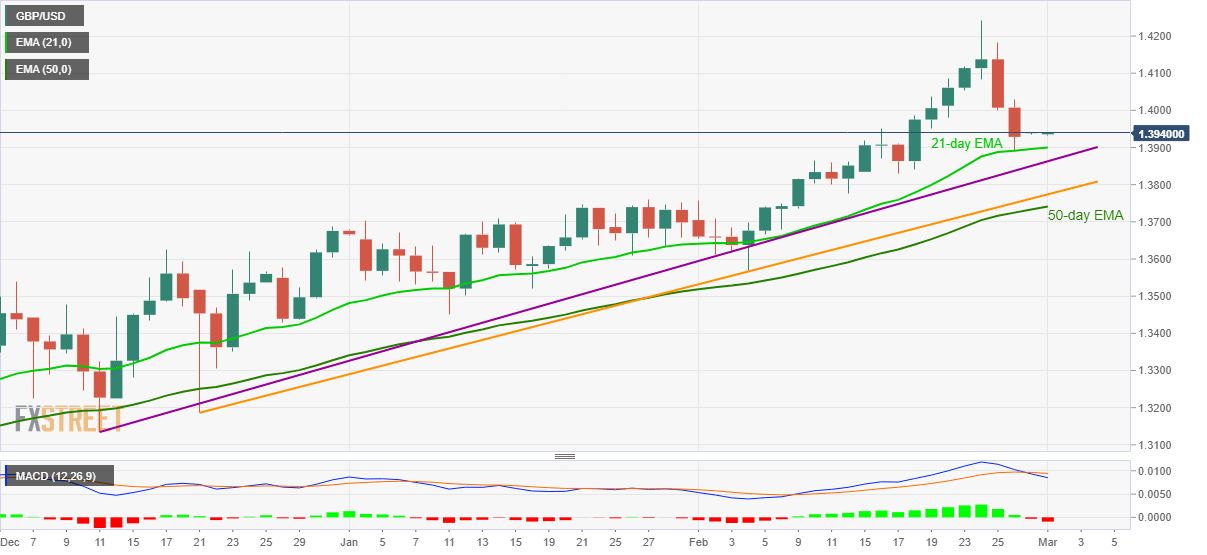

- GBP/USD wavers around one-week low amid bearish MACD.

- UK Chancellor Sunak is up for five billion pound help to British businesses.

- Immediate EMA, multiple support lines test two-day downtrend.

GBP/USD sellers catch a breather around 1.3935-40 amid the initial Asian session trading on Monday. In doing so, the cable pair snaps a two-day downside while cheering the news suggesting British Chancellor Rishi Sunak’s readiness to offer five billion worth of extra stimulus to the UK business during this week’s annual budget.

It should, however, be noted that the MACD prints the heaviest bearish sign in a month and hence challenges to the immediate support, namely the 21-day EMA level of 1.3900, can’t be ruled out. Though, any further weakness will be questioned by an upward sloping trend line from December, respectively around 1.3860 and 1.3775.

Also acting as a downside filter is the 50-day EMA level of 1.3740 that holds the key to the GBP/USD slump towards February’s low near 1.3565.

Meanwhile, a corrective pullback from the short-term key EMA can eye to regain the 1.4000 threshold whereas 1.4085-90 comprising late-February levels, could challenge the buyers afterward.

In a case where GBP/USD manages to cross 1.4090, it needs to pierce the 1.4100 round-figure before targeting the previous month’s peak surrounding 1.4245.

Overall, GBP/USD has multiple downside barriers and the stimulus chatters that keep buyers hopeful.

GBP/USD daily chart

Trend: Further recovery expected