- GBP/USD is trading near the 1985 lows, below the 1.1600 figure.

- GBP/USD correction up is failing as the market remains bearish.

- BOE cuts rates, adds £200 billion in QE, GBP/USD reacts up initially.

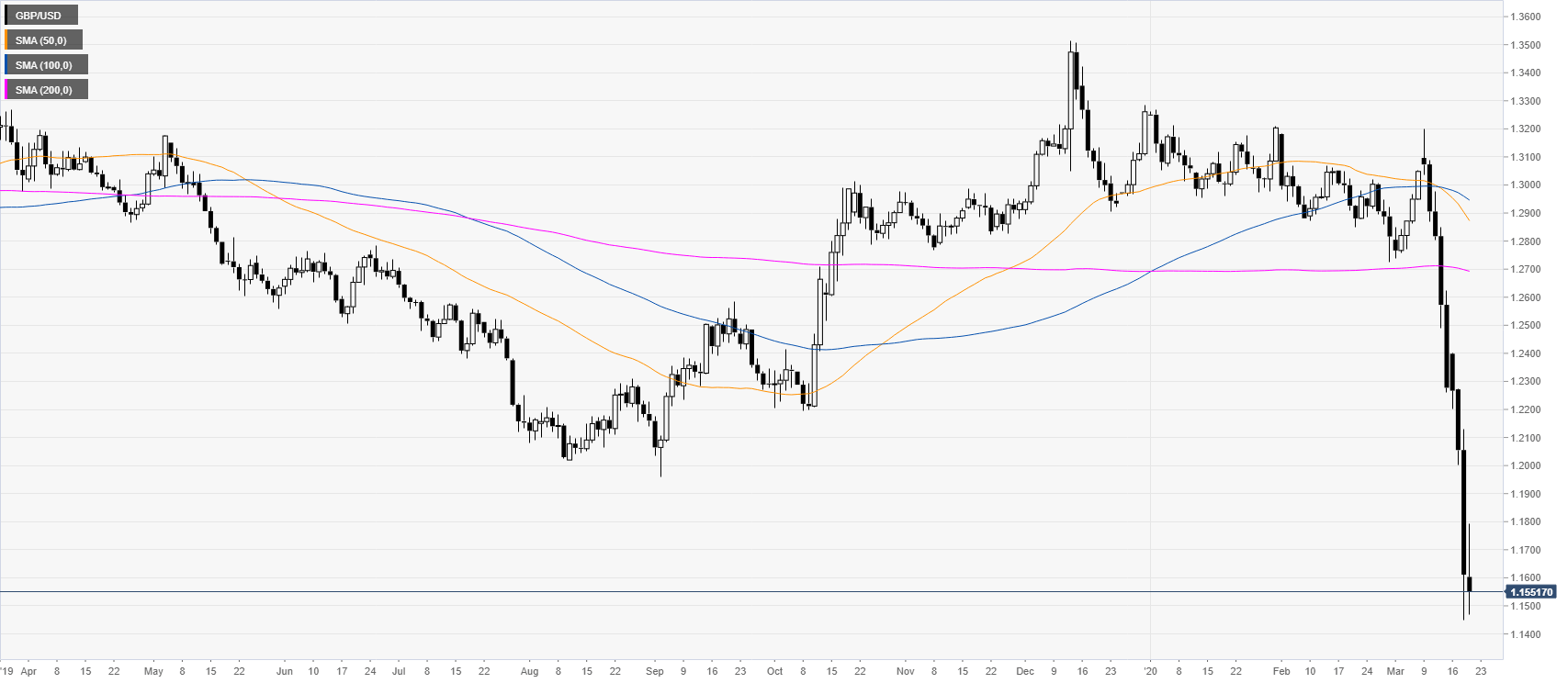

GBP/USD daily chart

GBP/USD remains under selling pressure near the 1985 lows after the Bank of England (BOE) cut interest rates and adds 200 billion in Quantitative Easing (QE).

