- Sterling kicked off Monday on the weak side as Brexit ministers resign over PM May’s latest Brexit strategy.

- The USD heads into the new weak on a softer tone following Friday’s NFP figures, and the Sterling has an opportunity to capitalize.

The GBP/USD is looking to find some bullish momentum for Monday’s upcoming London trading session, after spending the early week trading window on the hesitant side following headlines that several members of the UK parliament, including Brexit Secretary David Davis, have resigned from their posts within the parliament’s Brexit department in protest of Prime Minister Theresa May’s latest soft Brexit proposal, a plan that Davis has decried as betraying the original Brexit referendum results.

Monday sees little on the economic calendar for the GBP, with only a speech from the Bank of England’s Broadbent at 07:50 GMT, while the US side will be seeing traders turning their focus to Thursday’s upcoming CPI reading, and US CPI figures are expected to tick higher from 2.2% to 2.3%.

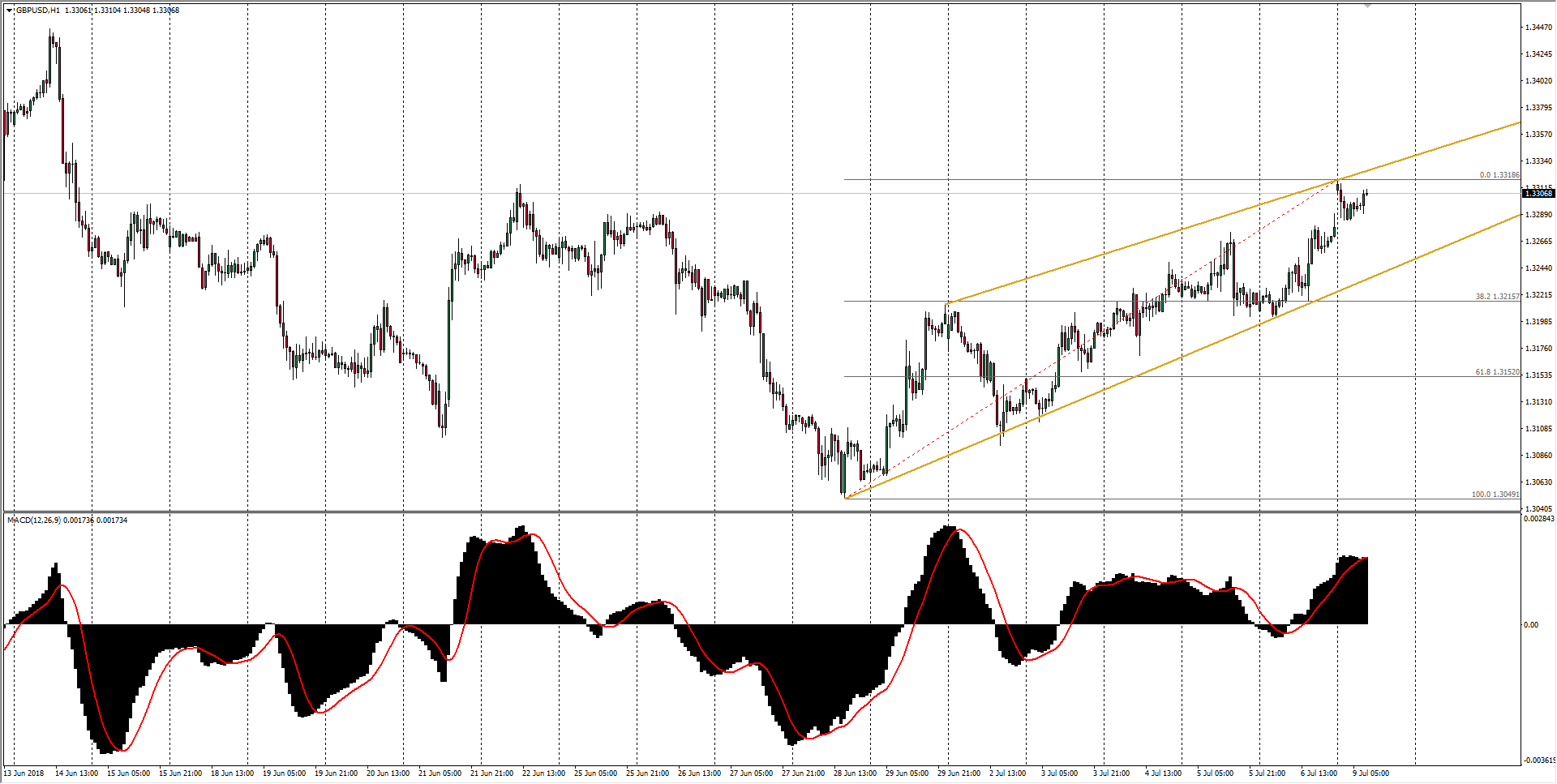

GBP/USD Technical analysis

The Sterling is in transition from a falling wedge into a rising channel, and the GBP/USD is heading to test the 50-day MA at 1.3355. The 5- and 10-day MAs have also crossed bullish, with a rising RSI.

Spot Rate: 1.3306

Relative change: -0.06%

Daily High: 1.3318

Daily Low: 1.3284

Trend: Bullish

R1: 1.3318 (Asian session high)

R2: 1.3355 (50-day MA)

R3: 1.3472 (June 7 high)

S1: 1.3285 (session low)

S2: 1.3244 (5-day MA)

S3: 1.3197 (10-day MA

GBP/USD Chart, 1-Hour