- GBP/USD drops to two-day low while extending pullback from 1.2250.

- Bearish MACD keeps sellers hopeful to refresh monthly low.

- Buyers will look for entry beyond 1.2300.

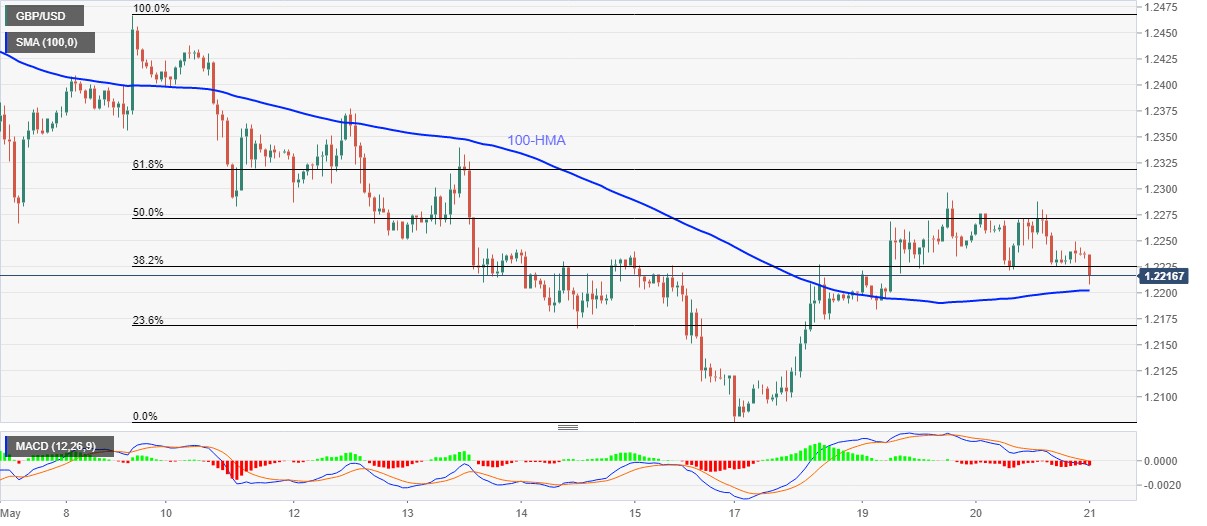

GBP/USD declines to 1.2217, down 0.20% on a day, after refreshing the two-day low by 1.2207 during Thursday’s Asian session. In doing so, the Cable extends its U-turn from the session start the top of 1.2250, not to forget magnifying the pair’s failure to cross 1.2300 during the current week.

That said, bearish MACD also favors the pair’s further fall toward a 100-HMA level of 1.2200, a break of which could drag it further down to 23.6% Fibonacci retracement of May 08-17 fall, around 1.2170/65.

During the pair’s extended fall below 1.2165, 1.2120 and the monthly low of 1.2075 will be on the sellers’ radars.

Alternatively, the pair’s pullback moves need to cross 1.2300 to challenge 61.8% Fibonacci retracement level of 1.2320 and aim for March 12 top near 1.2380.

GBP/USD hourly chart

Trend: Bearish