- GBP bulls gather strength for further upside, with eyes set on 1.40.

- Fed-led USD weakness offsets Brexit chaos amid an upbeat mood.

- Inverse H&S to get confirmed on a daily closing above 1.4009.

GBP/USD is attempting another run towards the 1.4000 round number, looking to extend its winning streak into a fifth day on Thursday.

Fed Chair Powell’s rejection of taper calls keeps the sentiment under the US dollar undermined. Meanwhile, the UK’s higher vaccination rates overshadow the negative vibes around the renewed Brexit chaos.

It’s worth noting that Goldman Sachs predicted the British economy to grow by a “striking” 7.8% this year, which also offers support to the pound.

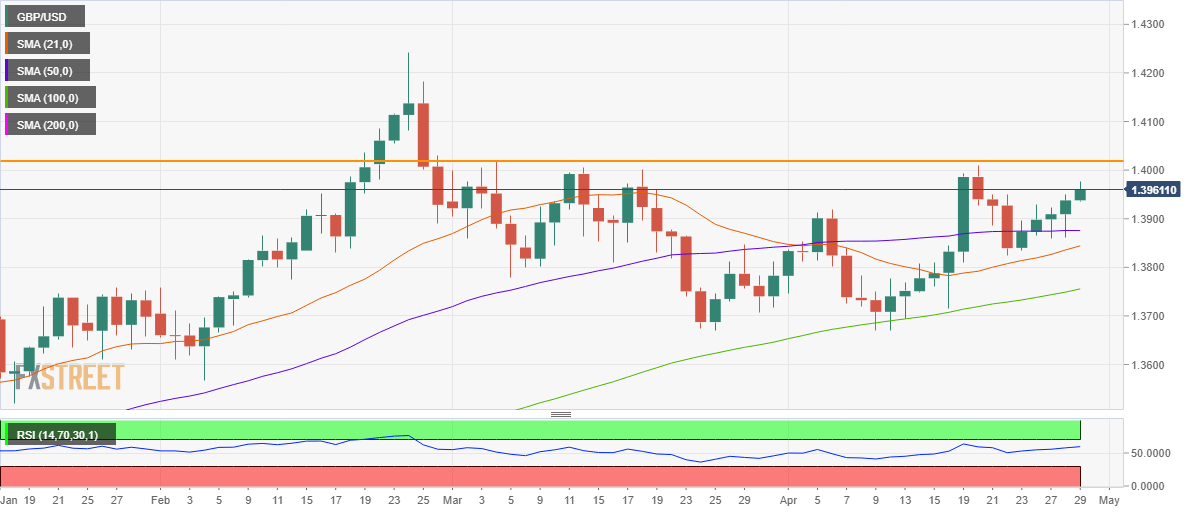

From a near-term technical perspective, the cable is on track to chart a perfect inverse head and shoulders formation on the daily sticks, if the pattern neckline (orange) at 1.4009 is taken out on a closing basis.

GBP/USD daily chart

The bullish confirmation will open doors for a test of the pattern target at 1.4348. However, it’s unlikely to be a smooth ride for the buyers, as they need to scale the February 25 high of 1.4182 before.

Also, the 2021 high of 1.4243 will come into play, testing the bulls’ commitments.

The 14-day Relative Strength Index (RSI) points higher above 50.00, allowing room for more gains.

Alternatively, any pullbacks could draw demand at the 50-daily moving average (DMA) at 1.3875, below which the 21-DMA at 1.3844 could be probed by the GBP sellers.

GBP/USD additional levels to watch