- GBP/USD is consolidating post-US CPI gains for now.

- UK GDP prints better than expected numbers but couldn’t trigger volatility in the Pound.

- Market awaits US PPI and unemployment claims data today in an earlier NY session.

Following the UK macro data release, GBP/USD price continued to consolidate sideways in an area from 1.3865-70.

After rising from the overnight level of 1.3800, the pair floated within a certain range during the first half of Thursday’s trading session. However, the sluggish movement of the US dollar continued to provide some support for the GBP/USD pair.

–Are you interested to learn more about forex bonuses? Check our detailed guide-

Several signs of cooling inflationary pressures were evident in Wednesday’s US CPI report, which relieved fears that the Fed will withdraw its stimulus soon. In the aftermath, US Treasury yields fell, counteracting the dollar.

The GBP/USD pair struggled to gain significant support after UK GDP data showed positive monthly growth of 1% versus 0.8% expected and quarterly growth of 4.8%.

The report came along with stronger manufacturing and industrial production figures for June. However, the positive numbers were offset by an unexpected increase in the UK trade deficit from £ 9.601 billion to £ 11.988 billion. This was seen as the only factor limiting the growth of the GBP / USD pair.

Market participants are eagerly awaiting the release of the Producer Price Index (PPI) and the usual weekly initial jobless claims report. This, along with the yield on US bonds, could affect the US dollar and add some trading momentum to the GBP/USD pair.

–Are you interested to learn more about day trading brokers? Check our detailed guide-

GBP/USD price technical analysis: Bulls trying to find the impetus

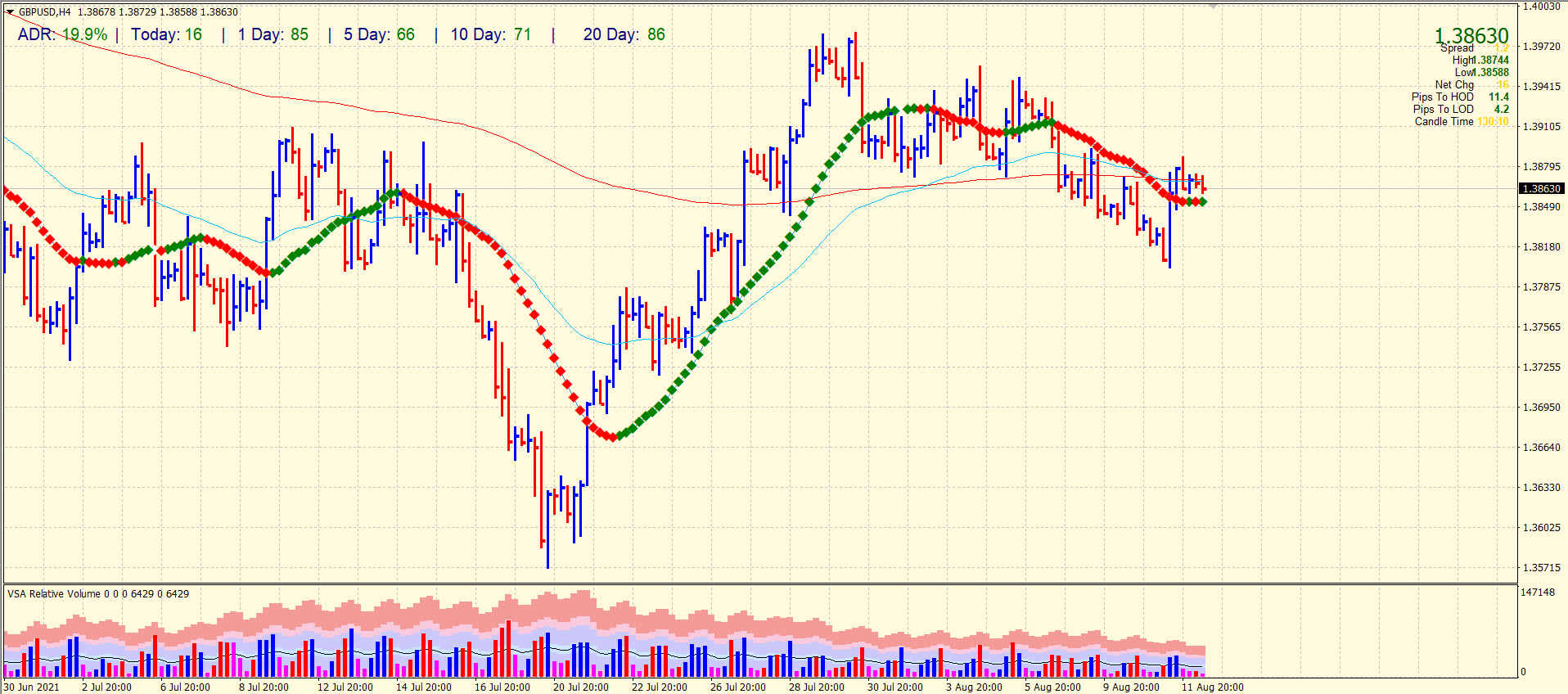

The GBP/USD pair managed to find acceptance above the 20-period SMA on the 4-hour chart. However, the price found some selling just under the 1.3900 level. The price is now consolidating yesterday’s gains. The 200 and 5 SMAs were trying for a death crossover that failed, and now they are converged and flat around the current price. The volume bars suggest that further gains cannot be ruled out. The up wave still has the strength to continue after a small phase of accumulation.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.