- GBP/USD has resumed its gains as opinion polls continue showing Conservatives well in the lead.

- Further political developments are set to rock the pound today.

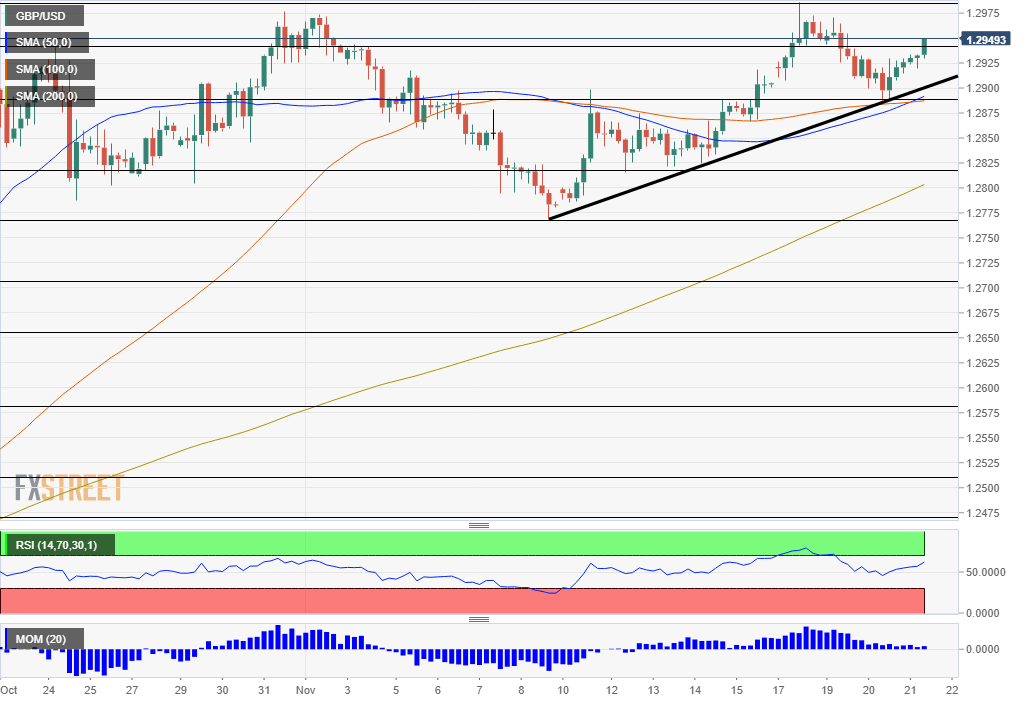

- Thursday’s technical chart is showing cable bounced off critical support.

Corbyn comeback? Not so fast. Labour leader Jeremy Corbyn may have exceeded expectations in Tuesday’s televised debate – but opinion polls have continued showing Prime Minister Boris Johnson in the lead. And that is sending sterling back up.

GBP/USD is trading in the mid 1.29s, up from a dip on Wednesday. The last six surveys published on Britain Elects are showing double-digit leads for Johnson’s Conservatives over the left-leaning opposition.

Investors prefer the Tories‘ perceived fiscal responsibility and certainty on Brexit than Labour’s spending and nationalization schemes, as well as its vaguer Brexit stance.

Both main parties are benefiting from falling support for smaller parties, and the Conservatives seem to have the upper hand in siphoning Brexit Party voters. And Britain’s two leading factions are also promising goodies to voters – just as Public Sector Net Borrowing has exceeded estimates and surpassed £10 billion in October.

Johnson inadvertently released a pledge to raise the National Insurance rate to £12,000 – a tax break that would most people with lower incomes. The Labour party is publishing its manifesto today, with promises of £75 billion social housing plans, and taking on the wealthy elite.

New opinion polls and potential blunders by the leading politicians are set to rock the pound today.

Outside the election bubble

GBP/USD has been mostly shrugging off developments outside the UK. The US and China are at loggerheads over Hong Kong. The House of Representatives approved a bill supporting the pro-Democracy demonstrations and President Donald Trump may sign it into law already on Thursday. Beijing sees this legislation as an interference in its internal affairs.

Both sides have also failed to agree on the removal of tariffs, and Trump seems reluctant to proceed toward an accord. Trade headlines are set to rock broader markets and that may affect pound/dollar.

The Federal Reserve’s meeting minutes have shown a broad consensus for leaving policy unchanged for some time, supporting the dollar. Impeachment hearings have drawn attention as Gordon Sondland, a donor to Trump has said that there was a quid pro quo around Ukraine and that everybody knew about it.

GBP/USD Technical Analysis

The four-hour sterling/dollar is showing that the currency pair bounced off uptrend support, which also coincided with the 50 and 100 Simple Moving Averages. The move is bullish and momentum remains to the upside.

The pound faces resistance at 1.2985, November’s high point. Next up, the six-month high of 1.3013 is another significant level.to watch. Further above, 1.3045, 1.3080, and 1.3175 dates back to the spring and await GBP/USD.

Cable has support at 1.2885, the weekly low, followed by 1.2820, which provided support last week. November’s trough at 1.2760 is the next level to watch.