- GBP/USD trims the early-Asia gains while stepping back from the key HMA.

- EU-UK agreed to extend Brexit talks but no-deal Brexit is still on the table.

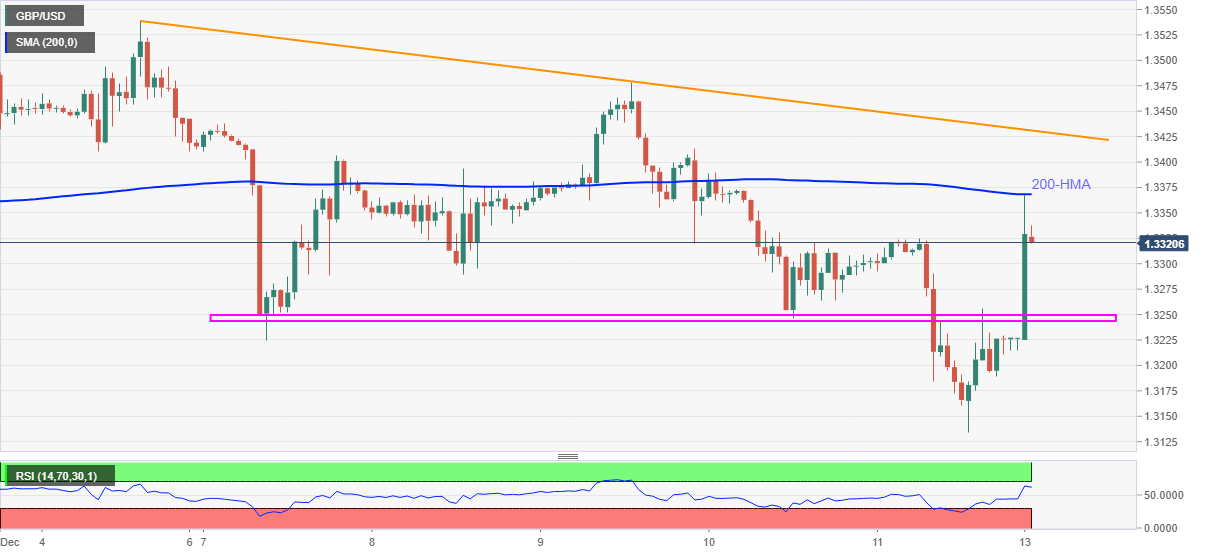

- Sellers eye one-week-old horizontal support, falling trend line from December 04 adds to the upside barriers.

GBP/USD drops to 1.3320 while flashing 0.67% intraday gains during Monday’s Asian trading. In doing so, the cable fades the week-start gap to the north, mainly due to the Brexit news, amid failures to cross the 200-HMA.

Read: Brexit “still has some legs”, US bipartisan group devides stimulus into two packages

Given the fears of a no-deal Brexit, the quote’s pullback from 200-HMA directs the GBP/USD sellers towards a horizontal area comprising multiple levels since November 07, between 1.3250 and 1.3240.

However, any further downside past-1.3240 will be challenged by the monthly bottom surrounding 1.3130.

Meanwhile, an upside clearance of 200-HMA, currently around 1.3370, will have to cross a downward sloping trend line from November 04, at 1.3430 now, before recalling the GBP/USD buyers.

If at all the pair remains positive past-1.3430, odds of its run-up to the monthly peak near 1.3540 can’t be ruled out.

GBP/USD hourly chart

Trend: Pullback expected