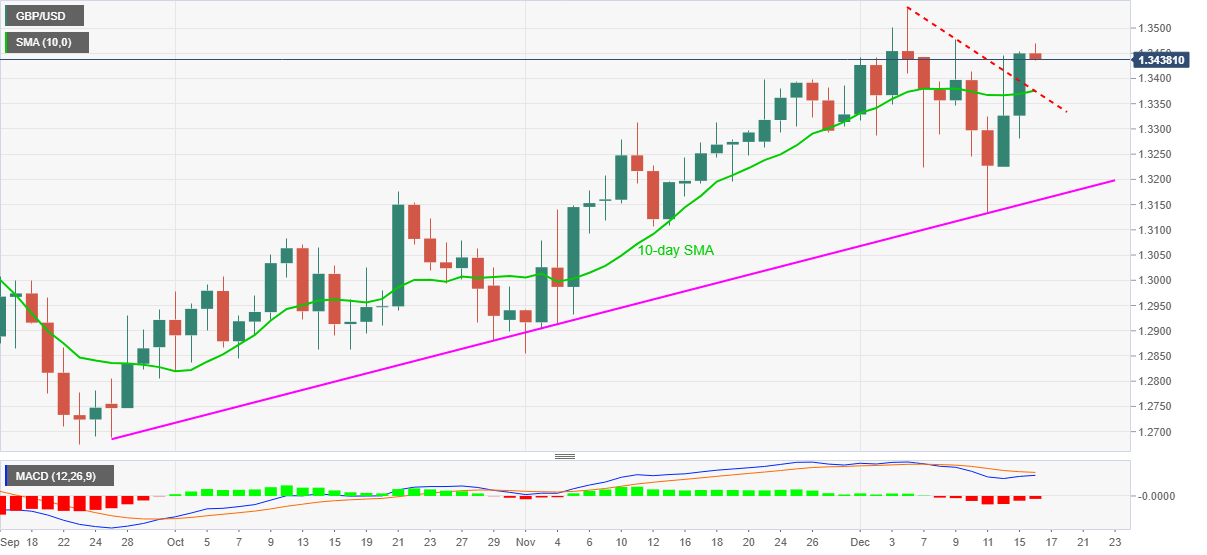

- GBP/USD eases from one-week high, trims the heaviest gains since December 01.

- Bearish MACD suggests further weakness, confluence of 10-day SMA, previous resistance line challenges downside.

- Bulls can eye monthly top before the mid-2018 levels.

GBP/USD declines to the intraday low of 1.3436, down 0.08% on a day, during early Wednesday. Even so, the buyers remain positive as the current downside can be considered as a consolidation after a two-day run-up.

While bearish MACD and failures to cross the December 09 high of 1.3478 indicates extra downside of the quote, a joint of 10-day SMA and a falling trend line from December 04, around 1.3375, will restrict any further weakness.

If at all the 1.3375 support convergence fails to stop GBP/USD sellers, an upward sloping trend line from September 25, at 1.3157 now, will be in focus.

Alternatively, an upside clearance of the one-week high near 1.3480 will attack the monthly peak surrounding 1.3540.

During the GBP/USD rise past-1.3540, the 1.3600 and highs marked during May of 2018, around 1.3615, will be the key to follow.

GBP/USD daily chart

Trend: Pullback expected