- The BoE raised rates by 75bps on Thursday, the most since 1989.

- The BoE warned of a looming protracted recession in Britain.

- The pair is falling on dollar strength after Powell’s hawkish comments.

Today’s GBP/USD price analysis is bearish. After the Bank of England changed its tone, investors recalculated their rate projections, which put the pound in freefall. Sterling fell 2% overnight before edging up 0.1% to $1.1170.

-Are you looking for automated trading? Check our detailed guide-

It was on track to post a weekly loss of around 4%, the most since the market turbulence that began in September due to an unsettling economic plan.

The BoE increased interest rates by 75bps on Thursday, the most since 1989, but cautioned investors that the likelihood of Britain experiencing its deepest recession in at least a century means that borrowing costs will likely increase less than anticipated.

“Sterling is getting a dose of the reality of the economy. That the Bank of England has to make – surely to the fiscal side – tough choices,” said Rodrigo Catril, a currency strategist at National Australia Bank.

On the other hand, the Federal Reserve increased interest rates this week by three-quarters of a percentage point. It hinted that its aggressive push to tighten monetary policy might be nearing an inflection point. Jerome Powell, the chair of the Federal Reserve, quickly dashed expectations of a potential pivot, adding that it was “extremely premature” to talk about when the Fed may stop raising interest rates. The dollar has been rising since then, further punishing the pound.

GBP/USD key events today

Investors will pay attention to the construction PMI report from the UK. From the United States, the nonfarm payrolls and the unemployment reports will give insight into the state of the labor market.

GBP/USD technical price analysis: Explosive bearish move set to go on to 1.1101

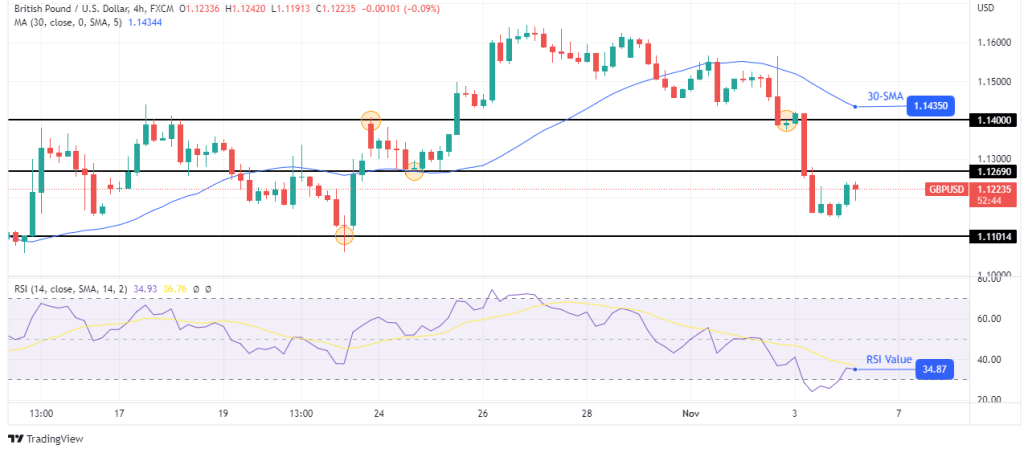

Looking at the 4-hour chart, we see the price trading well below the 30-SMA and the RSI below 50, showing bears are in charge. The price has made a steep, bearish move, leaping over support levels without pause.

-If you are interested in forex day trading then have a read of our guide to getting started-

Currently, the price has paused after breaking below the 1.1269 support level. Buyers might be looking to retest this level. However, the bearish bias is still strong. Therefore, the price will likely bounce off the 1.1269 key level and fall to the next support level at 1.1101.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.