- GBP/USD remains depressed, refreshes intraday low amid Brexit, virus woes.

- Downside break of 200-HMA also favors the sellers despite oversold RSI conditions.

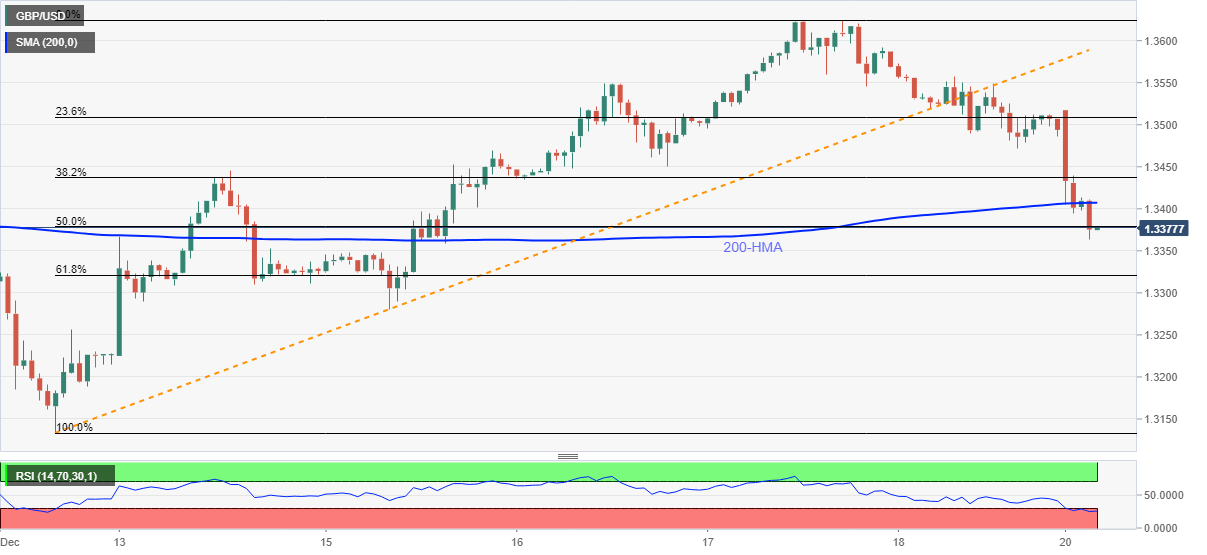

GBP/USD stays offered around the intraday low of 1.3363m, down 0.86% on a day, during early Monday. In doing so, the Cable extends Friday’s losses amid fears of a no Brexit deal in 2020 and the new covid variant outbreak.

Read: Brexit extension anticipation back on the cards

The resulted moves have recently broken 200-HMA, which in turn directs GBP/USD sellers toward 61.8% Fibonacci retracement of December 11-17 upside, near 1.3320.

During the quote’s further weakness past-1.3320, the mid-December low near 1.3280 and the monthly bottom surrounding 1.3135 should return to the charts.

Meanwhile, an upside clearance of 200-HMA, at 1.3407 now, need RSI recovery to regain the 1.3500 threshold.

Furthermore, any extended north-run past-1.3500 will refresh the month’s peak, also the highest since May 2018, near 1.3630.

GBP/USD daily chart

Trend: Further downside likely