- Cable lost the grip in the boundaries of the 1.3380 handle.

- UK’s Construction PMI came in a tad above estimates in April.

- Brexit talks back to the fore ahead of the EU-UK meeting later in June.

The Sterling is so far posting decent gains vs. the greenback at the beginning of the week, lifting GBP/USD to the 1.3380 area during early trade albeit losing some momentum afterwards.

GBP/USD bid on USD-weakness

Cable appears to have lost some upside traction in the vicinity of the 1.3380 area today, although it keeps the upside corrective well and sound after bottoming out in the 1.3200 neighbourhood during last week.

Today’s generalized offered bias around the greenback lent further oxygen to the almost 2-cent gain in spot in the last 5 sessions, while the British Pound paid little attention to the small improvement in the recently released Construction PMI during April.

Later in the day, US Factory Orders and Durable Goods Orders for the month of April are due in the NA session.

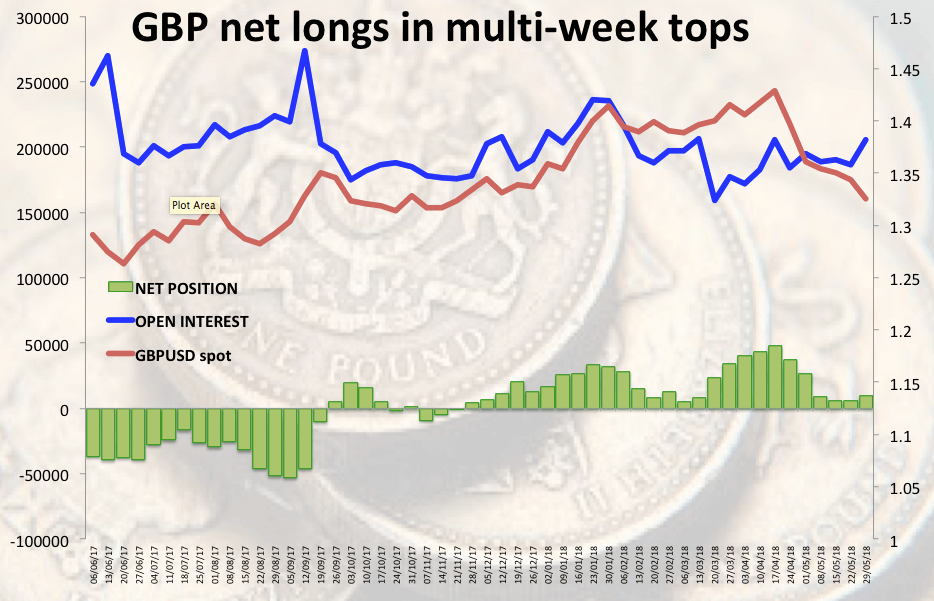

News from the speculative community noted GBP net longs rose to 4-week highs during the week ended on May 29, according to the latest CFTC report.

GBP/USD levels to consider

As of writing, the pair is gaining 0.17% at 1.3371 facing the initial resistance at 1.3430 (21-day sma) seconded by 1.3457 (low Jan.11) and then 1.3588 (200-day sma). On the other hand, a break below 1.3335 (10-day sma) would expose 1.3205 (2018 low May 23) and finally 1.3039 (low Nov.3 2017).