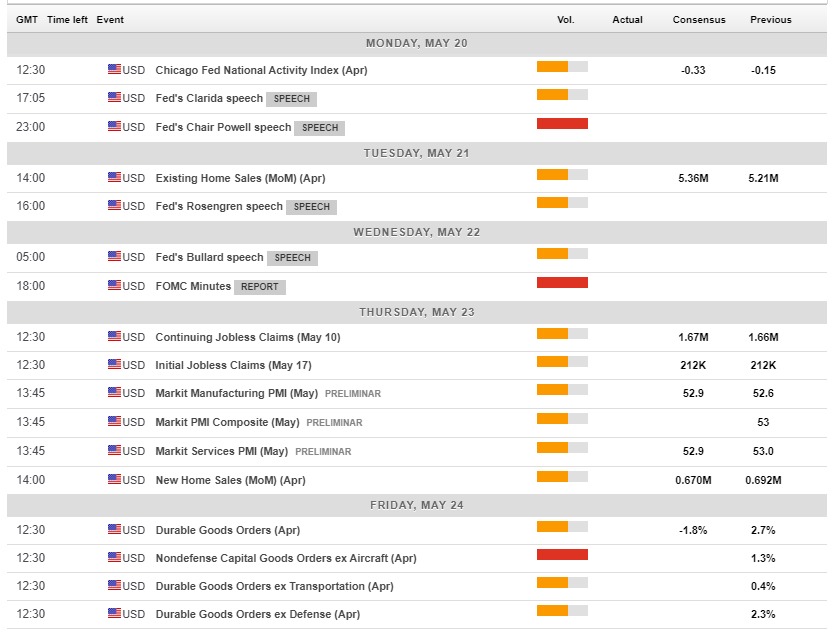

US events: Mostly about trade, but also the Fed

The fallout between the US and China will likely remain in the headlines. With every day that passes, the economic damage from the fresh round of tariffs will rise, and markets may suffer, pushing the greenback higher. If US Treasury Secretary Steven Mnuchin goes to Beijing for new talks, the atmosphere may improve.

The economic calendar features several speeches from Fed officials. Chair Jerome Powell will speak about risks to the financial system, and it is unclear if he will touch on monetary policy. Other members of the central bank will make public appearances, but the most significant Fed-related event is the publication of the meeting minutes from the latest rate decision.

Early this month, the central bank left the interest rate unchanged and rejected calls to signal a rate cut. Powell dismissed lower inflation as temporary and stressed the strength of the economy. The minutes may reveal more on members’ thoughts about inflation, employment, growth, and perhaps also trade. The meeting was held before the breakdown in talks, but the document is revised until the very last moment with the Fed having the market’s reaction in mind.

Sales of both new and existing homes have likely held onto recent gains. Other figures from the housing sector have been upbeat of late. The most significant economic data is due on Friday, with the release of durable goods orders for April. After an impressive advance in March, the data for April will likely be more moderate.

Here are the scheduled events in the US:

GBP/USD Technical Analysis

GBP/USD has suffered a losing streak of no less than ten days and is on the verge of entering into oversold territory. The Relative Strength Index is flirting with 30 at the time of writing, the threshold separating normal and oversold conditions.

Other indicators such as Momentum and the key Simple Moving Averages are implying to further falls. The 50 SMA is falling towards the 200 SMA. When it breaks below it, we will witness the “death cross” pattern.

Support awaits at 1.2670 that was a swing low in January. The round number of 1.2600 provided some support in late December, and 1.2480 was the trough earlier that month.

The first resistance line awaits at 1.2775 that was the low point in February. It is followed by 1.2830 that provided support in January and more importantly, 1.2870 that was the low point in April. 1.2930, and 1.2960 follow.

GBP/USD Sentiment

It is hard to see anything positive happening under a lame-duck PM. It would take a broad initiative for a second referendum to stop the pound from its free-fall. Otherwise, the growing chances of Boris Johnson to enter Downing 10, alongside no new US-Sino talks, could extend the suffering.

The FXStreet Poll shows that experts have downgraded their average targets in the short and medium terms, but hold their ground in the longer term. The bias is sideways in the short term and then becomes bullish.

-636936926834792366.png)