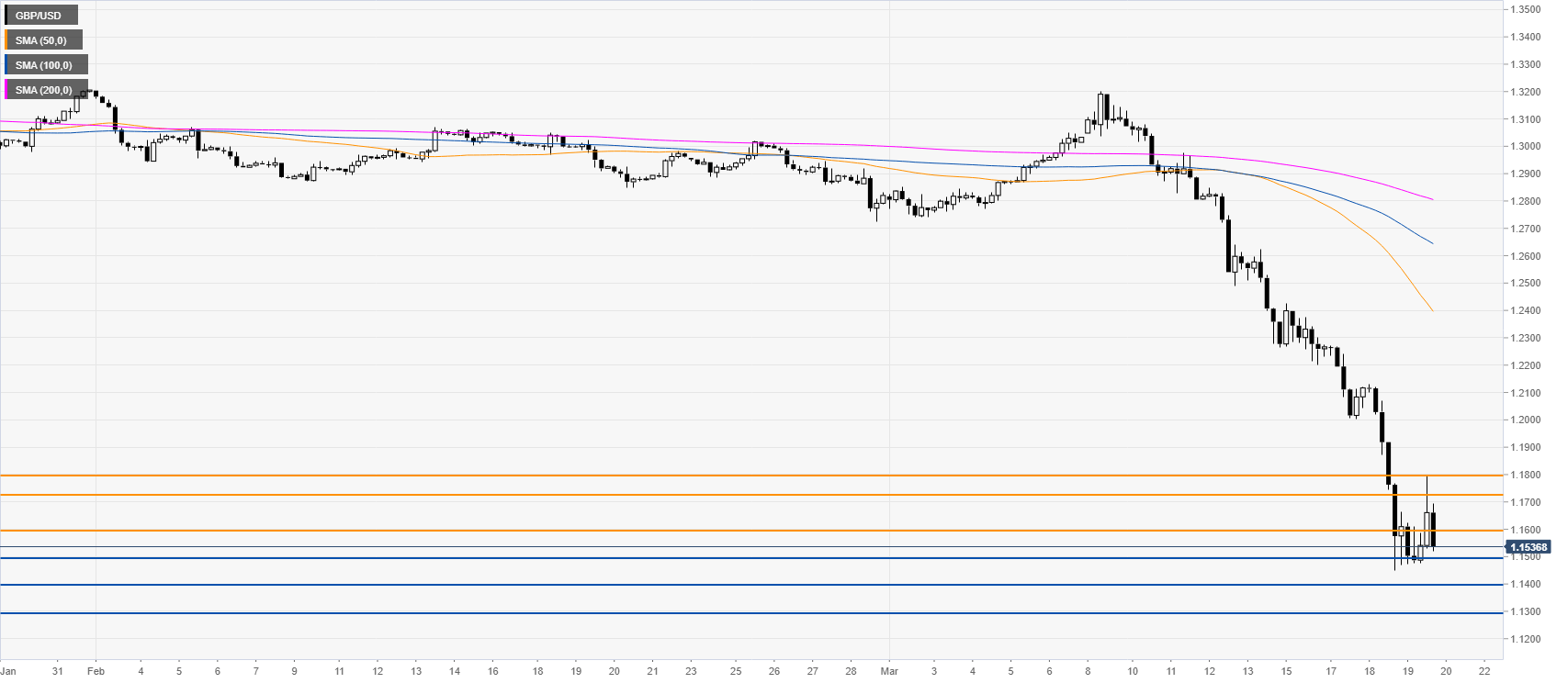

GBP/USD four-hour chart

GBP/USD correction is currently finding little follow-through from the bulls. Bears are pushing the price lower towards the 1.1485 level as they want to set their eyes on the 1.1400 and 1.1300 levels, if they can keep the momentum going. Resistance can be expected near the 1.1600, 1.1730 and 1.1800 figures, according to the Technical Confluences Indicator.

Resistance: 1.1600, 1.1730, 1.1800

Support: 1.1485, 1.1400, 1.1300

Additional key levels