- Dollar’s comeback, risk-off mood exacerbates the pain in GBP/USD.

- A test of the 100-DMA support remains inevitable for the GBP bears.

- RSI stays bearish, 21-DMA to limit any recovery attempts.

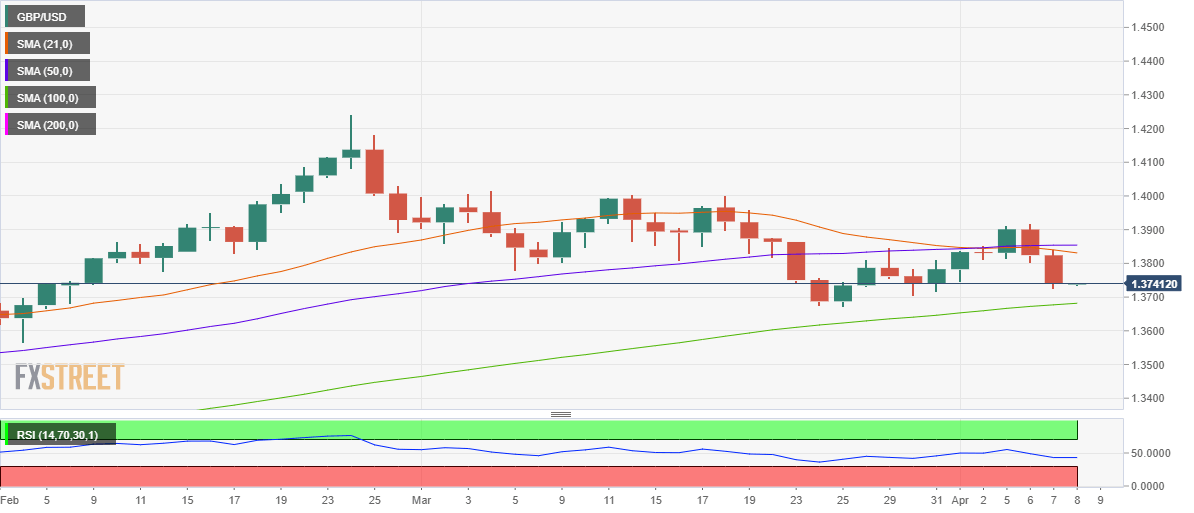

GBP/USD is nursing losses below 1.3750, as the sellers take a breather before resuming the downtrend, helped by a broad US dollar comeback and the Treasury yields.

As observed on the daily chart, the cable remains poised for deeper losses following the two-day heavy sell-off from three-week highs of 1.3918.

At the press time, the major trades better bid around 1.3840, with eyes on the critical upward-sloping 100-daily moving average (DMA) support at 1.3682 heading into the US Jobless Claims data and Fed Chair Powell’s speech due later on Thursday.

Any recovery attempts in the major are likely to remain shallow and could likely face a strong hurdle at the bearish 21-DMA at 1.3831.

If the bulls succeed in taking out that level, the next upside target is aligned at the ascending 50-DMA at 1.3853.

However, given that the Relative Strength Index (RSI) continues to hold below the central line, the downside appears more compelling for GBP/USD.

GBP/USD: Daily chart

Therefore, a test of the 100-DMA support remains in the offing, below which the March 25 low of 1.3670 could offer additional protection to the bulls.

A sharp sell-off towards 1.3600 cannot be ruled out if the latter is breached on a daily candlestick closing basis.

GBP/USD: Additional levels