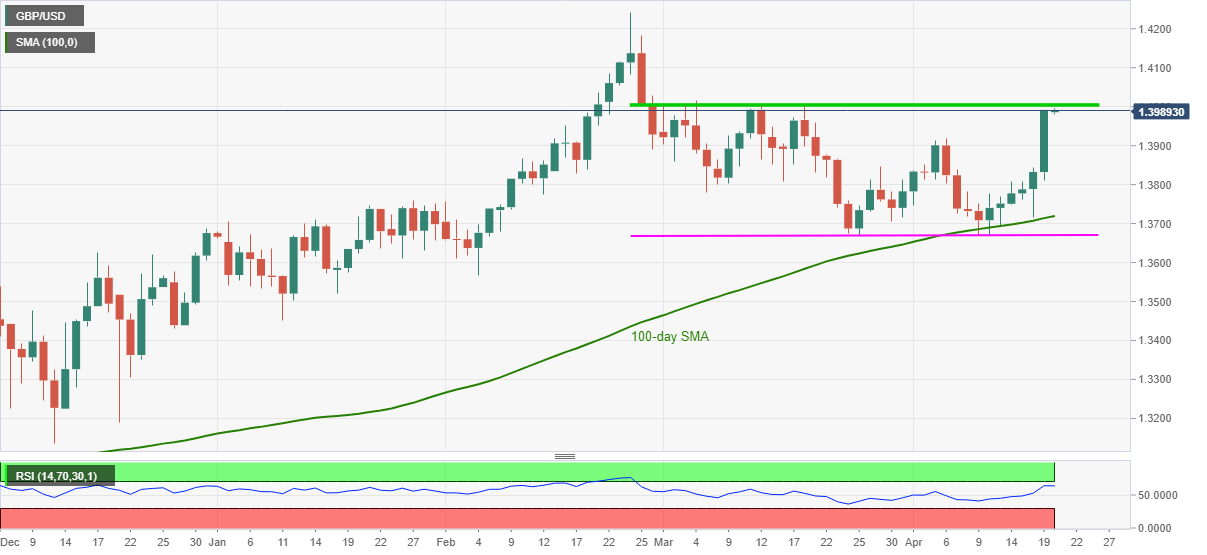

- GBP/USD bulls refrain from catching a breather after rising the most since January 12.

- A seven-week-old horizontal area tests further upside, early-month tops offer immediate support during pullback.

- Strong RSI suggests further rise but the key hurdle needs to be break for bullish confirmation.

GBP/USD takes the bids to refresh the highest level in a month around 1.3994, up 0.06% intraday, amid Tuesday’s Asian session. In doing so, the cable rises for the seventh consecutive day, needless to mention the previous day’s heaviest run-up in over three months.

Traders seem to wait for the UK’s employment figures for March for fresh impulse. Forecasts suggest the headline Claimant Count Change to ease from 86.6K to 25.5K whereas the Unemployment Rate may tick-up to 5.1% versus 5.0% prior.

Although strong RSI and sustained trading above 100-day SMA favor GBP/USD bulls, a horizontal area comprising multiple tops marked since early March, around 1.4000-10 will challenge the quote’s further upside.

Should the sterling buyers manage to cross the 1.4010 hurdle, the 1.4110 level may offer an intermediate halt during the rally targeting the yearly top of 1.4243.

Meanwhile, pullback moves may recall the 1.3920-15 area back to the chart.

However, 100-day SMA and lows marked since March 24, respectively around 1.3720 and 1.3670, will be tough challenges for the GBP/USD sellers before taking entries.

GBP/USD daily chart

Trend: Bullish