- GBP/USD remains on the front foot after three consecutive days of uptrend.

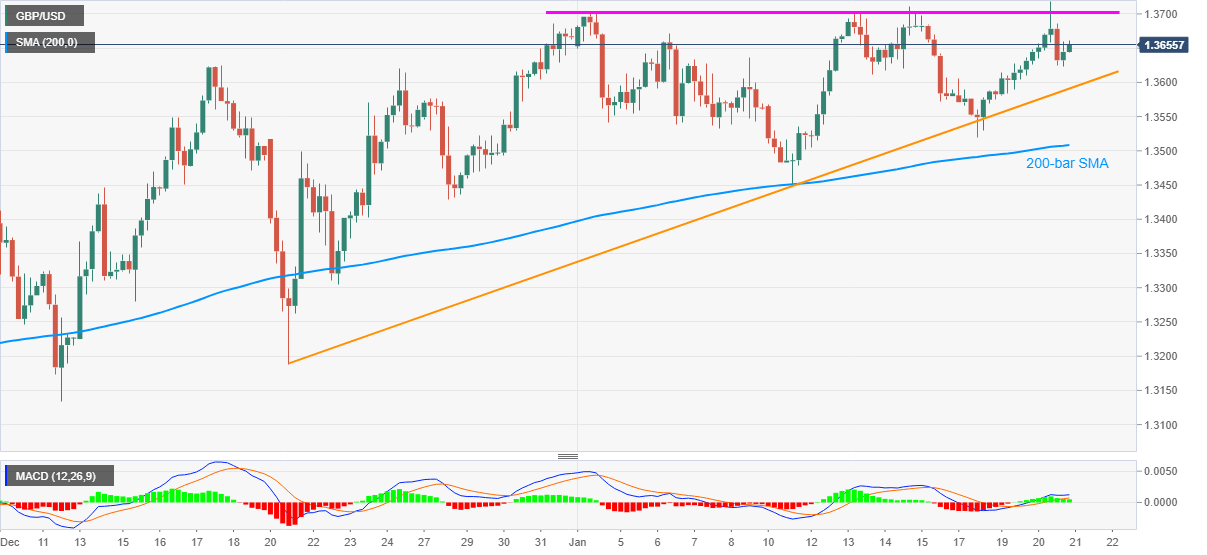

- Sustained trading beyond 200-bar SMA, one-month-old support line favor bulls.

- Multiple highs marked so far during January guard immediate upside.

GBP/USD picks up bids around 1.3660 during the early Asian trading session on Thursday. The cable jumped to the fresh high since May 2018 the previous day. However, the quote dropped back to the sub-1.3700 area before bouncing off 1.3623 off-late.

Considering the pair’s successful trading above 200-bar SMA, bullish MACD and an upward sloping trend line from December 21, GBP/USD bulls can stay hopeful to break multiple tops around 1.3700 marked during the current month.

Following that, February 2018 low near 1.3765 and the 1.3800 threshold could lure the GBP/USD buyers ahead of highlighting the 1.4000 psychological magnet.

On the downside, the aforementioned support line and 200-bar SMA, respectively around 1.3590 and 1.3505, followed by the 1.3500 round-figure, restricts sterling’s immediate declines. Also acting as strong short-term support is the monthly low near 1.3450.

In a case where GBP/USD sellers dominate past-1.3450, December 22 low near 1.3300 could become their rest-point during the journey towards the previous month’s bottom of 1.3134.

GBP/USD four-hour chart

Trend: Bullish