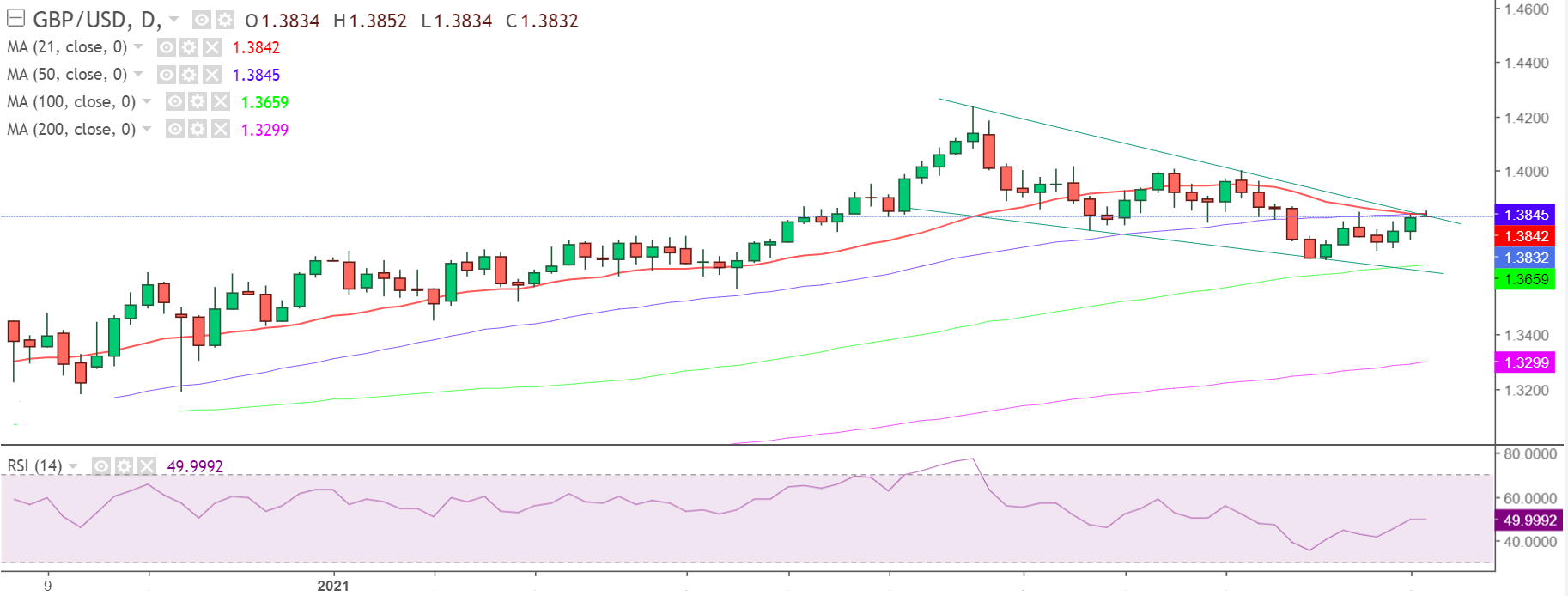

- GBP/USD has dived out of a falling wedge on the daily chart.

- Friday’s daily closing eyed for the pattern confirmation.

- US NFP data could offer fresh direction on the cable pair.

GBP/USD consolidates the recent recovery gains well above the 1.3800 mark, as the bulls catch a breather ahead of the critical US Nonfarm Payrolls release.

At the time of writing, the cable adds 0.06% on the day, trading at 1.3836, having failed to resist above the 1.3850 level.

From a near-term technical perspective, the spot is on the verge of a falling wedge breakout on the daily chart.

However, daily closing above the falling trendline resistance at 1.3843 is needed to validate an upside break. That level is the strong resistance now support of the 21 and 50-daily moving averages (DMA).

Acceptance above the latter could call for a test of the measured target at 1.4407.

Ahead of that several bumps could come in the way, with the 1.4000 round figure to offer stiff resistance.

The relative strength index (RSI) trades flat but just above the midline, allowing room for more upside.

GBP/USD: Daily chart

On the flip side, immediate support is envisioned at 1.3800, below which Thursday’s low of 1.3745 could be retested.

The next crucial support around 1.3650 is the last line of defense for the GBP bulls. At that level, the 100-DMA coincides with the falling trendline support.

GBP/USD: Additional levels