- GBP/USD showed some resilience below the 1.3300 mark and staged a goodish intraday bounce.

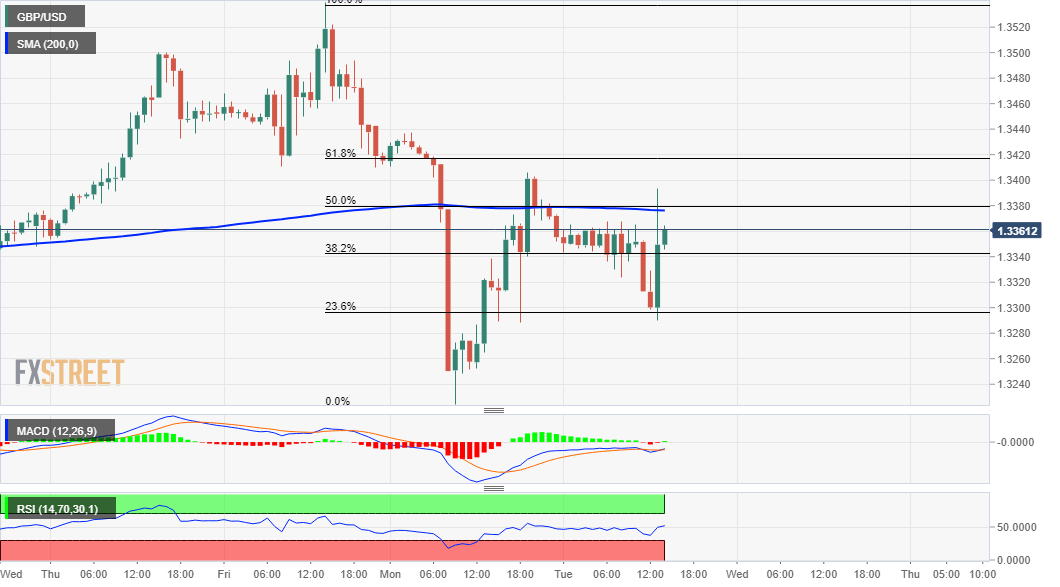

- Bulls struggled to find acceptance above 200-hour SMA and failed ahead of the 1.3400 mark.

- A sustained break below the 1.3300-1.3290 zone will be seen as a fresh trigger for bearish traders.

The GBP/USD pair witnessed a dramatic turnaround from sub-1.3300 levels and rallied around 100 pips in the last hour. The pair shot to fresh daily tops, albeit lacked follow-through buying and quickly retreated to the 1.3360 area.

The momentum followed after British Cabinet Minister Michael Gove announced an agreement in principle on all issues in the UK-EU Withdrawal Agreement Joint Committee. Bulls, however, struggled to capitalize on the move or find acceptance above 200-hour SMA and the strong move up stalled ahead of the 1.3400 mark.

Meanwhile, technical indicators on the daily chart maintained their bullish bias and have again started gaining positive traction on hourly charts. The set-up supports prospects for additional gains, though bulls might still need to wait for a sustained move beyond the 1.3400 mark before placing fresh bets.

The next relevant bullish target is pegged near the 1.3435-40 region, above which the GBP/USD pair seems all set to aim back to reclaim the key 1.3500 psychological mark.

On the flip side, the 1.3300-1.3290 region now becomes immediate support to defend, which if broken will negate intraday bullish bias. The GBP/USD pair might then turn vulnerable to accelerate the fall back towards the overnight swing lows support, around the 1.3225 region, en-route the 1.3200 round-figure mark.

GBP/USD 1-hourly chart

Technical levels to watch